- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dow Gains 5,000 Points In 2017: 5 Stocks Leading The Rally

This has been a banner year for the broad U.S. stock market, with the major benchmarks scaling multiple highs in the final weeks. In particular, the Dow Jones Industrial Average has moved up 5,000 points this year — the biggest annual gain in its history — and is moving closer to another major milestone of 25,000.

The index hit the mark of 20,000 on Jan 25, 21,000 on Mar 1, 22,000 on Aug 1, 23,000 on Oct 17 and 24,000 just three weeks ago. Additionally, the Dow Jones logged its 70th record close of the year, the highest-ever number of record closes in a calendar year. This suggests strong complacency in the stock market.

Optimism over tax reform and higher chances of the plan being signed into law this Christmas has acted as the latest catalyst to the second-largest bull market. This is especially true, as a massive $1.4-trillion tax cut will lead to an economic surge, boosting job growth and reflation trade. It will further accelerate earnings, leading to increased dividend and buyback activities. Additionally, the tax repatriation will allow companies to bring the offshore cash back home, paving the way for increased mergers and acquisitions.

Further, the dual tailwinds of strong corporate earnings and solid global economic growth, with most major countries growing simultaneously for the first time in years, are driving the rally throughout the year. The combination of other factors like a rise in oil price and higher interest rates are also fueling growth in the market.

Given this, most of the stocks on the blue-chip index have delivered astounding returns. Below, we have highlighted five players that are leading the index this year and are likely to continue doing so heading into the New Year.

Boeing Company (NYSE:BA)

Based in Chicago, IL, The Boeing Company is the world's largest aerospace company and leading manufacturer of commercial jetliners and defense, space and security systems. The company has seen positive earnings estimate revision of 12 cents for this year over the past three months, with an expected earnings growth rate of 30.89% compared with the industry average of 16.38%. While the stock carries a Zacks Rank #3 (Hold) and a VGM Score of B, it has a dismal Zacks Industry Rank in the bottom 31%. It has surged nearly 90% this year. (Looking for the Best Stocks for 2018? Be among the first to see our Top Ten Stocks for 2018 portfolio here.)

Caterpillar Inc. (NYSE:CAT)

Based in Peoria, IL, Caterpillar manufactures and sells construction and mining equipment, diesel and natural gas engines, industrial gas turbines, and diesel-electric locomotives for heavy and general construction, rental, quarry, aggregate, mining, waste, material handling, oil and gas, power generation, marine, rail, and industrial markets. The stock has seen solid earnings estimate revision of $1.22 per share over the past three months for this year, reflecting year-over-year earnings growth of 88.22%, much higher than the industry’s average growth of 70.46%. Further, Caterpillar has a Zacks Rank #1 (Strong Buy) and a VGM Score of C. It boasts a robust Zacks Industry Rank in the top 1% and has delivered solid returns of 61.5% this year. You can see the complete list of today’s Zacks #1 Rank stocks here.

Apple Inc. (NASDAQ:AAPL)

Based in Cupertino, CA, Apple is engaged in designing, manufacturing and marketing mobile communication and media devices, personal computers, and portable digital music players. It has seen positive earnings estimate revision of 26 cents over the past three months for this fiscal year with an expected growth rate of 21.43% compared with the industry’s average decline of 12.16%. Apple currently has a Zacks Rank #3 and a VGM Score of C. The stock has an ugly Zacks Industry Rank in the bottom 7% and has gained about 52.3% in the year-to-date time frame.

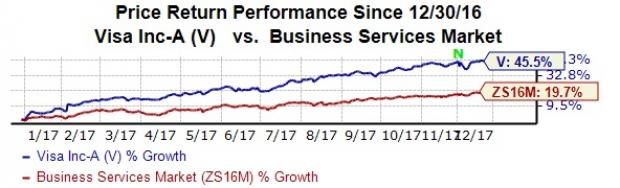

Visa Inc. (NYSE:V)

Based in San Francisco, CA, Visa operates the world's largest retail electronic payments network and is one of the most recognized global financial services brands. The stock has seen positive earnings estimate revision of six cents over the past three months for this fiscal year. Its earnings are expected to grow 16.45%, well above the industry’s average growth of 6.75%. Visa has a Zacks Rank #2 (Buy) and a VGM Score of D. However, it belongs to a dismal Zacks Industry Rank in the bottom 31%. The shares of Visa are up 45.5% this year.

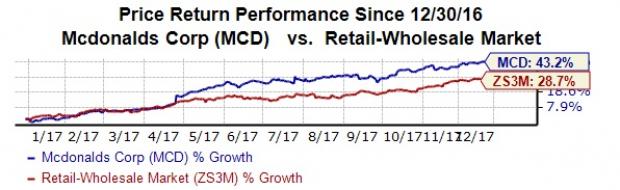

McDonald's Corporation (NYSE:MCD)

Based in Oak Brook, IL, McDonald’ operates and franchises restaurants in the United States, Europe, the Asia/Pacific, the Middle East, Africa, Canada, Latin America, and internationally. It has seen positive earnings estimate revision of couple of cents over the past three months for this year with an expected growth of 14.47% compared with the industry’s average growth of 6.70%. McDonald’s has a Zacks Rank #3 and a VGM Score of C. It belongs to a dismal Zacks Industry Rank in the bottom 13%. Shares of MCD have climbed 43.2% so far this year.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report. Download it free >>

Boeing Company (The) (BA): Free Stock Analysis Report

Apple Inc. (AAPL): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Visa Inc. (V): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home Depot’s (NYSE:HD) Q4 2024 report and guidance for 2025 have plenty to be unhappy about, but the simple truth is that this company turned a corner in 2024. It is on track for...

Nvidia is scheduled to release its Q4 earnings report at 4:20PM ET on Wednesday. A call with CEO Jensen Huang is set for 5:00PM ET. The chipmaker’s results will serve as a...

Warren Buffett has always critiqued airline stocks for being overly capital-intensive, exhibiting low growth, and relying heavily on cyclical consumer travel patterns—further...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.