DowDuPont Inc.’s (NYSE:) Transportation & Advanced Polymers unit is increasing production capacity at its Mechelen, Belgium site. The latest move will address the growing demand for DuPont Zytel HTN high-performance polyamide resin used in the automotive, consumer and electronics markets.

Transportation & Advanced Polymers, a segment of DowDuPont Specialty Products Division, owns and operates world-scale polymerization and compounding assets in major regions of the world.

The Specialty Products Division has increased its investment at the Mechelen site to install a new production line that will come online in the fourth quarter of 2017. DowDuPont Transportation & Advanced Polymers continues to invest in compounding capacity expansion to address the strong growth in demand for highly engineered specialty polymers including PPAs.

Part of Zytel HTN high-performance polyamide resin portfolio, Zytel HTN PPA grades offers outstanding chemical resistance. It is also known to retain properties when exposed to moisture and can even perform at high temperature.

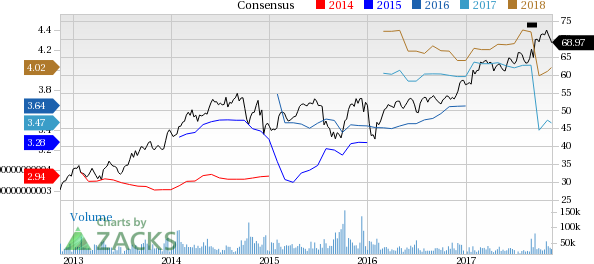

DowDuPont has underperformed the

industry it belongs to over the last three months. The company’s shares have moved up around 9.2% over this period, compared with roughly 11.4% gain recorded by the industry.

DowDuPont, in its third-quarter 2017 earnings call, said that demand outlook remains positive for most of its key end-markets. It will remain focused on executing its near-term priorities that include delivering earnings and cash flow growth, executing its $3-billion cost synergy initiatives and advancing activities to create three growth companies in Agriculture, Materials Science and Specialty Products.

DowDuPont also declared it will take actions to enable cost savings of $3 billion. These include workforce reductions, buildings and facilities consolidations and select asset shutdowns. DowDuPont recorded pre-tax charges of $180 million in the third quarter of 2017 in connection with the actions that are approved so far. It expects to record total pre-tax charges of around $2 billion, with around $1 billion expected in the fourth quarter of 2017.

Dow Chemical Company (NYSE:) (The) Price and Consensus

Dow Chemical Company (The) Price and Consensus | Dow Chemical Company (The) Quote

Zacks Rank & Stocks to Consider

DowDuPont is a Zacks Rank #3 (Hold) stock.

Some better-ranked companies in the basic materials space are Ingevity Corporation (NYSE:) , ArcelorMittal (NYSE:) and Westlake Chemical Corporation (NYSE:) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Ingevity has expected long-term earnings growth of 12%. Its shares have gained 33.5% year to date.

ArcelorMittal has expected long-term earnings growth of 11.3%. Its shares have rallied 27.5% year to date.

Westlake Chemical has expected long-term earnings growth of 8.4%. Its shares have moved up 61.8% year to date.

Zacks’ Best Private Investment Ideas

While we are happy to share many articles like this on the website, our best recommendations and most in-depth research are not available to the public.

Starting today, for the next month, you can follow all Zacks' private buys and sells in real time. Our experts cover all kinds of trades… from value to momentum . . . from stocks under $10 to ETF and option moves . . . from stocks that corporate insiders are buying up to companies that are about to report positive earnings surprises. You can even look inside exclusive portfolios that are normally closed to new investors.

Click here for Zacks' private trades >>

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.