- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ED Or CMS: Which Electric Utility Stock Should You Hold?

Utilities are safe investment options as these are mostly regulated and remain more or less steady in the face of economic fluctuations. These stocks thus provide investors with stable earnings and performance along with regular dividend.

Utilities are interest rate sensitive as they require constant investments to fund their capital projects. So, when the central bank revises the rates downward, it lowers capital servicing costs for utility companies. Though the recent rate cuts indicate economic slowdown, this will enable these companies to borrow funds at lower rates.

Currently, companies are focused on lowering carbon emission and are trying to shift their energy generation to renewable sources. In the Utility - Electric Power industry, players are going through a transition phase. Along with this, they are inclined toward the addition of energy storage projects to their portfolio. Such initiatives help meet heightened demand.

In this article, we run a comparative analysis of two electric power utilities — Consolidated Edison Inc. (NYSE:ED) and CMS Energy Corp. (NYSE:CMS) — to ascertain which of the Zacks Rank #3 (Hold) stocks is a better one to hold.

Consolidated Edison and CMS Energy have market capitalization of $29.38 billion and $19.42 billion, respectively. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

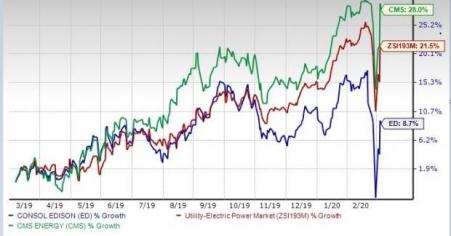

Price Movement

In the past 12 months, shares of CMS Energy have returned 28% compared with the industry’s rise of 21.5% and Consolidated Edison’s increase of 8.7%.

One Year

Growth Projections

The Zacks Consensus Estimate for CMS Energy’s 2020 earnings per share is pegged at $2.67 on revenues of $7.12 billion. The bottom-line figure suggests a 7.23% year-over-year increase. The same for the top line calls for a 4.02% rise on a year-on-year basis.

The consensus mark for Consolidated Edison’s 2020 earnings per share is pegged at $4.49 on revenues of $13.06 billion. The bottom-line suggests a 2.75% year-over-year increase. The same for the top line implies a 3.85% increase year on year.

Consolidated Edison’s long-term (3 to 5 years) earnings are expected to improve 2% compared with CMS Energy’s 7.10%.

Return on Equity (ROE)

ROE is a measure of a company’s efficiency in utilizing shareholders’ funds. ROE for the trailing 12-months for Consolidated Edison and CMS Energy is 8.02% and 14.28%, respectively. The industry’s ROE is at 9.72%. Clearly, CMS Energy has an edge over Consolidated Edison in this respect.

Dividend Yield

Currently, the dividend yield for CMS Energy is at 2.38%, compared with 3.48% for Consolidated Edison. Both the companies’ dividend yield is better than the Zacks S&P 500 composite’s 1.87%.

Surprise Trend

Consolidated Edison pulled off an average positive earnings surprise of 1.15% in the last four quarters. CMS Energy has an average negative earnings surprise of 2.83% for the last four quarters.

The Verdict

Our comparative analysis shows that Consolidated Edison has an edge over CMS Energy in terms of surprise trend and dividend yield. CMS Energy takes the cake in terms of price movement, long-term earnings growth, ROE measure and growth projections. It is clear that CMS Energy is a better utility stock than Consolidated Edison.

Biggest Tech Breakthrough in a Generation

Be among the early investors in the new type of device that experts say could impact society as much as the discovery of electricity. Current technology will soon be outdated and replaced by these new devices. In the process, it’s expected to create 22 million jobs and generate $12.3 trillion in activity.

A select few stocks could skyrocket the most as rollout accelerates for this new tech. Early investors could see gains similar to buying Microsoft (NASDAQ:MSFT) in the 1990s. Zacks’ just-released special report reveals 8 stocks to watch. The report is only available for a limited time.

See 8 breakthrough stocks now>>

Consolidated Edison Inc (ED): Free Stock Analysis Report

CMS Energy Corporation (CMS): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Investors are on edge about what tariff policy means for markets Coming off a strong Q4 earnings season, fresh February corporate sales figures can help assess the macro...

Broadcom stock is in a dynamic rebound phase. Markets seem optimistic ahead of the earnings release. Let's take a deep dive into what to expect from the report. Get the...

Consumers are feeling the pinch from inflation every time they go to the grocery store. Money is a zero-sum game; as disposable income and buying power erodes, consumers are...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.