- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Ecolab, Cargill And Techstars Launch Accelerator Program

Ecolab Inc. (NYSE:ECL) , Techstars and the world’s largest private agricultural company, Cargill, recently announced the launch of a accelerator program in Minnesota. The program is called ‘Farm to Fork Accelerator’.

The three-month program aims at integrating innovative ideas from other companies that are focused on agriculture, food-based digital technology, food processing and food safety.

Notably, 30 high-potential companies will be selected for the program that will receive monetary investment and mentoring from Ecolab and Cargill experts over the next three years. These companies can also leverage on Techstars’ global network.

Notably, the application process for the program opens in January 2018. The program will begin from July 2018.

Market Potential

The global population has quadrupled in this century. Per reports, the world will require 35% more food than the current period by 2030. The Farm to Fork Accelerator will enable companies upgrade technologies to meet the growing demand.

Factors including climate change, urbanization along with lack of investment and production have been major concerns for food companies. The program introduced by Ecolab, Cargill and the Techstars is expected to improve the current situation.

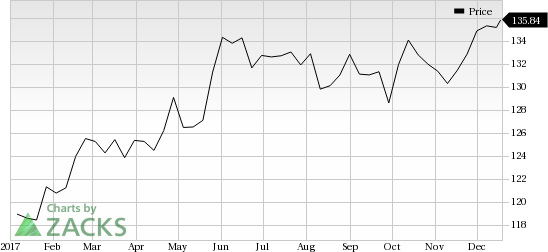

Ecolab Inc. Price

Acquisitions in Focus

The latest development closely follows Ecolab’s acquisition of Scotland-based Arpal Group. Arpal provides cleaning and sanitizing products and services in the United Kingdom and the Middle East.

The MedTech major announced the acquisition of three U.S. pest services companies that provide specialized services in food storage. The transactions are worth $36 million and were closed on Dec 1. The acquired companies are Food Protection Services LLC, Royal Pest Solutions, Inc. and Research Fumigation Company, LLC. The development expands Ecolab’s pest elimination solutions for the food and beverage industry.

In September, the company signed an agreement to acquire the paper chemicals business of Georgia-Pacific. The deal will enhance Ecolab’s position in the growing Tissue and Towel as well as the Packaging and Board segments of the paper industry.

Price Performance

Year to date, Ecolab’s stock has traded above the industry. The company has returned almost 15.1% compared with the industry’s rally of 10.6%. Ecolab continues to witness improvement in underlying sales volume and pricing in most business segments.

A robust product portfolio, launches and expanding customer base is likely to drive organic sales, while the realization of targeted synergies associated with acquisitions will expand margins. Further, solid performance in the company’s Global Institutional segment is a positive. Sales increased 6.6% to $1.22 billion at the segment in the last quarter, courtesy of strong growth in the Specialty and Healthcare business lines.

Zacks Rank & Key Picks

The stock has a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader medical sector are PetMed Express (NASDAQ:PETS) , Luminex Corporation (NASDAQ:LMNX) and IDEXX Laboratories (NASDAQ:IDXX) .

Notably, PetMed Express flaunts a Zacks Rank #1 (Strong Buy). The company has a long-term expected earnings growth rate of 10%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Luminex yielded a return of 6.4% over the last year. The stock sports a Zacks Rank #1.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. The stock rose 39.2% over a year’s time and carries a Zacks Rank #2 (Buy).

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Ecolab Inc. (ECL): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Original post

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.