- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Emerson (EMR) Launches New Solutions Center In Singapore

Emerson Electric Company’s (NYSE:EMR) business segment, Emerson Automation Solutions, recently opened a customer-focused Solutions Center at its regional headquarters in Singapore. Additionally, the company announced a collaborative project with Singapore Polytechnic for advance training of the digital workforce of the future. The move aligns with Emerson’s motto of making Singapore, a hub for the delivery of Industrial Internet of Things (IoT) technologies and services for Asia Pacific’s customers.

Inside The Headlines

Emerson’s newly opened Solutions Center in Singapore will support the capabilities of industry’s most comprehensive Industrial IoT automation platform, Emerson’s Plantweb digital ecosystem. The Plantweb offering is comprised of standards-based software, hardware, intelligent devices, as well as services for securely implementing Industrial IoT-based solutions. The Solutions Center would display state-of-the-art multimedia technologies including virtual reality as well as augmented reality.

The Emerson Solutions Center consists of two built-out plant settings. The company noted that the Digital Plant in the Center highlights a scaled-down replica of a process manufacturing facility for process control and safety systems as well as new Industrial IoT technologies. The Digital Plant enables simulation processes of a typical facility like an oil refinery, power plant, or a pharmaceutical plant. Further, the Central Control Room of the Solutions Center facilitates simulations of critical manufacturing processes for process optimization.

Our Take

Emerson is poised to grow on the back of global infrastructure growth, as its core businesses hold dominant positions in markets tied to energy efficiency and infrastructure spending. Moreover, environmental regulations are driving the need for new products, adding to its strength. Going forward, Emerson believes telecommunications infrastructure demand will continue to be one of the strongest catalysts.

Presently, the company is optimistic about the prospects of its Commercial & Residential Solutions segment as it is witnessing improving trends in the U.S., Europe and Asian construction markets. The company believes this segment to on the back of a favorable outlook for global demand within its served markets. For the Automation Solutions segment, favorable trends in power and life sciences along with improving MRO spending by oil and gas customers is expected to boost growth. Going forward, Emerson has prioritized key areas of investment for each of its business segments to maximize growth.

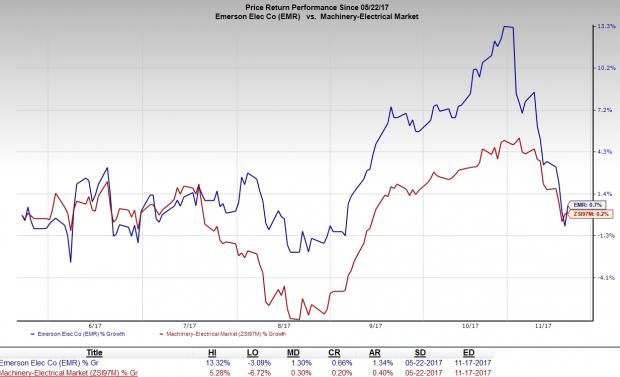

Furthermore, the company’s continuous launches of new products and technologies as well as restructuring efforts undertaken in the past few quarters are likely to benefit its results in the coming quarters. This Zacks Rank #3 (Hold) company has returned 0.7% in past six months, outperforming the industry’s gain of 0.2%.

However the fact remains that, continued softness in the oil and gas markets has affected both capital spending and operational expenditure of clients, which in turn are hurting Emerson’s operations. Also, the company’s Industrial Automation markets in North America have been extremely challenging and any improvements that it anticipated did not materialize, consequently adding to the challenges.

This apart, Emerson is expected to incur high expenses related to the spinoff of Network Power, and proposed divestitures of the motors and drives as well as power generation businesses. Escalating costs, stringent competition and volatility in the capital markets also pose concern for in the near-term.

Stocks to Consider

Some better-ranked stocks from the same space include Alamo Group, Inc. (NYSE:ALG) , Brady Corporation (NYSE:BRC) and Deere & Company (NYSE:DE) . While Alamo Group sports a Zacks Rank #1 (Strong Buy), Brady Corporation and Deere & Company carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Alamo Group has surpassed estimates twice in the trailing four quarters, with an average positive earnings surprise of 6.1%.

Brady Corporation has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 6.0%.

Deere & Company has outpaced estimates in the preceding four quarters, with an average earnings surprise of 55.1%.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Emerson Electric Company (EMR): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Alamo Group, Inc. (ALG): Free Stock Analysis Report

Brady Corporation (BRC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

When the market narrative becomes too widely accepted, excess seems to be created in some areas of the economy as businesses prepare for what’s coming their way. Today’s stock...

Markets are bouncing back as investors bet on technical support, tariff relief, and Germany’s stimulus plans. But with ISM and NFP data ahead, Fed rate cut bets could shift,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.