- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

EBay (EBAY) Prices $1B Senior Notes, Gets Moody's Baa1 Rating

eBay (NASDAQ:EBAY) recently announced an underwritten public offering of senior unsecured notes aggregating $1 billion. These notes have been issued in two tranches of different amounts with varying coupon rates and maturities.

The first tranche of $500 million carries an interest rate of 1.900% and is due in 2025 while the second tranche of $500 million, which has an interest rate of 2.700%, is due in 2030. The offering is expected to close on Mar 11, 2020, subject to customary closing conditions.

eBay will use the proceeds to repay all of its outstanding Notes. The remaining fund can be used for general corporate purposes, which may include capital expenditures, share repurchases, repayment of other indebtedness and possible acquisitions.

eBay’s new senior unsecurednotes were assigned a Baa1 rating by Moody's, a leading credit rating agency .

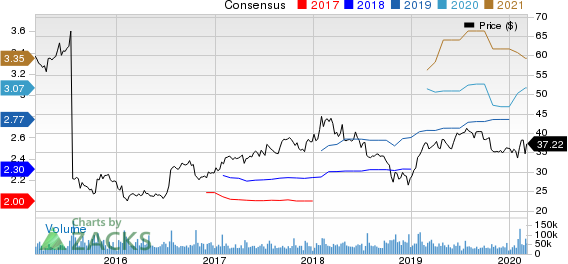

eBay Inc. Price and Consensus

Cash Position

At the end of fourth-quarter 2019, cash and short-term investments balance came in at $2.8 billion, down from $3.1 billion as on Sep 30, 2019. Further, eBay’s balance sheet is highly leveraged, with a long-term debt of $6.7 billion at the end of the fourth quarter.

The company generated $811 million of cash from operating activities and had free cash flow of $672 million during the reported quarter. Further, it returned $1.1 billion to shareholders, which includes dividend payouts worth $113 million, in the fourth quarter.

We believe that the company has a strong balance sheet, which will help it to capitalize on investment opportunities and pursue strategic acquisitions, further improving prospects. In our view, the senior notes’ offering will bring down the company’s cost of capital, and in turn will strengthen the balance sheet and support growth.

These notes should provide financial flexibility and propel long-term growth.

Bottom Line

eBay is one of the world's largest online trading communities with a powerful marketplace for the sale of goods and services by individuals, as well as small businesses. The company enables trade on a local, national and international basis via local sites in numerous markets in the United States, along with country-specific sites in the United Kingdom, Canada, Germany, Austria, France, Italy, Japan, Korea and Australia.

eBay Classifieds are designed to help people in free listing of products and services. The company is making all efforts to improve the Classifieds business. It is currently re-platforming itself by building product catalogs on structured data, enhancing mobile platform, rolling out new browse-inspired shopping journeys and strengthening its brand.

In addition, the company’s growing initiatives toward strengthening its managed payments offerings and advertising revenues remain major positives. Moreover, integration between listing flows and Seller Hub remains a tailwind.

Notably, the company entered into a definitive agreement to sell StubHub to viagogo as a result of slowdown in StubHub’s volume.

However, intensifying competition in the e-commerce space and foreign exchange headwinds remain major concerns. eBay’s core business faces tough competition from Amazon (NASDAQ:AMZN) , Alibaba (NYSE:BABA) , Etsy and Facebook (NASDAQ:FB) .

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

Facebook, Inc. (FB): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

As the digital economy starts to go online across businesses and the world, investors have to be aware of the companies and services that will be at the forefront of this...

Wall Street Indexes remain under pressure today but have held above the lows we saw on Tuesday as the Trump administration tariffs came into force. The announcement of tariffs on...

These stocks provide a compelling case as safe-haven stocks in the face of an escalating trade war. Each company operates within sectors that are relatively resilient to economic...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.