- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Edison International Declares 12% Hike In Quarterly Dividend

Edison International’s (NYSE:EIX) board of directors recently announced to increase quarterly dividend rate by 11.5%. The revised dividend of 60.5 cents per share will be distributed on Jan 31, 2018 to shareholders of record at the close of business on Dec 39, 2017.

The latest hike marks an increase of 6.25 cents from the prior payout of 54.25 cents per share. The new annualized dividend amounts to $2.42 per share, up from $2.17 paid earlier, resulting in a dividend yield of 3.37%.

Notably, this is the 14th consecutive year of a dividend hike by Edison International's management.

Solid Cash Flow Boosting Dividend Hike

With a strong portfolio of regulated utility assets and well-managed merchant energy operations, Edison International presents a lower risk profile than its utility-only peers. In addition, the company boasts a solid financial position backed by a strong cash generation capacity. As of Sep 30, 2017, Edison International had cash and cash equivalents of $117 million, compared with $84 million at 2016 end. In addition, the company continues to show efficiency in terms of reporting a stable cash inflow through operating activities. The company’s cash flow from operating activities in the first nine months of 2017 was $2,690 million, compared with the year-ago figure of $2,590 million.

Such a solid financial position enables Edison International to maximize shareholder value through the payment of regular dividends and repurchase of shares. Moreover, the company is on track to achieve the targeted payout ratio of 45-55% of its subsidiary Southern California Edison’s earnings. These initiatives will allow the company to retain investors’ interest in the stock.

Price Movement

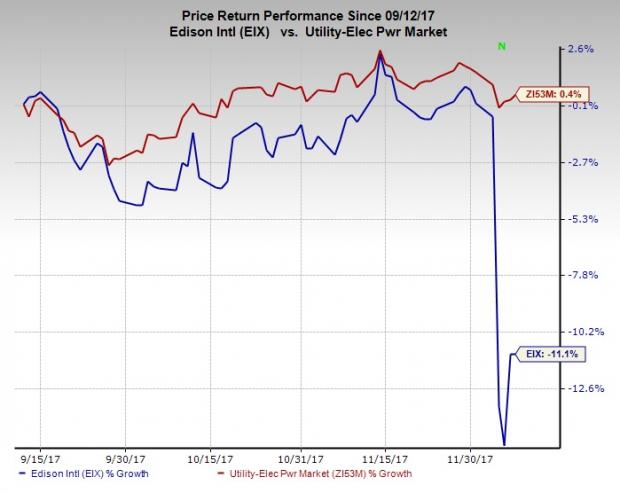

Edison International has underperformed the broader industry over the last three months. Edison International’s shares lost 11.1% during this time frame as against the industry’s gain of 0.4%.

Adverse decision of regulatory bodies for 2018 General Rate Case application might have led to this underperformance.

Zacks Rank & Key Picks

Edison International currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the same space are Atlantic Power Corporation (NYSE:AT) , Consolidated Edison Inc. (NYSE:ED) and DTE Energy Company (NYSE:DTE) . All three stocks carry a Zacks Rank #2 (Buy). You can seethe complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Atlantic Power Corp posted an average positive earnings surprise of 29.21% in the past four quarters. Its current-year Zacks Consensus Estimate for loss has narrowed by 5 cents over the last 30 days.

Consolidated Edison posted an average positive earnings surprise of 0.06% in the past four quarters. It currently boasts a long-term earnings growth rate of 3%.

DTE Energy posted an average positive earnings surprise of 3.81% in the past four quarters. It currently has a long-term earnings growth rate of 6%.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

See Them Free>>

Edison International (EIX): Free Stock Analysis Report

Consolidated Edison Inc (ED): Free Stock Analysis Report

DTE Energy Company (DTE): Free Stock Analysis Report

Atlantic Power Corporation (AT): Free Stock Analysis Report

Original post

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.