- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ericsson Extends Collaboration With NBN Co In Australia

Ericsson (BS:ERICAs)’s (NASDAQ:ERIC) partnership with NBN Co to provide fixed wireless as well as satellite operational services across Australia’s regional and rural parts was recently extended to 2020 by the latter. Per the latest deal, Ericsson will continue to be in charge of operations for nbn fixed wireless network and ground systems operations for Sky Muster. The company will also handle customer connections and assurance for both technologies.

NBN Co’s fixed wireless and Sky Muster services cater to over 980,000 homes in regional as well as remote Australia. Over 290,000 homes are linked to broadband services through NBN Co’s retail service providers. The presence of extensive broadband across Australia will facilitate the bridging of the digital divide, while supporting economic as well as community growth.

Of late, soft mobile broadband demand and challenging macroeconomic conditions in the emerging markets are acting as a deterrent for major investments by telecom equipment behemoths, and this has hurt Ericsson’s operations severely in recent times.

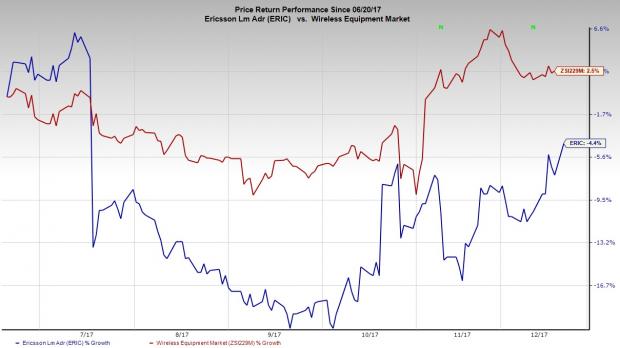

Persistently low investments in mobile broadband in certain markets and lower managed services sales have harmed the sales of the company’s Networks segment, while lower legacy product sales have hurt IT & Cloud revenues. Lower IPR licensing revenue and an unfavorable mix between coverage & capacity and services are adding to concerns. Notably, the Zacks Rank #5 (Strong Sell) company has lost 4.4% in the past six months in contrast to the industry’s gain of 2.5%.

Moreover, high restructuring charges are knocking on the company’s door, and we also have a subdued view of operator spending and investments in R&D. The company’s current savings plans and job reductions do not seem enough to counter macroeconomic miseries and swiftly waning product demand, further adding to the woes.

This apart, spectrum crunch has become a major issue in the U.S. telecom industry that has a saturated wireless market. In addition, the company’s cash flow could be materially hurt by market and customer project adjustments. Though the company is working diligently to improve the situation, tangible results are yet to materialize.

Stocks to Consider

Some better-ranked stocks from the same space include Comtech Telecommunications Corp. (NASDAQ:CMTL) , Motorola Solutions, Inc. (NYSE:MSI) and Harris Corporation (NYSE:HRS) . While Comtech Telecommunications sports a Zacks Rank #1 (Strong Buy), Motorola Solutions and Harris carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Analog Devices has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 88.7%.

Motorola Solutions has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 13.2%.

Harris has outpaced estimates thrice in the preceding four quarters, with an average earnings surprise of 2.8%.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Ericsson (ERIC): Free Stock Analysis Report

Harris Corporation (HRS): Free Stock Analysis Report

Motorola Solutions, Inc. (MSI): Free Stock Analysis Report

Comtech Telecommunications Corp. (CMTL): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

Often as dividend investors we buy stocks that provide us with income now. We take the current yield and happily collect the monthly or quarterly payout. Sometimes, though, it is...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.