- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dull Outlook For Electronics Miscellaneous Components Stocks

The Zacks Electronics - Miscellaneous Components industry primarily comprises companies that provide a wide range of electronic component products. Their offerings include power control and sensor technologies to mitigate equipment damage, testing products for safety, along with advanced medical solutions.

The industry participants cater to varied end markets such as telecommunications, automotive electronics, medical devices, industrial, transportation, energy harvesting, defense and aerospace electronic systems, as well as consumer electronics. Its customers mainly consist of original equipment manufacturers, independent electronic component distributors and electronic manufacturing service providers.

One of the prominent stocks in this industry is TE Connectivity Ltd (NYSE:TEL).

Here are the industry’s three major themes:

- As majority of the industry participants have manufacturing operations in China and South-East Asia, the ongoing trade dispute between the United States and China — including the restriction on sales to Huawei — is impacting the industry players, particularly in areas of robotics, industrial automation, as well as semiconductor applications. Also, the outbreak of coronavirus in China has impacted the industry participants as they have significant exposure in the country.

- Rising demand for products like ceramic and tantalum capacitors, Electro-Magnetic Compatible devices, sensors and sensor-based measurement systems bodes well for the industry participants. However, trade-war driven increases in raw material costs, rising freight expenses and volatility in commodity prices pose significant challenges.

- The demand for electronics continues to rise, driven by different factors including growing use of electronic devices in daily life, increasing complexity of electronic products, rising demand for AI in emerging markets and the ongoing development of new solutions for energy generation and conservation, thereby benefiting the industry participants.

Zacks Industry Indicates Dull Prospects

The Zacks Electronics - Miscellaneous Components industry is housed within the broader Computer and Technology sector. It carries a Zacks Industry Rank #175, which places it in the bottom 31% of more than 250 Zacks industries.

The group’s Zacks Industry Rank, which is basically the average of the Zacks Rank of all the member stocks, indicates weak near-term prospects. Our research shows that the top 50% of the Zacks-ranked industries outperforms the bottom 50% by a factor of more than 2 to 1.

Before we present a few stocks that you may want to consider for your portfolio, let’s take a look at the industry’s recent stock-market performance and valuation picture.

Industry Lags Sector and S&P 500

The Zacks Electronics - Miscellaneous Components industry has underperformed the broader Zacks Computer and Technology sector, and S&P 500 composite over the past year.

The industry has declined 0.4% over this period compared with the S&P 500 and the broader sector’s rally of 9.6% and 16.9%, respectively.

One-Year Price Performance

.jpg)

Industry’s Current Valuation

On the basis of forward 12-month price-to-earnings, which is a commonly used multiple for valuing electronics - miscellaneous components stocks, the industry is currently trading at 19.89X versus the S&P 500’s 17.66X and the sector’s 2.49X.

Over the past five years, the industry has traded as high as 21.69X, as low as 13.76X and recorded a median of 16.88X, which is depicted in the charts shown below.

Price-to-Earnings (P/E) Ratio (F1)

.jpg)

Price-to-Earnings (P/E) Ratio (F1)

.jpg)

Bottom Line

The development of new products and solutions in robotics, industrial automation, hybrid transportation systems, electronic controls for engines and industrial machinery, smart phones and portable devices, GPS navigation, as well as smart and connected (Internet of Things) devices should drive growth. However, trade tensions and volatility in prices of commodities like tantalum and ceramic powders are pressing concerns.

Here we present four stocks that have a Zacks Rank #2 (Buy). These stocks are well positioned to outperform the market. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

AVX Corporation (AVX) is a leading worldwide manufacturer, and supplier of a broad line of passive electronic components and related products. This Zacks Rank #1 stock has gained 67.1% in the past year. The Zacks Consensus Estimate for earnings for the current year has remained stable at $1 per share over the past 30 days.

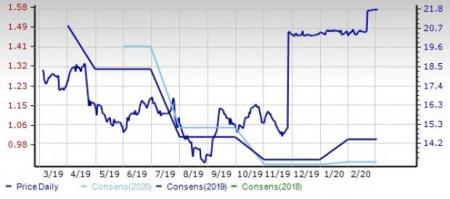

Price and Consensus: AVX

BWX Technologies, Inc. (BWXT) supplies precision manufactured components and services to the commercial nuclear power industry. The company offers technical, management and site services to governments in complex facilities and environmental remediation activities. This Zacks Rank #2 stock has gained 7.8% in the past year. The Zacks Consensus Estimate for earnings for the current year has increased 1.1% to $2.80 per share over the past 30 days.

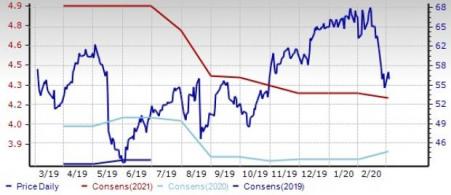

Price and Consensus: BWXT

Fabrinet (FN) provides precision optical, electro-mechanical and electronic manufacturing services to original equipment manufacturers of complex products such as optical communication components, modules and sub-systems, industrial lasers and sensors. This Zacks Rank #2 stock has gained 0.3% in the past year. The Zacks Consensus Estimate for earnings for the current year has increased 1.6% to $3.81 per share over the past 30 days.

Price and Consensus: FN

TE Connectivity Ltd. (TEL) manufactures and designs products that connect and protect the flow of power and data inside millions of products used by consumers and industries. This Zacks Rank #2 stock has gained 0.5% in the past year. The Zacks Consensus Estimate for earnings for the current year has increased 1.6% to $3.81 per share over the past 30 days.

Price and Consensus: TEL

TE Connectivity Ltd. (TEL): Free Stock Analysis Report

Fabrinet (FN): Free Stock Analysis Report

BWX Technologies, Inc. (BWXT): Free Stock Analysis Report

AVX Corporation (AVX): Free Stock Analysis Report

Original post

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.