- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Emerson (EMR) Secures Automation Systems & Services Contract

Emerson Electric Co. (NYSE:EMR) recently clinched a $40-million automation systems and services contract for Novo Nordisk’s drug manufacturing facility in Clayton, North Carolina. Per the contract, Novo Nordisk’s biggest project, $2-billion plant, will leverage Emerson’s Project Certainty methodologies and automation technologies to fight the global diabetes epidemic.

The Deal

Under the deal, Novo Nordisk (CO:NOVOb) will implement elements of Emerson’s Project Certainty approach, which would trim down project complexity as well as meet its tight-project schedule. The company’s integrated portfolio of automation technologies and services, including Syncade manufacturing execution system and DeltaV distributed control system would help to reduce Novo Nordisk’s project costs as well as accommodate late-stage project changes. This apart, Emerson will also offer smart automation technologies including measurement instrumentation and valves.

Other Notable Contract Wins

Emerson has a solid history of winning valuable contracts in the energy infrastructure field that are conducive to its top-line performance. Some notable contracts secured include a $20-million design-build contract for an automation project from San Francisco Public Utilities Commission and a contract for Biomass-Fueled Plant in United Kingdom. Such contract wins remain a key growth driver for the company.

Existing Business Scenario

Emerson is well-positioned to benefit from global infrastructure growth, as its core businesses hold dominant positions in markets tied to energy efficiency and infrastructure spending. Moreover, environmental regulations are driving the need for new products, adding to its strength. Going forward, Emerson believes telecommunications infrastructure demand will continue to be one of the strongest growth drivers.

Currently, the company remains optimistic about the prospects of Commercial & Residential Solutions segment as it has been witnessing improving trends in the U.S. and Asian construction markets. Also, the company remains bullish on its Automation Solutions segment backed by favorable trends in power and life sciences as well as improving MRO spending by oil and gas customers. Furthermore, the company’s restructuring efforts, undertaken over the past few quarters, are likely to benefit its upcoming results.

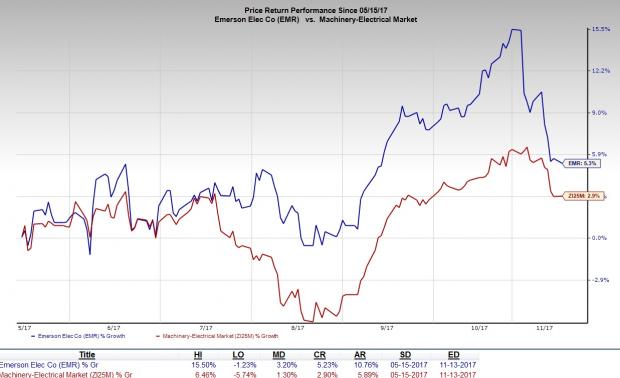

This Zacks Rank #3 (Hold) company has returned 5.2% in the past six months, outperforming the industry’s gain of 2.9%.

Despite these positives, prolonged softness in the oil and gas markets has affected both capital spending and operational expenditure of clients, which in turn are hurting Emerson’s operations. The company’s Industrial Automation markets in North America have been extremely challenging and the improvements which Emerson anticipated did not materialize, thereby compunding the challenges.

Stocks to Consider

Some better-ranked stocks from the same space are Columbus McKinnon Corp. (NASDAQ:CMCO) , Kennametal Inc. (NYSE:KMT) and Alamo Group, Inc. (NYSE:ALG) . While Columbus McKinnon and Kennametal sport a Zacks Rank #1 (Strong Buy), Alamo Group carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Columbus McKinnon has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 15.4%.

Kennametal has outpaced estimates thrice in the preceding four quarters, with an average earnings surprise of 20.6%.

Alamo Group has surpassed estimates twice in the trailing four quarters, with an average positive earnings surprise of 6.1%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Kennametal Inc. (KMT): Free Stock Analysis Report

Emerson Electric Company (EMR): Free Stock Analysis Report

Alamo Group, Inc. (ALG): Free Stock Analysis Report

Columbus McKinnon Corporation (CMCO): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Palantir Technologies (NASDAQ:PLTR) continues to sell off. On March 6, PLTR stock fell over 10% on nearly double the daily volume, bringing its 30-day decline to over 27%. A drop...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.