- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EUR/USD: Getting Ready For Non-Farm Payrolls

GROWTHACES.COM Forex Trading Strategies

Taken Positions

GBP/USD: long at 1.5160, target 1.5540, stop-loss moved to 1.5160, risk factor **

USD/CAD: short at 1.2110, target 1.1930, stop-loss moved to 1.2090, risk factor ***

AUD/USD: long at 0.7870, target 0.8230, stop-loss moved to 0.7900, risk factor ***

NZD/USD: long at 0.7560, target 0.7740, stop-loss 0.7450, risk factor ***

EUR/GBP: long at 0.7320, target 0.7590, stop-loss moved to 0.7420, risk factor **

GBP/JPY: long at 181.70, target 184.90, stop-loss 180.60, risk factor **

AUD/JPY: long at 93.80, target 97.00, stop-loss moved to 94.50, risk factor ***

Pending Orders

EUR/USD: buy at 1.1235, if filled - target 1.1450, stop-loss 1.1135, risk factor **

USD/CHF: sell at 0.9180, if filled - target 0.9000, stop-loss 0.9260, risk factor **

EUR/JPY: buy at 134.20, if filled – target 136.70, stop-loss 132.95, risk factor **

EUR/CAD: buy at 1.3580, if filled – target 1.3825, stop-loss 1.3445, risk factor **

CHF/JPY: buy at 129.80, if filled – target 132.50, stop-loss 128.70, risk factor **

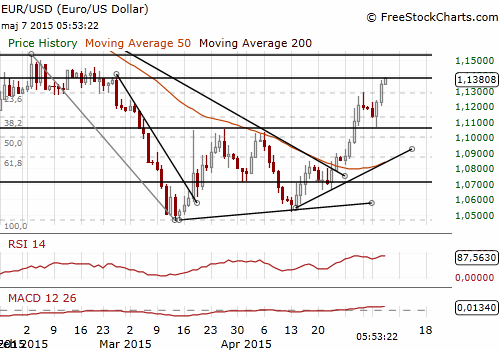

EUR/USD: Getting Ready For Non-Farm Payrolls

(buy at 1.1235)

- Federal Reserve Chair Janet Yellen described stock market valuations as high and said the central bank was carefully monitoring their impact on financial stability. Yellen added, however, that the overall risks to financial stability are “moderated, not elevated” and she does not see the signs of any bubbles. She explained that the very low level for short-term and long-term interest rates represented a risk because rates can move rapidly. Yellen said the Fed was mindful of the impacts of its decisions. The Fed at its recent meeting offered no sign that a rate increase was imminent.

- Atlanta Federal Reserve bank president Dennis Lockhart (voting this year) said he still expects it would be appropriate to raise interest rates some time in the middle of the year, and that market expectations of a September increase were in "reasonable alignment" with the central bank's likely path.

- Kansas City Federal Reserve President Esther George (non-voting) said the committee has been clear that it is going to base its decision on the data, which makes "each meeting a possibility" for the Fed to hike rates.

- The EUR/USD opened Asia at 1.1348 after strong rises yesterday. The rate reached the target of our long position. Investors are now focused on Friday’s U.S. non-farm payrolls (12:30 GMT). The ADP National Employment Report showed private employers added 169k jobs last month, the fewest since January 2014 and far below market expectations for a 200k gain. March's private payrolls were revised down to an increase of 175k jobs from the previously reported 189k. Weak ADP data suggests that Friday’s non-farm payroll figures may be below market consensus for a 224k. The unemployment rate is seen moving to 5.4% from 5.5%.

- We took profit on our long EUR/USD position (1.1150-1.1350) yesterday. Our strategy is to get long again and we have placed our buy offer at 1.1235. Prices closed above the previously broken 76.4% fibo at 1.1280 which opens the way for a full retracement to the 1.1534, high on February 3. However, tomorrow’s U.S. non-farm payrolls will be of key importance. Slightly weaker reading has been already priced in after low ADP employment data. That is why we need stronger NFP disappointment to push the EUR/USD higher tomorrow.

Significant technical analysis' levels:

Resistance: 1.1391 (session high May 7), 1.1450 (high Feb 19), 1.1486 (high Feb 6)

Support: 1.1325 (hourly low May 7), 1.1250 (100-dma), 1.1175 (low May 6)

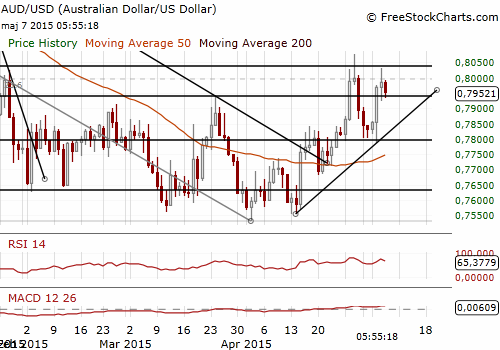

AUD/USD: Focus On RBA Forecasts Update

(stay long)

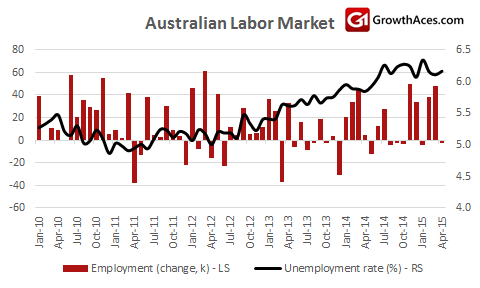

- Thursday's figures from the Australian Bureau of Statistics showed employment eased 2.9k in April, short of market forecasts of a 5.0k rise. However, March figures was revised up to show a gain of 48.2k, and that followed a 38k rise in February. The jobless rate rose a tick to 6.2%.

- Hours worked showed a healthy increase of 1.1% which is often a reliable indicator of improving demand for labour. 177.6k net new jobs were created in the year to April, while the labour force expanded by 230.9k.

- The AUD/USD found a support at 0.7929 after a fall in reaction to worse-than-expected jobs report. In our opinion the data are not as bad as it seems on first impression given upwards revision of March figures. The AUD/USD broke above 0.8000 soon, but now is again near the support area near 0.7950.

- The Reserve Bank of Australia cut rates to a record low of 2.0% on Tuesday. The central bank will release updated forecasts for growth and inflation in a quarterly review on Friday. The long-standing practice of the RBA is not to offer forward guidance when it has just changed rates. That was true in February when it cut to 2.25%, but expressed no easing bias in its quarterly policy statement.

- We maintain our long AUD/USD position with the stop-loss raised to 0.7900. The rate hold above 10-dma and a test of the April high looks likely. The nearest resistance level is 0.8075/80, but we see potential for even bigger gains.

Significant technical analysis' levels:

Resistance: 0.8004 (session high May 7), 0.8031 (session high May 6), 0.8077 (high Apr 29)

Support: 0.7929 (session low May 7), 0.7918 (low May 6), 0.7904 (10-dma)

Source: Growth Aces Forex Trading Strategies

Related Articles

The German election results initially boosted optimism, but uncertainty over coalition talks is keeping pressure on EUR/USD. Trump's confirmation of tariffs on Mexico and Canada...

The Japanese yen continues to have a quiet week. In the European session, USD/JPY is trading at 149.68, down 0.01% on the day. The yen has shown recent strength against the US...

Trump said yesterday that tariffs on Mexico and Canada are still on the table ahead of next Monday’s deadline. Markets remain reluctant to price that in for now, and some soft US...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.