- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ExxonMobil's Hebron Project Comes Online Ahead Of Schedule

ExxonMobil Corporation (NYSE:XOM) has commenced production in the Hebron project ahead of schedule. The project’s yield is expected at about 150,000 barrels of oil per day at its peak.

The Hebron field was discovered in 1980 and is estimated to hold more than 700 million barrels of recoverable resources. The Hebron platform has a storage capacity of 1.2 million barrels of oil and comprises a stand-alone gravity-based structure. This structure supports an integrated topside deck that includes living quarters and drilling and production facilities.

Tthe platform lies in water depth of about 300 feet (92 meters) and is located about 200 miles (350 kilometers) offshore Newfoundland and Labrador

The Hebron project entailed eight years of engineering, construction and startup phase. The company employed several vendors from the province of Newfoundland and Labrador. During the peak of the construction phase the project generated about 7,500 jobs. The total duration for the construction of the project was more than 40 million hours excluding any lost-time injury.

ExxonMobil’s affiliate, ExxonMobil Canada Properties, operates the Hebron with a stake of 35.5%. Chevron Corporation (NYSE:CVX) , Suncor Energy (NYSE:SU) , Statoil (OL:STL) ASA (NYSE:STO) and Nalcor Energy Oil and Gas Inc. hold 29.6%, 21%, 9% and 4.9%, respectively.

About ExxonMobil

ExxonMobil has a leading position in the energy industry owing to the size and diversity of asset base, business mix and geographical footprint. With a stable cash position, the company’s balance sheet is considered among the best in the industry. However, due to its integrated functions, the company is susceptible to risk from any weakness in the global economy. Moreover, dependence on costly offshore drilling might dent ExxonMobil’s cash flow.

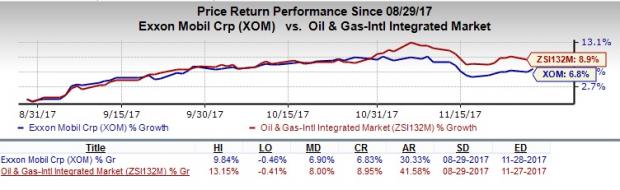

Shares of the company have returned 6.8% compared with the industry’s rally of 8.9% in the last three months.

Zacks Rank

ExxonMobil currently carries a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Investor Alert: Breakthroughs Pending

A medical advance is now at the flashpoint between theory and realization. Billions of dollars in research have poured into it. Companies are already generating substantial revenue, and even more wondrous products are in the pipeline.

Cures for a variety of deadly diseases are in sight, and so are big potential profits for early investors. Zacks names 5 stocks to buy now.

Click here to see them >>

Suncor Energy Inc. (SU): Free Stock Analysis Report

Chevron Corporation (CVX): Free Stock Analysis Report

Statoil ASA (STO): Free Stock Analysis Report

Exxon Mobil Corporation (XOM): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Early in 2025, value stocks emerged as a popular choice among investors seeking market-beating returns. However, factor-based investing strategies can be notoriously difficult to...

Mid-cap stocks don’t get the same headlines as large caps but move aggressively in both directions, creating outsized opportunities for investors. Unlike their mega-cap...

There’s no doubt it’s been a rough couple weeks for stocks: Both the S&P 500 and the tech-focused NASDAQ have wiped out most of this year’s gains, as of this writing. Stocks...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.