- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

5 Business Services Stocks To Gain From A Likely Rate Cut

Several economic data over the last two months are indicating that the U.S. economy is cooling down. Although the United States may not face recession anytime soon, aggravating trade-related conflicts started taking a toll on both domestic and global economies.

Weak job growth, tepid manufacturing data, lower business spending and muted inflation are near-term concerns. Despite these strong negatives, Wall Street rallied last week on high expectation of a rate cut within 1-2 months by the Fed. Notably, on Jun 4, Fed Chairman Jerome Powell signaled a possible cut in benchmark interest rate.

Tepid Economic Data

Non-farm job addition in May came in at just 75,000, significantly lower than the consensus estimate of 180,000. Total job addition in April and March was reduced by 75,000. Year to date, average monthly payroll gains was 164,000, a sharp decline from 223,000 in 2018.

The ISM Manufacturing Index for May came in at 52.1, the lowest level since October 2016. This metric declined in four out of the last five months. Construction spending also remained flat in May with respect to April. Factory orders for U.S. made durable goods declined 0.8% In April. New orders of U.S. manufactured goods fell 0.5% in April, the largest drop since April 2017.

The manufacturing sector, which constitutes 12% of the U.S. economy, is facing lower demand due to global economic slowdown as a result of ongoing trade conflicts. Additionally, U.S. core PCE inflation index –- Fed’s favorite inflation gauge –- increased 1.6% in April, well below the central bank’s target rate of 2%.

High Expectations of Rate Cut

Despite several negative economic factors, Wall Street rallied in the week ended Jun 7. Three major stock indexes --- the Dow, S&P 500 and Nasdaq Composite --- jumped 4.7%, 4.4% and 3.9%, respectively, marking the best weekly performance of all the three indexes so far in 2019. In fact, the Dow posted the best weekly gain since November 2018.

Primary reason for this impressive stock market performance is the expectation of interest rate reduction by the Fed. According to CME FedWatch tool, 65% responders were hoping for a rate cut in 2019 on Jun 3. However, after Powell’s speech on Jun 4, more than 90% of the responders are expecting a rate cut by September and 80% foresees a likely second cut by the end of December.

After the release of weak job data for May on Jun 7, market expectations of a Fed rate cut in June rose to 27.5% from 16.7%. Moreover, the market is also predicting a 79% chance of lower Fed rates by July.

Why Business Services Stocks?

Despite a tepid job growth in May, the professional and business services remained a notable exemption with a job addition of 33,000. Moreover, a possible cut in benchmark lending rate will lower borrowing costs for corporations and individuals. Low cost of capital is likely to inject more investment in the economy as well as in the stock market. This will further boost demand for business services providers.

Our Top Picks

At this stage, we have narrowed down our search to five such business services stocks with a Zacks Rank #2 (Buy) and strong growth potential. You can see the complete list of today’s Zacks #1 (Strong Buy) Rank stocks here.

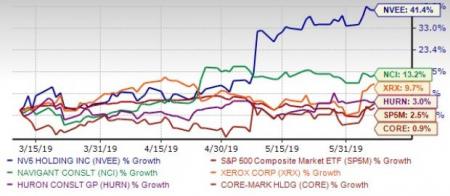

The chart below shows price performance of our five picks in the past three months.

Xerox Corp. (NYSE:XRX) is the world's leading provider of business process and document management offering intelligent workplace services. The company has expected earnings growth of 12.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 3.5% over the last 60 days.

Core-Mark Holding Company Inc. (NASDAQ:CORE) is one of the largest marketers of fresh and broad-line supply solutions to the convenience retail industry in North America. The company has expected earnings growth of 13.7% for the current year. The Zacks Consensus Estimate for the current year has improved by 3.3% over the last 60 days.

Navigant Consulting Inc. (NYSE:NCI) provides professional services worldwide. It operates through three segments: Healthcare, Energy and Financial Services Advisory and Compliance. The company has expected earnings growth of 95.7% for the current year. The Zacks Consensus Estimate for the current year has improved by 3.4% over the last 60 days.

NV5 Global Inc. (NASDAQ:NVEE) provides professional and technical engineering and consulting services to public and private sector clients in the infrastructure, energy, construction, real estate and environmental markets in the United States and internationally. The company has expected earnings growth of 16.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 2.7% over the last 60 days.

Huron Consulting Group Inc. (NASDAQ:HURN) is a professional services firm that provides advisory, technology, and analytic solutions in the United States and internationally. The company has expected earnings growth of 14.4% for the current year. The Zacks Consensus Estimate for the current year has improved by 0.4% over the last 60 days.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +98%, +119% and +164% in as little as 1 month. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Core-Mark Holding Company, Inc. (CORE): Free Stock Analysis Report

Xerox Corporation (XRX): Free Stock Analysis Report

Huron Consulting Group Inc. (HURN): Free Stock Analysis Report

Navigant Consulting, Inc. (NCI): Free Stock Analysis Report

NV5 Global, Inc. (NVEE): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.