- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Emini Could Be Starting 2 Week Pullback From November High

Emini and Forex Trading Update: Monday December 2, 2019

Pre-Open market analysis

Friday closed early, but it closed below the open and the midpoint of the range. It was a bear bar on the daily chart and a reversal down from the top of the 2 month trading range.

Traders do not yet know if the pullback will last only 1 – 3 days, like all of the other pullbacks for 2 months. With the daily chart in a buy climax, the pullback might instead last a couple weeks. If so, a reasonable target is the start of the bull channel. That is either the October 18 or October 31 low.

I have been saying that the Emini was probably going to begin a 2 week, 50 – 100 pullback by the end of November. If this is not the start, it will probably begin within a couple weeks.

A buy climax typically attracts profit takers. But the bull trend is so strong that the bulls will buy the pullback. Therefore, the best the bears can probably get is a 2 – 3 week pullback. They will likely need a double top before they can get a 5% correction.

Overnight Emini Globex trading

The Emini rallied overnight and then reversed down. It is currently unchanged. Traders know that many bulls will be quick to take profits in the extended buy climax on the daily chart. There is therefore a higher probability of one or more bear trend days this week.

Furthermore, many bulls will take profits above any recent high. Traders should expect a 50 – 100 point pullback to begin this week. Even though the Emini has had many bull days over the past several weeks, profit taking will probably begin to create some bear days. That reduces the chance of a continued strong bull trend this week.

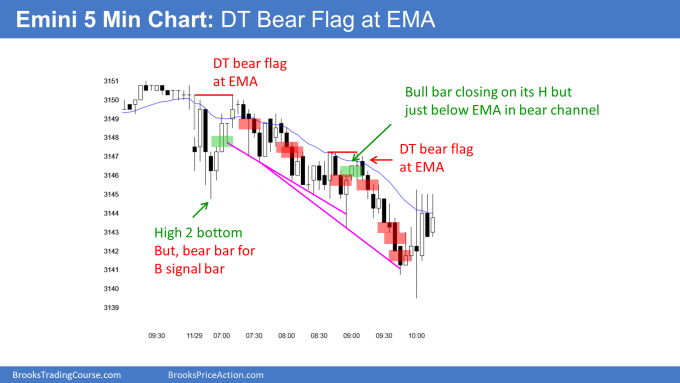

Friday’s setups

Here are several reasonable stop entry setups from Friday. I show each buy entry with a green rectangle and each sell entry with a red rectangle. I rarely also show limit order entries and entries on the close of bars. Buyers of the Brooks Trading Course and Encyclopedia of Chart Patterns have access to a much more detailed explanation of the swing trades for each day.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or nearly Always In a position all day, and he was not currently in the market, these entries would be logical times for him to enter.

Related Articles

While market cap weighting is still the go-to for many investors due to its low cost and low turnover, it's becoming increasingly fragile these days thanks to the concentration...

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.