- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Earnings Watch: 5 Ways To Trade Whole Foods

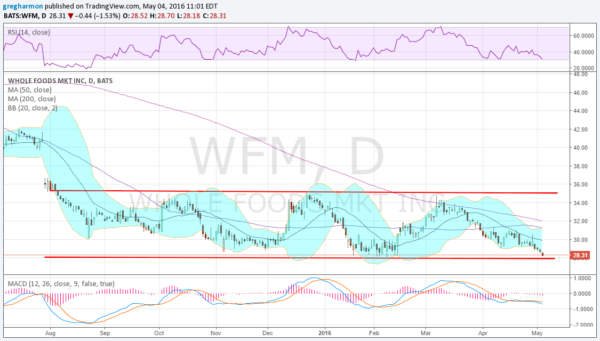

Whole Foods Market (NASDAQ:WFM),peaked on a bounce to 57 in February 2015. It started lower, then, and gapped down on earnings last May. A consolidation followed before another gap down in July. Since then it has moved back and forth in a channel between 28 and 35 for 9 months. Into tonight's earnings, it's testing the bottom of that channel.

The RSI is falling and at the edge of being oversold while the MACD is flat but negative. The Bollinger Bands® are opening lower, to allow the down move since early March to continue. Ugly.

There is support lower at 28 and then you need to look back to 2011 to find it again at 27 and 25 before 24 and 22.50. There is resistance above at 29.15 and 30.80 followed by 32.70 and 35. The reaction to the last 6 earnings reports has been a move of about 6.73% on average or $1.90 making for an expected range of 26.30 to 30.20.

The at-the-money May 6 Expiry Straddles suggests a larger $2.65 move by Expiry with Implied Volatility at 147% above the May at 60%. Short interest is high at 10%. Open interest is focused on the Put side at 29.5 and 30, biggest at 29.5, with a smattering lower. On the Call side it is smaller and spreads from 29 to 31.50, biggest at 29.

5 Ways To Play WFM

- Trade Idea 1: Buy the May 6 Expiry 28/26.5 1×2 Put Spread for free.

- Trade Idea 2: Buy the May 6 Expiry 28.5/29.5 Call Spread for $0.47.

- Trade Idea 3: Buy the May 6 Expiry 28.5/29.5 Call Spread and sell the May 6 Expiry 26.5 Put for a $0.08 credit.

- Trade Idea 4: Sell the May 6 Expiry 26.5/30 Strangle for a $1.20 credit.

#1 gives the downside with leverage and a possible entry to the stock at 25.

#2 gives the upside.

#3 adds leverage and a possible entry at 26.42.

#4 is profitable on a close from 25.30 to 31.20 at Expiry Friday.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.