- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

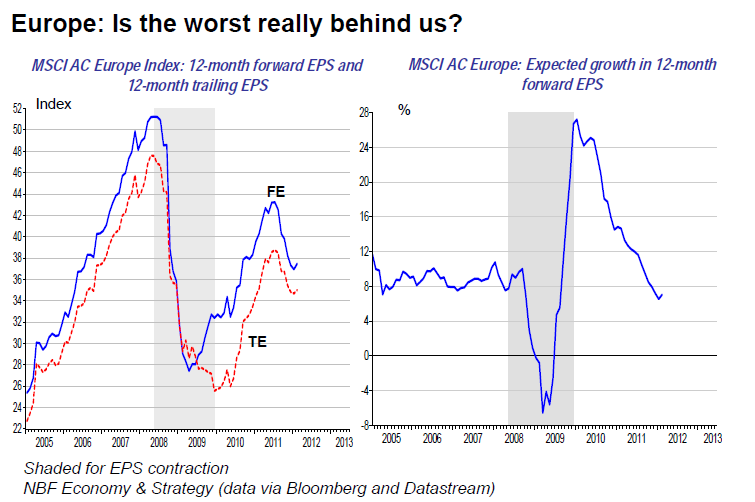

Europe: Is the Worst Really Behind Us?

European equity markets have recorded a solid advance since the start of Q4 2011 with the MSCI AC Europe index up 17% after loosing 18% in the first three quarters of 2011. Proactive measures taken by the ECB have clearly supported European equities and strengthen the financial system through its LTRO program. However, we question whether the horizon truly holds clearer skies for investors exposed to European equities as some pundits suggest. Much depends on whether European economic activity remains resilient over the next couple months. Will solid global growth outside Europe help withstand a recession or is the region currently falling in a period of worst than expected economic activity? If the later, we would expect this to lead to an earnings recession as well. Historically in periods of recession the equity market experiences a significant price correction due to a contraction in both the top and bottom lines. Recently the MSCI AC Europe index reported a 10% decline in EPS however, this was due to losses in the financial sector. We have yet to see any significant slowdown in non-financial sales and EPS as off Q4 2011. If operating activity does contract it is worth noting that markets have not priced in such an event with bottom up estimates for 12-month forward EPS still suggesting a 7% increase. Historically earnings estimates have always been too optimistic when a recession hits, and there is no reason to think this time will be different.

Related Articles

We haven’t had to change our subjective probabilities for our three alternative economic scenarios for quite some time. We are doing so today and may have to do so more frequently...

The US, Japan, and parts of Europe had a rough week, while China, Germany, France, and the Euro Stoxx 50 stayed steady. Tariffs, central banks, and the war in Ukraine keep...

We haven’t discussed global monetary inflation for a while, mainly because very little was happening and what was happening was having minimal effect on asset prices or economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.