- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Owens-Illinois Closes Mexican Glass Packaging Facility Deal

Owens-Illinois, Inc. (NYSE:OI) recently completed the acquisition of Mexico-based glass packaging facility — Nueva Fanal — from Grupo Modelo, a wholly-owned affiliate of Anheuser-Busch InBev SA/NV, for $188 million.

At present, the Nueva Fanal plant has four furnaces with the capacity to produce and supply 300,000 tons of glass containers per year for Grupo Modelo brands such as Modelo Especial, Corona and Pacifico for the local and global export markets.

This business will likely contribute around $140 million of revenues and $40 million EBITDA, annually. Moreover, following the deal’s closure, Owens-Illinois is expected to achieve financial and operational synergies. Further, Owens-Illinois has entered into a long-term agreement to keep supplying glass containers to Grupo Modelo.

On Apr 2, Owens-Illinois entered into an agreement to acquire Nueva Fanal. The buyout is in line with Owens-Illinois’ strategy to invest in the sustainable growth of glass packaging, especially in premium brands, like Corona, which is one of the fastest growing and most popular beer brands, globally.

Acquisitions: A Key Growth Strategy

On Nov 12, 2018, Owens-Illinois acquired 50% interest in Empresas Comegua S.A., for $119 million. Empresas caters to Owens-Illinois’ global strategic customers and various segments, including food, soft drinks, beer, spirits and pharmaceuticals. The buyout will help Owens-Illinois expand its presence in new and growing glass markets in Central America, as well as in the Caribbean markets.

Moreover, on Mar, 11, the company made a $60-million investment plan to build a new furnace at its Gironcourt, France plant, which is slated to complete in early 2020. The expansion at Gironcourt will mainly focus on the growing premium beer segment which is highly differentiated and uses unique bottle shapes to build strong, premium brand equity. These investments, along with the Nueva Fanal glass-plant acquisition, will open up near-term growth opportunities for Owens-Illinois.

Collaboration with Constellation Brands Drives Growth

Owens-Illinois’ joint venture (JV) plant with Constellation Brands, Inc. (NYSE:STZ) has exceeded expectations so far — productivity has been higher than anticipated, capital costs were considerably lesser than initially expected and earnings have been growing every year.

Owens-Illinois has built four furnaces at this JV plant in just four years, and is currently building the fifth one which is expected to come on line by the end of this year. The fifth furnace will help cater to the rising demand from Constellation’s adjacent brewery. With the installation of the latest furnace, the Nava plant will be the largest glass-container factory in the world, equipped with all the latest facilities.

Robust End Markets to Sustain Growth

The glass container market in Europe is healthy and continues to grow at a rate of about 1% per year. The company’s efforts to add capacity in Europe, supply-chain performance, focus on growing strategic relationships and footprint optimization poise it well for improving volumes and expanding margins in the region.

Considering the rising market demand in Mexico and Brazil, the company is boosting its capacity. In the United States, demand for glass is shooting up, on the back of favorable consumer trends and increased preference of customers for glass packaging. Non-beer categories in the nation continue to grow in low-single digits.

Consequently, the company has been focusing on these categories by improving customer relationships, commercial and design capabilities, and converting almost 20% of its beer capacity into flexible capacity to meet non-beer customer demand. Overall, the Americas are expected to generate higher sales, profit and margin in 2020.

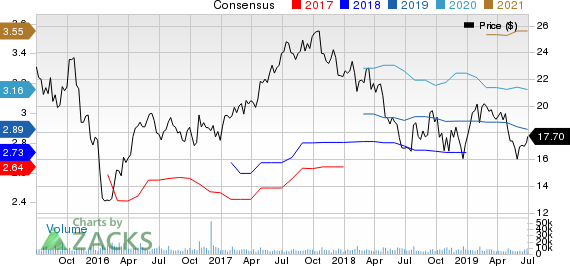

Owens-Illinois, Inc. Price and Consensus

Stocks to Consider

A few better-ranked stocks in the Industrial Products sector are AptarGroup, Inc. (NYSE:ATR) and Roper Technologies, Inc. (NYSE:ROP) , each sporting a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

AptarGroup has an estimated earnings growth rate of 8.7% for the ongoing year. The company’s shares have gained 34% in the past year.

Roper Technologies has an expected earnings growth rate of 9.4% for the current year. The stock has appreciated 37.7% in a year’s time.

This Could Be the Fastest Way to Grow Wealth in 2019

Research indicates one sector is poised to deliver a crop of the best-performing stocks you'll find anywhere in the market. Breaking news in this space frequently creates quick double- and triple-digit profit opportunities.

These companies are changing the world – and owning their stocks could transform your portfolio in 2019 and beyond. Recent trades from this sector have generated +98%, +119% and +164% gains in as little as 1 month.

Click here to see these breakthrough stocks now >>

Constellation Brands Inc (STZ): Free Stock Analysis Report

AptarGroup, Inc. (ATR): Free Stock Analysis Report

Owens-Illinois, Inc. (OI): Free Stock Analysis Report

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.