- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Alibaba's Gateway '17 Reveals Focus On Small Businesses

Alibaba Group Holding Limited’s (NYSE:BABA) Gateway '17 confab is underway in Detroit, an event dedicated to small businesses, entrepreneurs and farmers. The event is aimed at making them aware of the opportunities and ease of selling in China and attracting them to its platforms.

Attended by around 3,000 entrepreneurs, the confab reveals important insights about Chinese consumers, growing industries and modes of finding reliable and quality suppliers.

Let’ delve deeper into what this event has in store for buyers, sellers, investors, Alibaba itself and the public at large.

Competitive Move to Tap U.S. Sellers

The event so far has been focused on a wide range of aspects that give a fair idea regarding where Alibaba is headed for the future. There is a strategic motive behind tapping U.S. sellers. It is probably the company’s way of countering tough competition from established players such as Amazon (NASDAQ:AMZN) , eBay (NASDAQ:EBAY) and JD.com (NASDAQ:JD) in the U.S.

The strategy behind attracting small businesses appears to be a part of Alibaba’s effort to tap the relatively untapped portions of the retail market. Unlike big brands, small businesses cater to niche markets and tapping them could help Alibaba bring these markets into its fold.

Eyeing the Lion’s Share of the Market

China is currently the world’s largest retail market followed by the U.S. According to eMarketer, the Chinese retail market offers a $4.89 trillion opportunity compared with the U.S.’ $4.52 trillion. So, it seems that by attempting to connect U.S. sellers with Chinese buyers, the company is trying to grab the lion’s share of the global retail market.

During the event, the company pointed out a win-win situation for U.S. merchants and Chinese consumers. Co-founder and vice chairman Joe Tsai stated that growing demand for high quality consumption allows American businesses to play a major role in China.

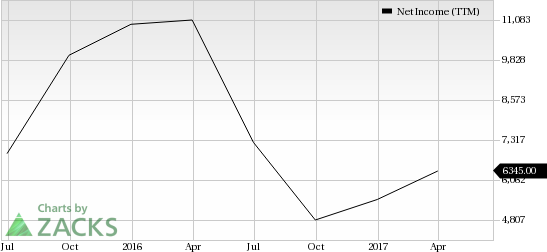

Alibaba Group Holding Limited Net Income (TTM)

Big Data Opportunities

Alibaba currently serves around 500 million consumers in China and holds valuable data about their purchasing behavior. Tsai stated, "We get a lot of information about them, which informs us about what's really in high demand in terms of consumer products."

Going forward, Alibaba could offer its big data capacities to U.S. merchants to help them explore new retail opportunities across technology, customer relationship management, supply chain management, payment and logistics.

Keeping the Promise to the President

Bridging the gap between U.S. sellers and Chinese buyers holds considerable business potential for Alibaba and will require additional human resource to support the endeavor. This in turn will pave the way for the creation of 1 million jobs that Jack Ma recently promised to the President.

Don’t Forget “New Retail”

Alibaba is working on the development of what it calls “New Retail” to bridge the gap between online and offline shopping using its big data capacity.

Alibaba could give this vision a boost by offering U.S. brick-and-mortar retailers new ways to evolve across marketing, inventory and distribution networks. These retailers will be happy to grab the opportunity given Amazon’s increasing push into the space.

Investors Have a Reason to Cheer

Alibaba appears to be quite confident about its success in the U.S. going forward. This could probably be the reason behind the company’s upbeat revenue guidance for fiscal 2018 that it offered at its investor day in Hangzhou.

It expects staggering revenue growth of 45–49% in the current fiscal, or revenues of around $34.3 billion, far above analysts’ estimates. The company is bullish on the revenue growth, given its solid expansion in e-commerce, cloud computing, and strong media and entertainment businesses.

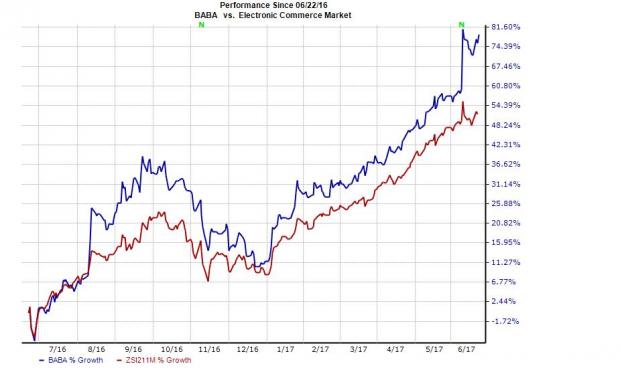

Investors will keep an eye on how Alibaba’s efforts with respect to U.S. small businesses impact its share price that has appreciated 78.8% over the last one year compared with the Zacks Internet – Commerce industry’s gain of 51.8%.

If Alibaba could repeat its domestic success internationally, especially in the U.S., investors can expect accelerated growth.

Currently, Alibaba is a Zacks Rank 3 (Hold) company. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Zacks' Hidden Trades

While we share many recommendations and ideas with the public, certain moves are hidden from everyone but selected members of our portfolio services. Would you like to peek behind the curtain today and view them?

Starting now, for the next month, I invite you to follow all Zacks' private buys and sells in real time from value to momentum...from stocks under $10 to ETF to option movers...from insider trades to companies that are about to report positive earnings surprises (we've called them with 80%+ accuracy). You can even look inside portfolios so exclusive that they are normally closed to new investors.

Click here for Zacks' secret trade>>

Amazon.com, Inc. (AMZN): Free Stock Analysis Report

eBay Inc. (EBAY): Free Stock Analysis Report

JD.com, Inc. (JD): Free Stock Analysis Report

Alibaba Group Holding Limited (BABA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.