- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

U.S. Dollar Loses Steam Ahead of Powell’s Testimony

Fed chief testifies before Congress, investors focused on his tone

Aussie slides after cautious RBA rate hike, yen ignores softer data

Stock markets little changed, waiting for Fed signals and US payrolls

Powell appears before Congress

The spotlight today will fall on Fed Chairman Powell, who will testify before the Senate Banking Committee at 15:00 GMT. Investors usually pay more attention to the Q&A session with lawmakers, where the Fed chief will face a grilling on the outlook for inflation and interest rates.

Following a streak of encouraging data releases recently that highlighted the resilience of the US economy, several Fed officials stressed that interest rates could be raised beyond the 5.1% point they projected back in December. Market pricing currently implies rates will peak around 5.4% and the big question is whether Powell will endorse this view.

Considering just how strong the economic data pulse has been lately, with services inflation staying persistently high and the labor market still firing on all cylinders, it seems likely the Fed chief will strike a similarly hawkish tone to his colleagues. Another topic that could spark fireworks in the markets is the balance sheet, as the Fed’s prepared report said the pace of quantitative tightening could be adjusted if needed.

The dollar would likely benefit from any hawkish remarks, especially on the balance sheet, although the currency’s broader trajectory will depend mostly on the upcoming nonfarm payrolls data on Friday and next week’s inflation report.

RBA sinks aussie, Japanese wages slow

Over in Australia, the Reserve Bank raised rates by 25 basis points today as expected but the underlying message was quite cautious, putting the emphasis purely on incoming data to determine how much further rates will rise. The RBA said the full effect of its existing rate increases hasn’t been fully felt in mortgages yet, hinting at the vulnerabilities in the nation’s housing market and essentially preaching caution.

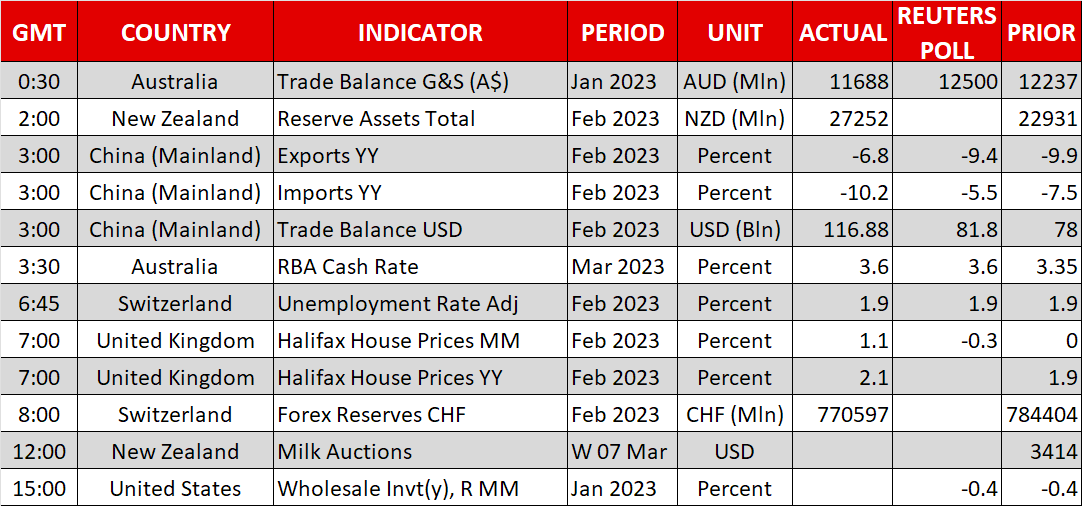

Traders interpreted this shift in language as opening the door for a pause in the tightening cycle, which pushed the Australian dollar lower in the aftermath. A drop in commodity prices likely exacerbated this selloff, after China played down the prospect of enacting powerful stimulus measures and its trade data for February revealed sharp declines in both exports and imports.

In Japan, the latest wage growth data was disappointing, dealing a heavy blow to speculation that the Bank of Japan will raise its yield ceiling on Friday. Wages rose only 0.8% in January, a dramatic slowdown from the 4.1% increase in December. This means real wage growth is now deeply negative, which alongside the latest cooldown in Tokyo inflation metrics, might give the BoJ some pause.

Stocks waiting on Powell

Crossing into the equity realm, Wall Street closed a volatile session virtually unchanged on Monday, with trading being dominated by positioning and hedging flows ahead of Powell’s Congressional address.

While the outcome of today’s session will depend on how markets perceive Powell’s commentary, the ultimate path for stock markets seems to be downhill. Corporate earnings are contracting, equity valuations are still expensive, and investors can now earn 5% returns in risk-free US government bonds instead of taking chances in riskier plays.

In the geopolitical sphere, the US Senate will unveil a bill today that would allow the White House to ‘respond’ to national security threats posed by companies like TikTok. There is a sense that the days of TikTok are numbered in the United States, at least in its current form. This notion has fueled a serious rally in shares of its competitors such as Snapchat, which gained 9.5% yesterday.

Related Articles

Investor’s bearish sentiment has surged to levels that generally align with server market corrections and crashes. While concerns about the recent market correction have risen,...

The latest economic indicators aren’t supporting our resilient-economy thesis. Nevertheless, we are sticking with it for now. Consider the following: The Atlanta Fed’s GDPNow...

US imposes increased tariffs on its closest trading partners US equities decline as risk appetite remains weak Dollar records losses against major currencies Oil and cryptos...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.