- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dycom (DY) Q1 Earnings Beat, Project Initiations Expected

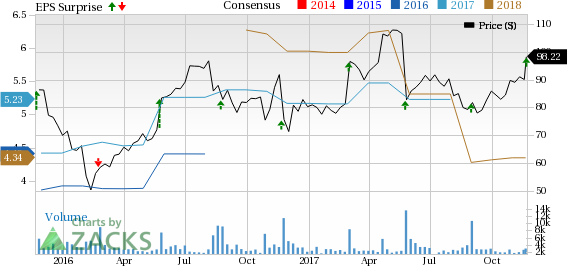

Specialty contracting services provider, Dycom Industries Inc. (NYSE:DY) , continued its winning streak for the seventh consecutive quarter with the first-quarter fiscal 2018 adjusted earnings of 99 cents per share having surpassed the Zacks Consensus Estimate by 8.8%. The bottom line also came in above the projected range of 81-96 cents.

However, the bottom line was substantially lower than the year-ago tally of $1.65.

Shares of the company rose 9.1% in the trading session post release of the quarterly results as investors were hopeful of a turnaround in the company’s fortunes. Positive industry developments and the company’s optimism about its growth prospects helped raise investors’ spirits, despite a massive year-over-year decline in earnings as well as revenues. In fact, the company expects a large number of project initiations soon.

Inside The Headlines

Dycom’s fiscal first-quarter contract revenues came in at $756.2 million, down 5.4% year over year. The top line beat the Zacks Consensus Estimate of $730 million and came in above the company’s expected range of $715-$745 million. Extensive deployment of 1-Gigabyte wireline networks by major customers and storm restoration services fuelled the top-line growth during the quarter. This was however, offset by a near-term moderation in spending by an important customer. Organic revenues contracted 8.4% year over year.

The company reported non-GAAP adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) of $97.6 million for the quarter compared with $129.2 million a year ago.

Dycom Industries, Inc. Price, Consensus and EPS Surprise

Liquidity

As of Oct 28, 2017, Dycom had cash and cash equivalents of $24.5 million compared with $38.6 million as of Jul 29, 2017. The company’s long-term debt was $736 million at the quarter-end compared with $738.3 million at fiscal 2017-end.

Guidance

The company issued guidance for second-quarter fiscal 2018, wherein adjusted earnings per share are projected in the range of 24-36 cents on revenues within the $645-$675 million band. The stock has seen the Zacks Consensus Estimate for fiscal second-quarter earnings being pegged at 57 cents per share.

The company expects revenues in the fiscal second quarter to stabilize and also projects strong demand from several heavyweight customers. Dycom is optimistic about fiber deep cable capacity projects, 1 gigabit deployments and initial phases of fiber deployments for newly emerging wireless technologies. However, the company’s margins will likely suffer due to an adverse mix of work activities.

Our Take

Despite earnings outperformance, the company’s business remains highly vulnerable to risks associated with the U.S. telecommunications industry. Presently, the space is facing intense pricing competition. Severe spectrum crunch coupled with gradual smartphone and tablet adoption is compelling wireless operators to seek other options for raising revenues.

Moreover, the telecommunications industry is highly dynamic in nature. It continues to experience rapid technological, structural and competitive changes and may reduce the service requirements from this company, thus affecting the latter’s financial performance.

Nevertheless, the industry is witnessing a dramatically increasing network bandwidth with major industry participants deploying significant 1 gigabit wireline networks. Also, emerging wireless technologies necessitate incremental wireline deployments. Such positive industry trends are generating unprecedented opportunities for Dycom. Converged wireless/wireline network deployments will also serve to expand this Zacks Rank #3 (Hold) company’s growth prospects.

In light of these increased fiber deployments (which have already begun in many parts of the United States), Dycom expects numerous project launches to occur in the near term. This in turn bodes well for the company’s growth.

Stocks to Consider

Better-ranked stocks in the same space include EMCOR Group, Inc. (NYSE:EME) , Sterling Construction Company Inc. (NASDAQ:STRL) and MasTec, Inc. (NYSE:MTZ) . While EMCOR and Sterling Construction sport a Zacks Rank #1 (Strong Buy), MasTec holds a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

EMCOR Group pulled off an average positive earnings surprise of 17% for the last four quarters, having surpassed estimates thrice in the trailing four quarters.

Sterling Construction delivered an average beat of 65.2%, having surpassed estimates thrice in the trailing four quarters.

MasTec came up with a four-quarter average positive earnings surprise of 28.1%, having outpaced estimates in each.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

EMCOR Group, Inc. (EME): Free Stock Analysis Report

MasTec, Inc. (MTZ): Free Stock Analysis Report

Dycom Industries, Inc. (DY): Free Stock Analysis Report

Sterling Construction Company Inc (STRL): Free Stock Analysis Report

Original post

Related Articles

Walgreens Boots Alliance Inc. (NASDAQ:WBA) is on the brink of a significant transformation as it nears a deal with Sycamore Partners to become a private entity. The transaction,...

Using the Elliott Wave Principle (EWP), we have been successfully tracking the most likely path forward for the S&P 500 (SPX) over several months. Although there are many ways...

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.