- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Don't See Any Risk? Who Will 'Buy-The-Dip' In A Freefall?

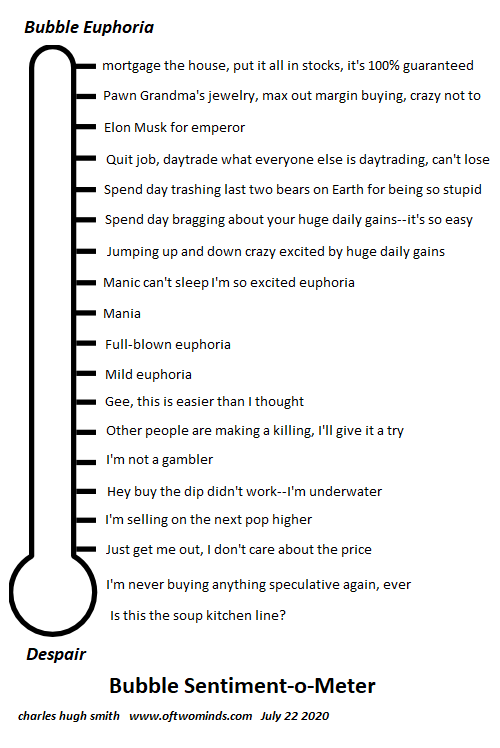

Nobody thinks a euphoric rally could ever go bidless, but as Greenspan belatedly admitted, liquidity is not guaranteed.

The current market melt-up is taken as nearly risk-free because the Fed has our back, i.e. the Federal Reserve will intervene long before any market decline does any damage.

It's assumed the Fed or its proxies, i.e. the Plunge Protection Team, will be the buyer in any freefall sell-off: no matter how many punters are selling, the PPT will keep buying with its presumably unlimited billions.

If this looks risk-free, ask who else will be "buying the dip" in a freefall? Former Fed Chair Alan Greenspan answered this question in his post-2008 crash essay Never Saw It Coming: Why the Financial Crisis Took Economists By Surprise (Dec. 2013 Foreign Affairs):

"They (financial firms) failed to recognize that market liquidity is largely a function of the degree of investors' risk aversion, the most dominant animal spirit that drives financial markets. But when fear-induced market retrenchment set in, that liquidity disappeared overnight, as buyers pulled back. In fact, in many markets, at the height of the crisis of 2008, bids virtually disappeared."

For the uninitiated, bids are the price offered to buyers of stocks and ETFs and the ask is the price offered to sellers. When bids virtually disappear, this means buyers have vanished: everyone willing to buy on the way down (known as catching the falling knife) has already bought and been crushed with losses, and so there's nobody left (and no trading bots, either) to buy.

When buyers vanish, the market goes bidless, meaning when you enter your "sell" order at a specific price (limit order), there's nobody willing to buy your shares at the current price. The shares remain yours all the way down.

If you decide to just get out at any price and place a market order (sell at whatever the bid is offered), your $100 per share stock might sell for $5 a share. This is known as a flash crash, and astute punters have observed that these are becoming more common.

When markets go bidless, the predictable order flow of low-volume days goes out the window. On a typical low volume day (and all days are low volume recently), the spread between bid and ask is modest in heavily traded issues and sellers can be confident their sell order will execute in a few seconds. In a freefall sell-off, sell orders pile up and the bid plummets to levels that were considered "impossible" in low-volume days.

What Greenspan didn't discuss is the trading bots that do most of the trading have been programmed to be risk averse. In a real sell-off, why catch the falling knife by hitting the bid on the way down? That's a guaranteed way to either lose money or ending up a bagholder.

Humans have a default setting for risk aversion: it's called panic. Once the euphoric comnfidence that the Fed will never allow the market to fall by more than a few percentage points is broken, it's not replaced by rational risk assessment; it's replaced by full-blown, just-get-me-out panic.

The Plunge Protection Team works just fine on low-volume days, but it fails when a tsunami of selling washes away the bid. Though few seemed to notice, massive selling volume begets more selling as the bots' risk aversion kicks in.

Ironically, the mass migration of retail punters into the market has introduced a heightened potential for panic selling. The wild swings in GameStop (NYSE:GME) earlier in the year were a sneak preview of what can happen as panicked newbies enter market sell orders.

Euphoric punters forget that many of the players are leveraged, meaning that they're using borrowed money (margin debt) to buy more stocks. Should the market drop instead of rebounding, their account will fall below minimum requirements and they will have to add cash or sell stocks. When buy-the-dip fails, those with margin calls add to the selling.

Other limits can manifest in cryptocurrency trading. When most trades are buys, few notice the fine print on exchange sell orders in crypto wallets and exchanges. Prices may be guaranteed for a limited time (for example, 10 minutes), and there may not be an option for limit orders. If the order doesn't execute before the time limit expires, then the order to sell executes at whatever bid is offered.

There's also no guarantee that your sell order will execute in a timely manner. A reader recently sent me a screenshot of an exchange of a top 100 (by market cap) cryptocurrency for Bitcoin that took almost 2 hours to execute. (The reader passed on using the Lightning Network after reading the disclosures.)

Exchanges may limit the number of coins per exchange. In other words, the implicit assumption that punters can unload their entire position at the current bid may prove unfounded in heavy sell volume days.

The point here is bottlenecks can emerge in heavy sell volume days that traders did not anticipate. The possibility that markets, brokerage platforms and exchanges could break and simply cease to function isn't on anyone's radar, despite various bits of evidence that a breakdown isn't as farfetched as punters currently assume.

Ten minutes is more than enough time for supreme, euphoric confidence to crumble into panic, and trading bots can pull their buy orders in 10 milliseconds.

This is why the big players distribute their shares to overly confident retail punters over many weeks. Big players know there is no way they can dump their entire position without crushing the bid, so they sell in bits and pieces all the way up the euphoric melt-up.

The issue isn't just the price you get when you sell—it's being able to get out of your position at all. A strange phenomenon occurs in freefall sell-offs: the exit door (i.e. the liquidity that allows you to liquidate your entire position at the current bid) suddenly shrinks from a barndoor to a mouse-sized hole in the baseboard.

Nobody thinks a euphoric rally could ever go bidless, but as Greenspan belatedly admitted, liquidity is not guaranteed. In a real tsunami of trading-bot selling, the Plunge Protection Team's card table is no match for the sea of selling.

Risk aversion can go from zero to 200 faster than overconfident punters believe possible.

Related Articles

Just recently, S&P Global released its 2026 earnings estimates, which, for lack of a better word, have gone parabolic. Such should not be surprising given the ongoing...

Trump threatens EU tariffs, creates confusion about Mexico and Canada duties Dollar rebounds but gold slides again Nvidia falls in after-hours trading as earnings fail to set...

Gold Consolidates Ahead of Key US Data Releases The gold (XAU/USD) price was relatively unchanged on Wednesday as markets remained cautious ahead of upcoming inflation data and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.