- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

ECB Running Out Of Bonds To Buy For QE

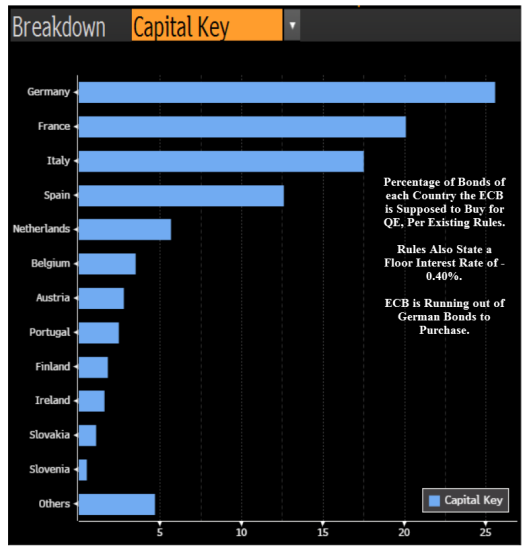

ECB rules say QE bond purchases must be weighted according to size of the economy. That means German bonds are the preferred issue.

The rules also stipulate a floor interest rate of -0.4%. Most German bonds trade below that figure.

Expect a rule change because the ECB wants to continue its ridiculous and counterproductive QE program.

Please consider The ECB Could Soon Run Out of Bunds to Buy:

The European Central Bank’s haul of bonds passed a trillion euros this month. A second trillion may be harder to come by.

The ECB could run out of German government bonds to buy as soon as October, according to Citigroup Inc’s Harvinder Sian. That’s a problem because the bonds of eurozone governments form the largest component of the asset purchase plan it’s designed to stimulate lending and boost inflation — and bunds in turn make up the largest share of those sovereign debt purchases. The program is set to run until at least March 2017 at a pace of about 80 billion euros ($90 billion) per month.

The ECB’s own policies may be making its job harder. Both its asset purchases and its negative interest rates have sparked a decline in bond yields, complicating the bank’s ability to meet its asset-purchase targets. Decreasing yields push a larger proportion of bonds below the -0.4 percent deposit rate that’s been set as a floor for the program, making them ineligible for purchase.

To address this, Sian says the ECB will need to make changes that could include increasing the share of bonds it can buy from a single debt issue (it has already increased that ceiling to 33 percent, from 25 percent). Another option could be to loosen up the application of the ECB’s so-called ‘capital key,’ which stipulates that the quantity of purchases should be roughly proportionate to the size of each nation’s economy — a system that favors the bonds of Germany, whose notes tend to yield the lowest.

Out of Bunds

Fed Uncertainty Principle

The ECB is on the same path as Japan. Both countries may as well purchase 100% of all the bonds and be done with it. It will not help spur lending one bit, as Japan, who is far ahead in this ridiculous endeavor, has proven.

But central banks are stubborn. They will never change their inept ways. This is a perfect example of Fed Uncertainty Principle Corollary Number Three: “Don’t expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.”

Simply remove the word “Fed” in the previous sentences and replace with ECB, Bank of Japan, or any other central bank of your choice.

For discussion of the Fed Uncertainty Principle and all its related corollaries, please see Uncertain Measures of Uncertainty; Fed Uncertainty Principle Revisited.

Related Articles

When it comes to the economy, we’re in a bit of a weird spot: The data tells us that, despite inflation fears, interest rates are likely to fall in the year ahead. Falling rates...

Telegram Group Inc. is a globally recognized messaging service company, offering a cloud-based mobile and desktop messaging application. Known for its strong focus on security,...

Many investors regard passively managed index mutual funds or ETFs as favorable options for stock investing. However, they may also find that actively managed funds offer...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.