- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Extra Space Storage (EXR) Q2 FFO Tops Estimates On NOI Growth

Extra Space Storage, Inc.’s (NYSE:EXR) second-quarter 2019 core funds from operations (FFO) per share of $1.22 outpaced the Zacks Consensus Estimate of $1.19. The figure also comes in higher than the prior-year quarter’s $1.15.

Results reflect growth in same-store net operating income (NOI). Further, it witnessed higher rental rates for both new and existing customers.

Quarterly revenues of $323.6 million climbed 9% year over year. The revenue figure also exceeded the Zacks Consensus Estimate of $309.4 million.

Behind the Headlines

Same-store rental revenues increased 3.9% year over year to $258.3 million during the second quarter, while same-store NOI was up 3.9% to $186.3 million. The upswing in same-store revenues stemmed from higher net rental rates for both new and existing customers. However, same-store square foot occupancy was 93.6% as of Jun 30, 2019, down 60 basis points from 94.2% as of Jun 30, 2018.

Notably, during the reported quarter, Chicago, Hawaii, Las Vegas, Oklahoma City, Phoenix and Sacramento were the major markets, which registered revenue growth above the company's portfolio average.

Nonetheless, markets, including Charleston, Dallas, Denver, Houston, Miami and West Palm Beach/Boca Raton, performed below the company's portfolio average.

Portfolio Activity

Extra Space Storage acquired one store at the completion of construction and completed the development of one store, for a total investment of nearly $20.2 million, during the April-June period. Also, in combination with its joint-venture partners, the company acquired 11 operating stores for $228.5 million. Of this, the company has invested $36.6 million. Further, the company added 48 stores (on a gross basis) to its third-party management platform.

Moreover, it sold one store for $11.8 million during the quarter.

As of Jun 30, 2019, the company managed 595 stores for third-party owners. Furthermore, with additional 243 stores owned in joint ventures, total stores under management summed 838.

Balance Sheet

Extra Space Storage exited second-quarter 2019 with roughly $47.7 million of cash and cash equivalents, down from the $57.5 million recorded at the end of 2018. As of Jun 30, 2019, the company's percentage of fixed-rate debt to total debt was 75.5%.

During the reported quarter, Extra Space Storage entered into a new ATM equity distribution agreement that enabled the company to reset balance available for issuance under its ATM program to $500 million.

During the June-end quarter, the company sold 930,000 shares of common stock using its ATM equity program for net proceeds of $99.1 million. Finally, as of Jun 30, 2019, Extra Space Storage had $399.9 million available for issuance under its ATM equity program.

Outlook

Extra Space Storage anticipates full-year 2019 core FFO per share of $4.79-$4.87. The Zacks Consensus Estimate for the same is currently pegged at $4.82.

The company projects same-store revenue growth of 2.5-3.25% and same-store NOI growth of around 1.75-3% for the current year (excluding tenant reinsurance).

In Conclusion

Amid competitive summer leasing season, the company posted solid results which indicate decent growth in same-store NOI. This apart, accretive acquisitions, a strong third-party management platform and the company’s first net lease transaction significantly fueled external growth. During the quarter, the company added 61 stores to its platform through these transactions.

Extra Space Storage’s presence in key cities and strategic joint ventures will drive long-term profitability. However, the company operates in a highly fragmented market in the United States, with intense competition from numerous private, regional and local operators, which is a concern.

Extra Space Storage currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

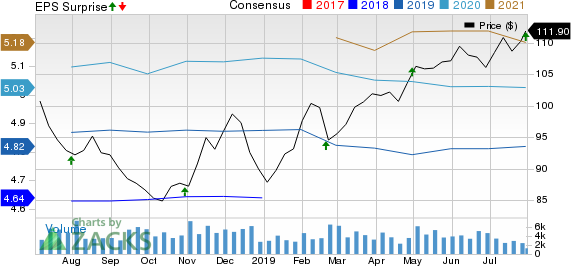

Extra Space Storage Inc Price, Consensus and EPS Surprise

Performance of Other REITs

Cousins Properties Incorporated (NYSE:CUZ) reported second-quarter FFO per share (before TIER transaction costs) of 71 cents, missing the Zacks Consensus Estimate by a whisker. Nonetheless, the figure came in higher than the prior-year quarter’s reported tally of 60 cents.

SL Green Realty Corp. (NYSE:SLG) delivered second-quarter 2019 FFO of $1.82 per share, surpassing the Zacks Consensus Estimate of $1.73. The tally includes promote income from the sale of 521 Fifth Avenue of $3.4 million or 4 cents per share. Results also compared favorably with the year-ago quarter’s tally of $1.69.

Crown Castle International Corp. (NYSE:CCI) posted second-quarter adjusted AFFO per share of $1.48, up from the prior-year figure of $1.31. Furthermore, the reported figure outpaced the Zacks Consensus Estimate of $1.43.

Note: Anything related to earnings presented in this write-up represent funds from operations (FFO) — a widely used metric to gauge the performance of REITs.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Crown Castle International Corporation (CCI): Free Stock Analysis Report

SL Green Realty Corporation (SLG): Free Stock Analysis Report

Extra Space Storage Inc (EXR): Free Stock Analysis Report

Cousins Properties Incorporated (CUZ): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Tesla (NASDAQ:TSLA) (NYSE: TSLA), the electric vehicle giant, has recently experienced a significant drop in its stock value, which has fallen nearly 45% since December. This...

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.