- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Exelixis (EXEL) Q4 Earnings Meet Estimates, Revenues Beat (revised)

Investors were not much impressed with Exelixis, Inc.’s (NASDAQ:EXEL) fourth-quarter 2017 performance, wherein though the company beat on revenues, its earnings were in line with estimates. Following the announcement of the results, shares of Exelixis fell 4% in the after-market trading session.

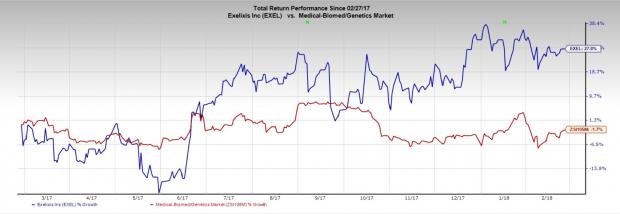

Exelixis’ shares have rallied 27.9% over a year, outperforming the industry’s decline of 2.5%.

The company reported earnings of 12 cents, in line with the Zacks Consensus Estimate and flat year over year.

Net revenues came in at $120.1 million, up from $77.6 million from the year-ago quarter. However, the company suffered a sequential decline from $152.5 million generated in third-quarter 2017 as an increase of 5% in overall demand was offset by the reduction of approximately one-week of wholesaler inventory built in the quarter.

Revenues surpassed the Zacks Consensus Estimate of $118.5 million.

Quarter in Detail

The FDA approved a tablet formulation of cabozantinib, (distinct from the capsule form) under the brand name Cabometyx in April 2016 for the treatment of advanced renal cell carcinoma (RCC) in patients who have received prior anti-angiogenic therapy. In December 2017, the FDA also approved Cabometyx for the treatment of previously untreated advanced RCC, approximately two months ahead of the assigned Prescription Drug User Fee Act (PDUFA) action date.

Cabometyx generated $95.7 million in net product revenues, up 84% y/y, driven by growth in demand for second-line RCC. Demand was driven by increases in market share, refills for patient already on therapy and continued expansion of the prescriber base (15% sequential increase).

Cometriq (cabozantinib) capsules for the treatment of medullary thyroid cancer generated $5.3 million in net product revenues.

Total collaboration revenues were $10.0 million compared with $20 million earned in the year-ago quarter.

In the fourth quarter, research and development expenses increased 35.3% to $32.2 million stemming from increases in personnel expenses, clinical trial costs and consulting and outside services. Selling, general and administrative expenses were $46.2 million, significantly up from $13.0 million driven by increases in consulting and outside services to support the company’s marketing activities resulting primarily from an increase in general and administrative headcount to support the company’s commercial and research and development organizations.

2017 Results

Revenues came in at $452.5 million in 2017, up from $191.5 million in 2016 and beat the Zacks Consensus Estimate of $451.3 million. Earnings per share came in at 49 cents, up from a loss of 28 cents in 2016 and in line with the Zacks Consensus Estimate. Cabometyx sales came in at $349 million, up 158% year over year.

Pipeline Update

In March 2017, the FDA granted cabozantinib orphan drug designation for the treatment of advanced hepatocellular carcinoma (HCC). In October 2017, Exelixis announced that the CELESTIAL trial met its primary endpoint of overall survival (“OS”) with cabozantinib providing a statistically significant and clinically meaningful improvement in OS compared with placebo in patients with advanced HCC. The independent data monitoring committee for the study recommended that the trial should be stopped for efficacy following review of the second planned interim analysis. Exelixis plans to submit an sNDA to the FDA in first-quarter 2018.

Exelixis inked agreements with Bristol-Myers (NYSE:BMY) and Roche Holding (OTC:RHHBY) to develop cabozantinib in combination with immunotherapy agents in 2017. Exelixis and Bristol-Myers initiated a phase III trial, CheckMate 9ER, in July 2017 which is evaluating the combination of checkpoint inhibition therapy, combined with a cabozantinib, compared to Sutent.

Meanwhile, updated results from the ongoing phase I trial of cabozantinib in combination with Opdivo, with or without Yervoy, in patients with refractory genitourinary tumors demonstrated an acceptable tolerability profile, and high rates of durable responses in the previously treated metastatic UC and metastatic RCC cohorts.

In January 2018, Exelixis announced an amendment to the protocol for the phase Ib trial of cabozantinib in combination with Tecentriq in patients with locally advanced or metastatic solid tumors. The amendment added four new expansion cohorts to the trial, which now includes patients with non-small cell lung cancer and castration-resistant prostate cancer, in addition to previously included patients with RCC and urothelial carcinoma. The primary objective in the expansion stage of this trial remains to determine the objective response rate in each cohort.

The IMspire150 (TRILOGY) trial, which evaluates the combination of Cotellic, Tecentriq, and Xelboraf in first-line BRAF V600 mutation-positive metastatic or unresectable locally advanced melanoma is underway while IMspire170, the trial evaluating the combination of Cotellic and Tecentriq versus Merck’s (NYSE:MRK) Keytruda in first-line BRAF wild-type metastatic or unresectable locally advanced melanoma, has enrolled its first patient.

2018 Guidance

Exelixis expects total costs and operating expenses for 2018 in the range of $430-$460 million.

Our Take

Exelixis’ fourth-quarter results were positive wherein while sales beat estimates, earnings came in line with expectations. Exelixis put up a strong performance in 2017 driven by gain in market share for Cabometyx. New patient market share in the second-line plus setting grew to approximately 42% at the end of 2017, up from 38% in the third quarter.

We expect sales to get a further boost in 2018 as the company will launch the drug for first-line RCC which will increases the eligible patient population for Caobometyx in the United States by approximately 14,000 patients and grab market share from two key drugs — Sutent and Votrient in the first-line RCC market.

We expect investors focus to remain on further label expansion of cabozantinib and Cotellic. A potential label expansion for advanced HCC will further boost the growth prospects of the company.

Zacks Rank

Exelixis currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

(NOTE: We are re-issuing this article to correct an error. The original version, published earlier today, Tuesday, February 27, 2018, should not be relied upon.)

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Roche Holding AG (RHHBY): Free Stock Analysis Report

Bristol-Myers Squibb Company (BMY): Free Stock Analysis Report

Merck & Company, Inc. (MRK): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.