- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

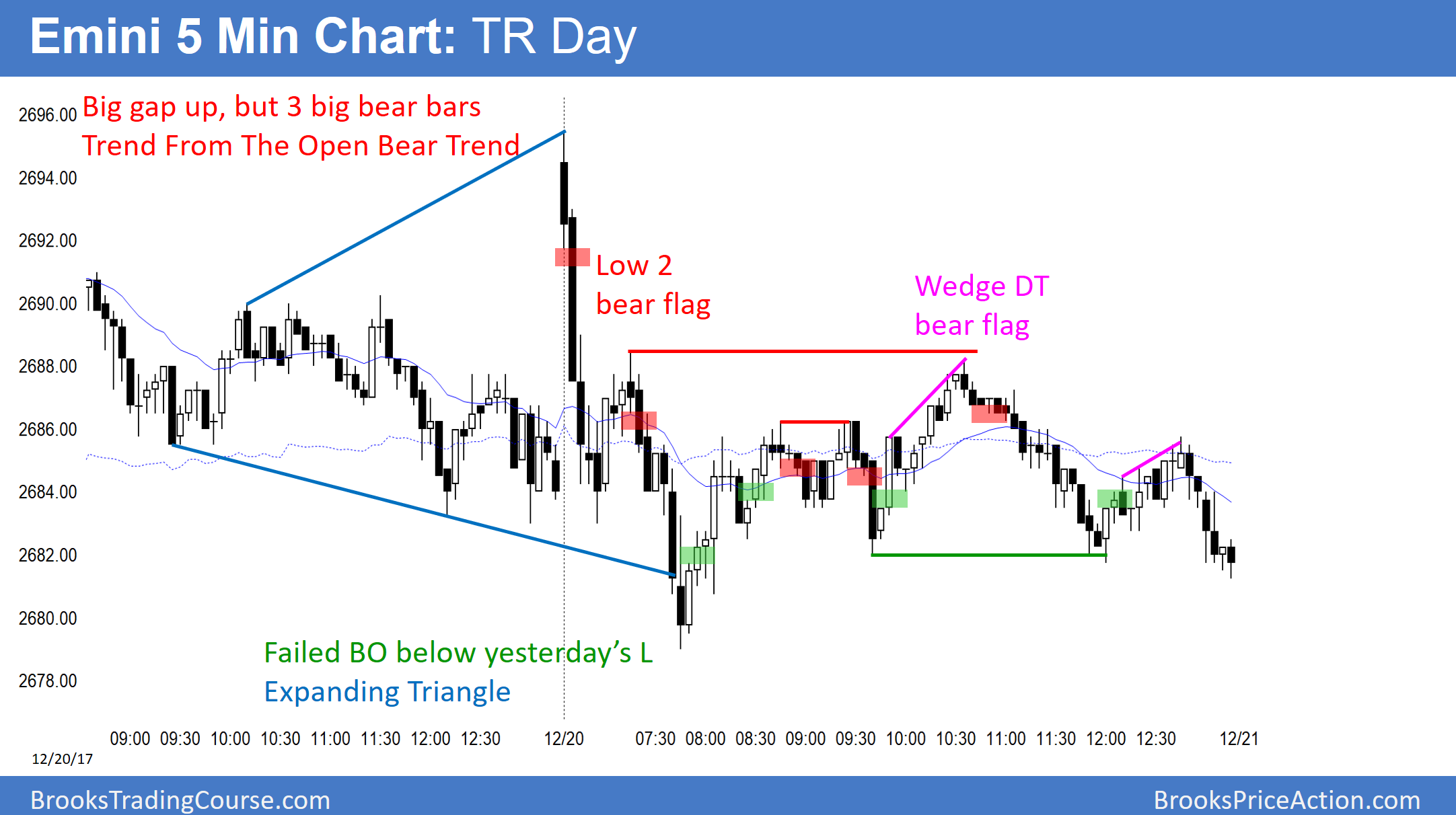

Emini Traders Eye Government Shutdown

Pre-Open Market Analysis

The Emini sold off yesterday in a trend from the open bear trend. In addition, it traded below Friday’s high. It therefore closed the gap on the daily and weekly charts, which was likely. The gap is now an exhaustion gap. However, that is minor. Until there is a strong reversal down, the odds favor that every reversal will just be another bull flag.

Congress is working on a continuing budget resolution. If they fail to pass one in the next week, the government will run out of money and shut down. That would result in a selloff that would last at least a few weeks.

The buy climaxes on the daily, weekly, and monthly charts have never been this extreme. Therefore, the odds of much higher prices without at least a 5% correction first are small.

All bull trends are constantly trying to reverse. However, my 80% rule says that 80% of reasonable reversals attempts will fail. That means that betting that the current top will be the one that finally begins a 5% correction is a low probability bet. Traders will not believe that the correction is underway until there are at least 2 strong bear bars on the daily chart. But, at that point, the correction will already be half over.

Overnight Emini Globex

The Emini is up 6 points in the Globex market. Traders still see the 3 day selloff as a bull flag after Friday and Monday’s rally. The bulls tried for a bull breakout yesterday and failed. If the Emini opens here, it would be breaking above the 3-day bear channel again.

However, the bulls need a strong rally before traders believe that last week’s bull trend is resuming. Without that, traders will conclude that the sideways to down pullback is continuing. The Emini is probably waiting for the government shutdown vote that will take place before the end of the month.

The bears need a strong breakout below the 3-day bull flag before traders will conclude that Friday-Monday rally has failed. Even then, the odds continue to favor only minor reversals down on the daily chart until there are at least 2 consecutive big bear trend days.

Yesterday’s Setups

Here are several reasonable stop entry setups from yesterday. I sometimes also show limit order entries and entries on the close of bars.

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.