- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

DXC Technology (DXC) Q2 Earnings & Revenues Top, Shares Up

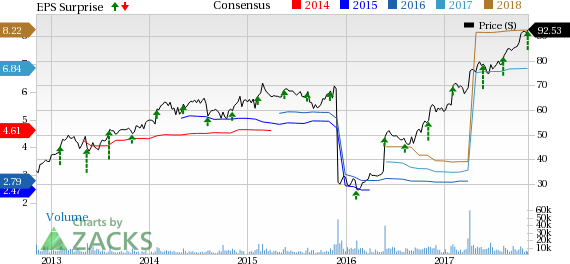

Shares of DXC Technology Company (NYSE:DXC) rose more than 5%, in after-hours trading, as the company released better-than-expected second-quarter fiscal 2018 results. Further, the company provided encouraging fiscal 2018 outlook, which positively impacted the share price.

Notably, DXC Technology is result of the merger between Computer Sciences and Enterprise Services Division of Hewlett Packard Enterprise (NYSE:HPE) , which was concluded on Apr 1, 2017.

The company reported non-GAAP earnings from continuing operations of $1.93 per share, which surpassed the Zacks Consensus Estimate of $1.53 per share and also increased on a year-over-year basis.

DXC Technology’s stock price history reveals that it hasn’t disappointed in a long time. In fact, shares of the company have risen 59% in the past one year, outperforming the industry’s increase of meager 39.4%.

Quarter Details

Revenues were not only up a whopping 229.4% from the year-ago quarter to $6.163 billion, but also surpassed the Zacks Consensus Estimate of $5.993 billion. On a constant currency basis, revenues were down 3.5% year over year.

Segment-wise, revenues from Global Business Services (GBS) increased 123.3% on a year-over-year basis to $2.311 billion. Excluding the impact of purchase price accounting, on constant currency basis, revenues decreased 4.3% year over year. The decline was primarily due to completion of two large government contracts in the UK. Revenues from the new business for GBS came in at $2.5 billion during the quarter.

Global Infrastructure Services (GIS) revenues during the quarter came in at $3.142 billion as compared with $836 million reported in the year-ago-quarter. On constant currency basis, revenues decreased 4.8% year over year (excluding the impact of purchase price accounting), primarily due to decline in traditional infrastructure services. Revenues from new business for GIS awards came in at $2.8 billion during the quarter.

United States Public Sector (USPS) revenues were $710 million during the quarter. USPS revenue was up 5.5% year over year (excluding the impact of purchase price accounting). Revenues from new business for USPS awards came in at $644 million during the quarter.

The company’s non-GAAP operating income from continuing operations (excluding restructuring costs, transaction and integration-related costs and amortization of intangible assets) amounted to $814 million as compared with $311 million reported in the year-ago quarter. Operating margin came in at 13.2% as compared with 16.6%, reported in the prior-year quarter. Non-GAAP selling, general and administrative expenses amounted to $606 million compared with $539 million reported in the year-ago quarter.

Non-GAAP net income from continuing operations came in at $566 million during the quarter as compared with $225 million reported in the year-ago period.

The company exited the quarter with $2.671 billion in cash and cash equivalents compared with $2.517 billion in the previous quarter. Long-term debt balance (including current portion) was $8.525 billion. Net cash provided by operating activities during the six months ended Sep 30, 2017, came in at $1.534 billion. Free cash during the quarter came in at $589 million.

During the quarter, the company paid $51 million as dividends and $47 million as share repurchase.

Outlook

The company reiterated fiscal 2018 revenues guidance. For fiscal 2018, DXC Technology continues to expect revenues to be in the range of $24-$24.5 billion in constant currency. The Zacks Consensus Estimate for revenues is pegged at $24.18 billion. Non-GAAP EPS is now anticipated to be in the range of $7.25-$7.75 per share (previous guidance $6.50-$7 per share). The Zacks Consensus Estimate for earnings is pegged at $6.84 per share.

Recent activity

DXC Technology recently announced the spin-off of its USPS business, and subsequently merged the same with Vencore Holdings and KeyPoint Government Solutions. The three companies have come together to form a publicly-traded IT service-providing company, primarily to the U.S. government. Notably, Vencore and KeyPoint are owned by private-equity firm Veritas Capital. The transaction is anticipated to close by the end of March 2018.

Per the agreement, the deal will be structured as a ‘Reverse Morris Trust’ transaction, consequently making the entire transaction as tax-free to DXC Technology and its shareholders.

Upon conclusion of the deal, shareholders of DXC Technology will receive 86% of the combined company’s shares. Along with this, the company will receive $1.05 billion of cash from USPS, upon the completion of its spin-off. The proceeds from USPS are intended to be used for debt repayments, share buyback and other general corporate purposes.

Our Take

The company reported stellar second-quarter fiscal 2018 results, where in both top and bottom line surpassed the Zacks Consensus Estimate. The company also provided an encouraging guidance for fiscal 2018.

Post-merger, DXC Technology has become the world’s second largest end-to-end IT services providing company after Accenture plc (NYSE:ACN) . We believe that the merger has opened up avenues of growth for the combined company. The merger has combined Computer Sciences’ strength in insurance, healthcare, and financial services with HPE’s expertise in industries like transportation, pharma, technology, media and telecom.

Following the footsteps of Computer Sciences, DXC Technology may be seen making strategic acquisitions to enhance portfolio, which is likely drive growth over the long run. Further, the company is projected to generate cost synergies worth $1 billion during the first year and record a run rate of $1.5 billion at the end of the same.

Nonetheless, the market is very competitive with companies like CACI International Inc. (NYSE:CACI) and Accenture, which could hurt DXC Technology’s top and bottom lines. Additionally, a challenging macroeconomic situation and uncertain IT spending environment remain headwinds.

Currently, DXC carries a Zacks Rank #2 (Buy).You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Hewlett Packard Enterprise Company (HPE): Free Stock Analysis Report

CACI International, Inc. (CACI): Free Stock Analysis Report

Accenture PLC (ACN): Free Stock Analysis Report

DXC Technology Company. (DXC): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.