- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Emerson To Buy Cooper-Atkins, Boosts Cold Chain Business

Emerson Electric Company (NYSE:EMR) has decided to acquire a leading technology company in foodservice markets, Cooper-Atkins. The buyout will serve to deepen Emerson’s ability to cater to the needs of its cold chain customers, offering safe control of food as well as other temperature-sensitive products. Financial details of the deal have been kept under wraps. The transaction is anticipated to close within next couple of months after fulfilling regulatory conditions.

Cooper-Atkins’ added expertise, when combined with Emerson’s global cold chain business will expand latter’s capabilities in monitoring food, its preparation, as well as high-value shipments all through the supply chain to preserve freshness and quality. Cooper-Atkins’ strong portfolio of automated temperature and monitoring solutions will augment Emerson’s ProAct Services portfolio for supermarkets and Cargo Solutions business.

The Acquiree

Headquartered in Middlefield, CT, Cooper-Atkins offers temperature management devices and wireless monitoring solutions for foodservice, industrial as well as healthcare markets. The company has offices with operations across Ohio, Florida and Singapore with about 150 employees. The company’s solutions utilize mobile and cloud-based quality, safety as well as compliance systems to modernize food quality management.

Existing Business Scenario

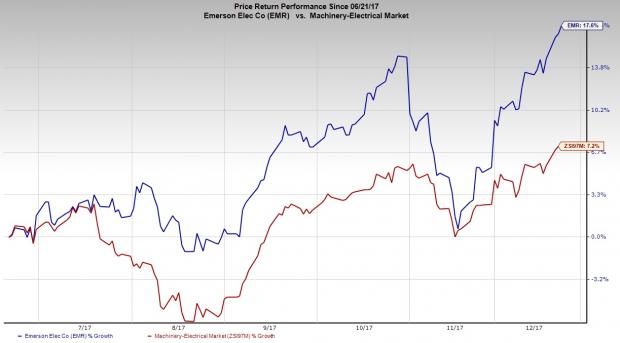

Emerson has been executing restructuring activities since 2015 to drive efficiency and growth. The company has taken a series of concerted efforts to develop a better brand with significant customer focus. Moreover, all of its segments garnered significant savings from restructuring actions, consequently adding to strength. Notably, this Zacks Rank #3 (Hold) company has outperformed the industry in the past six months, having appreciated 17.6% compared with the industry’s gain of 7.2%.

The company is on a constant lookout for small bolt-on and strategic acquisitions to increase sales to up to $20 billion and cash flow back to over $3.2 billion over a span of next five years. Some of the notable acquisitions made by the company in recent times include Pentair Valves & Controls and a business unit of Pentair plc. This apart, the company expanded global capabilities in fresh food monitoring, with the acquisitions of Locus Traxx and PakSense. These buyouts are likely to enable the company widen the scope of cargo solutions.

Despite these positives, macroeconomic factors like sluggish economic conditions, recession and adverse conditions in the end markets are impeding growth. Further, prolonged softness in the oil and gas markets has affected both capital spending and operational expenditure of clients, consequently marring the company’s prospects.

Stocks to Consider

Some better-ranked stocks from the same space include Deere & Company (NYSE:DE) , Actuant Corporation (NYSE:ATU) and Harsco Corporation (NYSE:HSC) . While Deere & Company sports a Zacks Rank #1 (Strong Buy), Actuant and Harsco carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere & Company has outpaced estimates in the preceding four quarters, with an average earnings surprise of 19.5%.

Actuant has surpassed estimates twice in the trailing four quarters, with an average positive earnings surprise of 0.8%.

Harsco has surpassed estimates in the trailing four quarters, with an average positive earnings surprise of 145.6%.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Actuant Corporation (ATU): Free Stock Analysis Report

Emerson Electric Company (EMR): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Harsco Corporation (HSC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.