- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

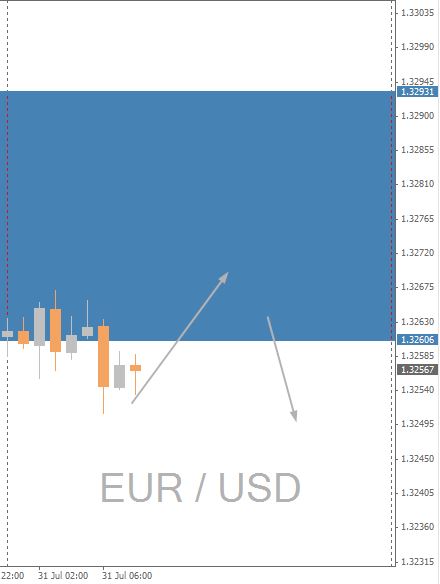

EUR/USD: Mixed Sentiments On The Dollar

Tuesday’s forecast went in our direction for the most part. In fact all pairs behaved close to what was thought possible, some not having the strength to retrace as far as our blue zones. Japanese Yen however still seems to be getting ready for some strong moves in the near future. At the moment we seem to be having a clear direction on Yen while US Dollar is proving to be very difficult to read, overall the Dollar has been weak. Today we are going to take a mixed stance on US Dollar while Japanese Yen could Strengthen. Adding three hedged pairs to offset the trading risk. Happy trading everyone!!

Forecasts Outlook

US Dollar: Mixed Sentiments

Today we're expecting the EUR/USD to proceed Short below the barrier levels of 1.32931 and 1.32606.

Fundamental Watch

- ADP Non-Farm Employment Change

- GDP m/m

- Advance GDP q/q

- FOMC Statement

- Manufacturing PMI

Related Articles

GBP/AUD Forex Strategy is Bearish: We are currently @ 2.0405 after putting a top in place. If we can get a quick pullback here, we are looking for a continuation to the ATR target...

The Australian dollar has extended its gains on Wednesday. AUD/USD is trading at 0.6271 in the European session, up 0.20% on the day. The Australian dollar jumped 0.75% on...

The euro EUR/USD has surged after European leaders announced big spending plans for defence and infrastructure. This comes at a time when President Trump acknowledges that tariffs...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.