- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dover (DOV) Hits 52-Week High: What's Fueling The Stock?

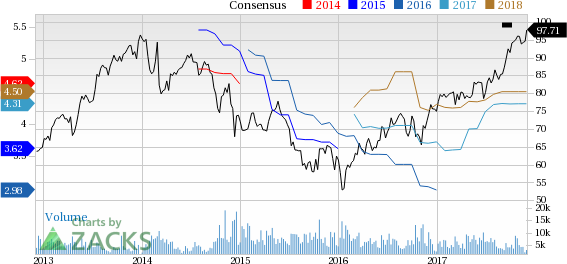

On Nov 30, Dover Corporation (NYSE:DOV) scaled a 52-week high of $98.00 during intraday trading, finally closing lower at $97.71.

Investors are optimistic on this Zacks Rank #3 (Hold) company's efforts to streamline business, solid booking and backlog growth, potential opportunities in the fast-growing digital textile printing market and an improving Energy segment.

The stock surged 31.3% in a year, higher than the S&P 500's growth of 20.2%. Dover has also outperformed the industry's 26.2% gain.

Growth Drivers

Dover continues to simplify portfolio. Earlier, the company had announced that it is searching for sound alternatives to separate its Wellsite business either by a tax-free spin-off, sale or other strategic combination. Dover's Wellsite business, which includes Dover Artificial Lift, Dover Energy Automation, and US Synthetic, operates in the oil & gas drilling as well as production industry.

During the third-quarter conference call, the company stated that the Wellsite business is on track to be separated in early 2018. Dover added that the company has recently signed an agreement to sell the consumer and industrial winch business of Warn for $250 million, anticipated to close in the fourth quarter. These steps will aid the company in streamlining business along with investing in market-leading platforms that have strong market positions, margin profiles and are less volatile with bright prospects.

Dover is also reviewing cost structure to right size the company and boost margins. It plans to achieve around $40 million of cost savings in 2018.

The company’s bookings at the end of the third quarter were worth $1.94 billion, up from $1.69 billion. Backlog increased 18% to $1.27 billion at the end of the reported quarter. Backed by strong bookings growth, the company is poised for a solid finish to this year. For 2017, it projects earnings per share to in the range of $4.23-$4.33. The mid-point of the guidance reflects an increase of 38% over 2016 on an adjusted basis. The company projects revenues to grow in the range of 14-15%, comprising organic growth of 6-7% and acquisition growth of approximately 10%. This will be partially offset by a 2% impact from the dispositions.

Dover anticipates Printing & Identification platform to deliver consistently solid performance, backed by unique position in the digital textile market along with focus on consumables in marking and coding. From the current 3-4% rate, Dover projects the penetration rate of digital technology to surge 30% over the next decade. The company’s comprehensive solutions, including equipment, ink and software, positions it well to fully capitalize on this technology shift. In refrigeration, food retailers in an effort to manage operating cost and differentiate themselves in the market are now investing in closed-door refrigeration cases, energy-efficient systems and in specialized display cases. Dover will benefit from this demand as it has a leading position in these categories.

Further, the company’s Energy segment has a large backlog of drilled but uncompleted wells in the last few quarters driven by significant drilling activity. It expects most of these wells to be completed over the coming quarters.

All these factors are anticipated to boost the company's share price in the days ahead.

Dover Corporation Price and Consensus

Terex Corporation (TEX): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Dover Corporation (DOV): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.