- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

El Pollo Loco Expands Delivery Partnership With DoorDash

El Pollo Loco Holdings, Inc. (NASDAQ:LOCO) has recently expanded its delivery partnership with privately held restaurant delivery service, DoorDash.

In September 2017, the partnership began with the duo launching a pilot program in El Pollo Loco’s 98 restaurants in Nevada, Las Vegas and Orange County, CA. Following the expansion, delivery is now available from over 280 of El Pollo Loco’s restaurants, which is more than half of the total number of restaurants operated by the company.

Notably, the new participating markets include Los Angeles, Houston, Phoenix, Dallas, Ariziona, San Francisco, San Jose, San Diego and Sacramento. While ordering is available at El Pollo Loco’s website and app, DoorDash will take care of delivery only.

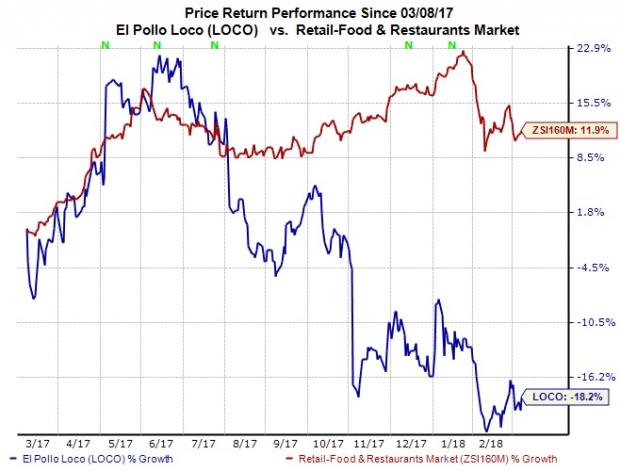

We observe that El Pollo Loco shares have lost 18.2% in a year’s time against the industry’s 11.9% gain.

Delayed Entry Into Delivery

Though relatively late, El Pollo Loco’s entry in to delivery makes sense. This is because delivery is considered to be the fastest growing channel in the business and an effective way of addressing changing needs of customers.

Moreover, the move should help the company better compete with the likes of Chipotle Mexican Grill (NYSE:CMG) , YUM! Brands’ (NYSE:YUM) Taco Bell and Rubio’s Coastal Grill that offer delivery directly through apps like DoorDash and Postmates.

El Pollo Loco Holdings, Inc. Net Income (TTM)

Targeting Millennials

With millennials getting more concerned about convenience and seeking speedier options, enhancing delivery has become crucial for quick-service industry players.

Per market research firm The NPD Group, delivery currently represents 1.7 billion foodservice visits annually and young adults represent 56% of foodservice delivery orders.

We believe that with increased focus on delivery, El Pollo Loco will be in a better position to capture a bigger share of millennial traffic.

Zacks Rank & Key Picks

El Pollo Loco carries a Zacks Rank #3 (Hold). A better-ranked stock in the same space is DineEquity (NYSE:DIN) sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

DineEquity posted better-than-expected fourth-quarter 2017 results, wherein adjusted earnings surpassed the Zacks Consensus Estimate by 15.6% and revenues outpaced the same marginally. The company’s 2018 earnings are projected to grow 22.7%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Yum! Brands, Inc. (YUM): Free Stock Analysis Report

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

DineEquity, Inc (DIN): Free Stock Analysis Report

El Pollo Loco Holdings, Inc. (LOCO): Free Stock Analysis Report

Original post

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.