- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Embraer (ERJ) Q4 Earnings & Sales Miss, Deliveries Slip Y/Y

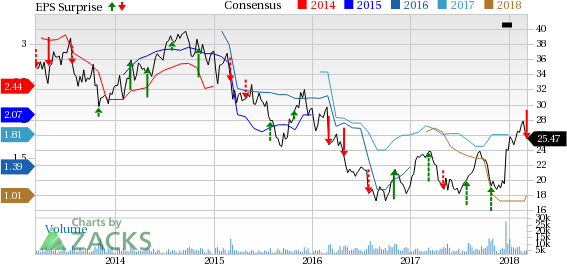

Embraer SA (NYSE:ERJ) reported fourth-quarter 2017 adjusted earnings of 32 cents per American Depository Share (ADS), which missed the Zacks Consensus Estimate of 69 cents by 53.6%. The bottom line also plunged 71.9% from $1.14 in the year-ago quarter.

Barring the one-time items, the company posted GAAP earnings of 19 cents per share compared with $1.06 in the prior-year quarter.

In 2017, Embraer delivered adjusted earnings per share of $1.52, which fell short of the Zacks Consensus Estimate of $1.83 by 17% and the year-ago figure of $1.58.

Revenues

Embraer’s fourth-quarter revenues came in at $1,733 million, missing the Zacks Consensus Estimate of $1,784 million by 2.9%. The top line also declined 14.6% year over year primarily on lower deliveries at the Commercial Aviation segment and a decrease in revenues in the Defense & Security segment.

While revenues at the company’s Commercial Aviation segment were down 22.4%, the Executive Jets segment witnessed a decline of 2.5%. At the Defense & Security segment, the same decreased 15% year over year.

In 2017, the company’s revenues totaled $5.84 billion, which lagged the Zacks Consensus Estimate of $5.89 billion. The reported figure was down compared with $6.22 billion in a year ago.

Order and Delivery

Embraer delivered a total of 73 jets in the quarter, down 2.7% year over year. Of these, deliveries to the commercial aviation market and the business aviation market included 23 and 50 jets, respectively.

In fourth-quarter 2016, the company had delivered 32 jets to the commercial aviation market and 43 jets to the business aviation market, totaling to delivery of 75 jets a year ago.

Notably, in 2017, Embraer reported deliveries of 210 jets compared with 225 in the year-ago period, reflecting a 6.7% decline.

Deliveries to commercial and business aviation markets included 101 and 109 jets in 2017, respectively, compared with 108 jets and 117 jets each in the previous year. Meanwhile, deliveries to the executive aviation market included 72 light and 37 large executive jets. However, the full-year delivery numbers met the company’s guidance for 2017.

In the fourth quarter, Embraer’s Commercial Aviation unit supplied 14 E175s, 5 E190s and 4E195 jets. The rest were delivered by Business Aviation, which included 32 light and 18 large jets.

Embraer’s Commercial Aviation unit supplied 79 E175s, 12 E190s and 10 E195 jets in 2017. The rest were delivered by Business Aviation, including 72 light and 37 large jets.

Markedly, Embraer exited 2017 with a backlog of orders worth $18.3 billion, lower than $18.8 billion last year.

Operational Highlights

In the fourth quarter, Embraer’s cost of sales and services was $1,387 million, down from $1,621 million a year ago.

Additionally, the company’s gross profit declined 15.1% to $345.9 million.

Embraer posted quarterly adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $220.3 million compared with $348 million in the prior-year quarter.

Financial Update

As of Dec 31, 2017, the company’s cash and cash equivalents were $1,270.8 million compared with $1,241.5 million as of Dec 31, 2016.

At the end of 2017, Embraer had net debt of $310.8 million, reflecting an improvement from $722.8 million at the end of 2016.

Net cash inflow from operating activities was $1,001.9 million compared with $287.2 million a year ago.

The company’s adjusted free cash flow was $404.8 million at 2017-end compared to outflow of $359.2 million in the previous year.

Guidance

For 2018, Embraer expects to generate revenues in the range of $5.8-$5.9 billion. While Defense & Security revenues are projected in the $0.80-$0.90 billion band, Commercial Aviation revenues are envisioned to lie within $2.30-$2.45 billion. For the Executive Jets segments, the company anticipates revenues between $1.35 and $1.50 billion.

Furthermore, the company anticipates delivering 85-95 jets in the Commercial Aviation segment along with 70-80 light jets and 35-45 large jets in the Executive Jets segment for 2018.

It expects EBIT margin in the range of 5-6% and EBITDA margin of in 10-11% band.

For 2018, Embraer expects to invest $550 million, including capital expenditures of $200 million.

Zacks Rank

Embraer carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

Huntington Ingalls Industries’ (NYSE:HII) fourth-quarter 2017 adjusted earnings per share of $3.11 surpassed the Zacks Consensus Estimate of $2.92 by 6.5%. However, the bottom line declined 26% from $4.20 a year ago.

Lockheed Martin’s (NYSE:LMT) fourth-quarter 2017 adjusted earnings from continuing operations were $4.30 per share, which surpassed the Zacks Consensus Estimate of $4.06 by 5.9%.

Raytheon’s (NYSE:RTN) fourth-quarter 2017 adjusted earnings from continuing operations were $2.03 per share, which outpaced the Zacks Consensus Estimate of $2.02 by 0.5%.

Don’t Even Think About Buying Bitcoin Until You Read This

The most popular cryptocurrency skyrocketed last year, giving some investors the chance to bank 20X returns or even more. Those gains, however, came with serious volatility and risk. Bitcoin sank 25% or more 3 times in 2017.

Zacks’ has just released a new Special Report to help readers capitalize on the explosive profit potential of Bitcoin and the other cryptocurrencies with significantly less volatility than buying them directly.

See 4 crypto-related stocks now >>

Embraer-Empresa Brasileira de Aeronautica (ERJ): Free Stock Analysis Report

Lockheed Martin Corporation (LMT): Free Stock Analysis Report

Huntington Ingalls Industries, Inc. (HII): Free Stock Analysis Report

Raytheon Company (RTN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

In a market fraught with uncertainty, investors often seek refuge in defensive-minded stocks that offer stability and resilience. Two such stalwarts, Johnson & Johnson and...

Bitcoin has gained legitimacy as it has achieved mainstream status these days. Even the United States Securities and Exchange Commission (SEC) has acknowledged its legitimacy with...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.