- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Disney (DIS) Q4 Earnings Miss: Hopes Hinge On New Star Wars

Media behemoth – The Walt Disney Company (NYSE:DIS) – reported negative earnings surprise in the fourth-quarter fiscal 2017 after beating the estimate in the trailing three quarters. Moreover, the company’s top-line also missed the Zacks Consensus Estimate for the fifth straight quarter.

The company’s adjusted earnings in the reported quarter came in at $1.07 per share, missing the Zacks Consensus Estimate of $1.12 and decreased 3% year over year. Moreover, revenues came in at $12,779 million, down 3% year over year and also missed the Zacks Consensus Estimate of $13,149 million. The company’s disappointing results in the quarter was primarily due to dismal performance of Media Networks, Studio Entertainment. and Consumer Products & Interactive Media, which overshadowed growth at Parks and Resorts.

The company’s total operating income came in at $2,812 million during the quarter, down 11% year over year. The downside was due to decline in operating income from Media Network, Studio Entertainment, and Consumer Products & Interactive Media.

Despite Disappointing Results Stock Gains: Why?

Even though Disney reported dismal results, shares inched up nearly 1% during after-hour trading session yesterday. Analysts believe that the deal with Rian Johnson, the director of The Last Jedi, to produce a brand new Star Wars trilogy may have raised hopes of investors. We note that, the stock has increased 4.2% in a month, outperforming the industry, which has witnessed a decline of 2.8%.

Further, Disney plans to launch its own streaming services – one for Disney and Pixar brands, and another for ESPN followers. The company had earlier stated that it will terminate distribution agreement with Netflix, Inc. (NASDAQ:NFLX) for subscription streaming of the new movies starting in 2019.

Disney will start online streaming services for ESPN sports in early 2018 and its branded direct-to-consumer streaming service in 2019 will carry Disney movies as well as TV shows. The ESPN-branded multi-sport streaming service will give an option to enjoy 10,000 live international, national and regional games every year. Tournaments like Major League Baseball, National Hockey League, Major League Soccer, Grand Slam tennis, and college sports will be live streamed.

Meanwhile, through the fresh Disney-branded service, subscribers can view both Disney’s and Pixar’s latest live action and animated movies, starting with the 2019 theatrical slate.

Disney Now Controls BAMTech

In an effort to attract online viewers, the company has completed the acquisition of video streaming, data analytics as well as commerce management company BAMTech in September.

In the past few quarters Disney’s ESPN has been a hot topic in the media industry and investors are closely monitoring the performance of ESPN. In the reported quarter, advertising revenues declined in the low-single digit. Falling subscriber base and higher programming costs at ESPN continues to hamper the company’s results. Most of the media companies are failing to cope with "cord cutting" as consumers are unwilling to pay for large bundles of channels.

ESPN has sealed a number of deals with new platform owners, mostly over-the-top. These deals have started to yield positive results and are also increasing the number of subscribers. Moreover, the company has inked a deal with Hulu and another entity, and is also in discussion with others. The company had earlier stated that mobile apps are going to play an important role in the future of media, and ESPN is rightly on the way of taking the advantage of the trend with wide range of apps.

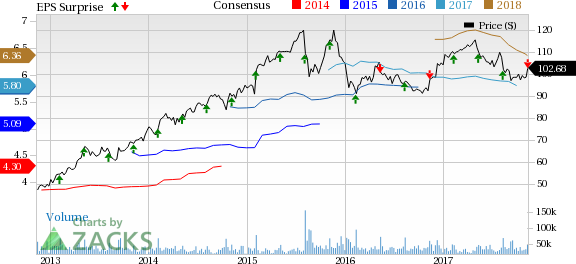

Walt Disney Company (The) Price, Consensus and EPS Surprise

Segment Details

The Media Networks segment’s revenues were down 3% to $5,465 million, primarily due to 11% decrease in Broadcasting revenues to $1,514 million. However, Cable Networks came in at $3,951 million, almost flat year over year.

The segment’s operating income came in at $1,475 million, down 12% year over year. Cable Networks saw 1% drop in operating income to $1,236 million, while the Broadcasting segment reported a 15% slump in operating income to $229 million. Drop in operating income at Cable Networks were primarily due to decline at Freeform, which overshadowed the gain at the Disney Channels. At ESPN increase in affiliate revenues were ooffset by higher programming cost and dismal advertising revenues. Decrease in advertising revenues were chiefly due to decline in average viewership. Meanwhile, growth in affiliate revenues was driven by rise in contractual rate, which mitigated the fall in subscribers.

Parks and Resorts revenues came in at $4,667 million, up 6% from the year-ago period. The segment’s operating income climbed 7% to $746 million backed by growth at the company’s international operations, which was due to robust performance of Disneyland Paris and Shanghai Disney Resort. Rise in guest spending and attendance were the main reasons behind growth in operating income at Disneyland Paris. Meanwhile, growth at Shanghai Disney Resort was driven by lower marketing cost, increase in attendance, which negated lower average ticket pricing. Meanwhile, operating income declined at the company’s domestic operations due to the impact of Hurricane Irma.

The Studio segment generated revenues of $1,432 million, down 21% year over year. Moreover, operating income dropped 43% to $218 million. Sharp decline in operating income was due to decrease in TV/SVOD distribution results and increase in film cost impairments. Home entertainment as well as theatrical distribution results was flat year-over-year. However, decrease in theatrical distribution results were due to better performance of the company’s releases in the prior-year quarter compared with this quarter.

However, analysts believe that the coming two years will be the most fruitful for Disney. The studio is all set to continue with its success story beyond Star Wars, Zootopia and Beauty and the Beast as it boasts of an impressive lineup of big budget movies up to 2018. In 2018, the company is expected to release Black Panther, A Wrinkle in Time, Avengers: Infinity War, The Incredibles 2 and Ant-Man and the Wasp. Further, movie lovers must be really pumped up as Star Wars saga, The Last Jedi will hit the in December.

Consumer Products & Interactive Media division saw a 6% decrease in revenues to $1,215 million. Moreover, the unit’s operating income dropped 12% to $373 million owing to decline at merchandise licensing business.

Other Financial Details

Disney, which shares space with Twenty-First Century Fox, Inc. (NASDAQ:FOXA) , generated free cash flow of $2,691 million during the reported quarter, down 3% year over year. The company ended the quarter with cash and cash equivalents of $4,017 million, borrowings of $19,119 million and shareholder’s equity of $41,315 million, excluding non-controlling interest of $3,689 million.

During the quarter, the company bought back nearly 33.6 million shares for $3.4 billion.

Zacks Rank & Key Picks

Currently, Disney carries a Zacks Rank #4 (Sell) which is subject to change following the earnings announcement. Some better-ranked stocks worth considering include News Corporation (NASDAQ:NWSA) and World Wrestling Entertainment, Inc. (NYSE:WWE) . Both the stock carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

News Corporation has long-term earnings growth rate of 11%.

World Wrestling Entertainment has an impressive long-term earnings growth rate of 20%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Walt Disney Company (The) (DIS): Free Stock Analysis Report

Netflix, Inc. (NFLX): Free Stock Analysis Report

World Wrestling Entertainment, Inc. (WWE): Free Stock Analysis Report

Twenty-First Century Fox, Inc. (FOXA): Free Stock Analysis Report

News Corporation (NWSA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.