- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

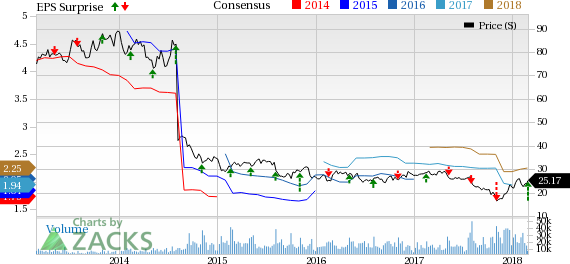

Discovery (DISCA) Q4 Earnings Beat, Scripps Buyout On Track

Discovery Communications, Inc. (NASDAQ:DISCA) performed well in the fourth quarter of 2017, wherein revenues and earnings surpassed the Zacks Consensus Estimate.

The company’s earnings (excluding $2.46 from non-recurring items) of 47 cents per share surpassed the Zacks Consensus Estimate of 39 cents. The bottom line, however, declined 9.6% on a year-over-year basis owing to higher costs.

Discovery’s fourth-quarter revenues of $1,864 million improved 11.5% on a year-over-year basis. Also, the top line outpaced the Zacks Consensus Estimate of $1,783 million. In fact, revenue growth was witnessed across all major divisions of the company. Quarterly adjusted operating income before depreciation and amortization (OIBDA) increased 10% year over year.

Performance Details

Revenues from Discovery’s U.S. Networks division rose 10% to $892 million. Segmental growth was driven by 7% and 8% growth in distribution and advertising revenues, respectively.

Distribution revenues came in at $402 million compared with $375 million a year ago. Higher affiliate fee rates contributed to the increase. However, total portfolio subscribers decreased 5% while subscribers of the company’s fully distributed networks declined 3% in the quarter.

Advertising revenues came in at $456 million compared with $421 million a year ago. Revenues from other sources increased to $34 million from $16 million in the previous year. The substantial improvement was primarily owing to Discovery's joint venture with TEN for automotive media. Also, adjusted OIBDA was up 7% year over year at the segment. On the contrary, adjusted OIBDA margin declined to 54% from 55% a year ago.

International Networks revenues rose 13% to $927 million. While Distribution revenues in the segment improved 15% to $479 million, advertising revenues increased 11% to $419 million. Revenues from other sources were up significantly on a year-over-year basis to $29 million. Adjusted OIBDA margin slid to 27% from 28% a year ago.

Revenues from the Education and Other division increased 10% to $45 million. This upside was primarily owing to increased International and digital textbook revenues at Education. In fact, the company intends to sell the majority stake in its Education business 2018 to Francisco Partners for $120 million in cash. The transaction is expected to close by Jun 30, 2018.

Liquidity

The company exited 2017 with cash and cash equivalents of $7,309 million and $14,755 million of debt (non-current portion) compared with $300 million and $7, 841 million, respectively, at the end of 2016. In 2017, the company shelled out $603 million for buybacks.

Scripps Buyout Update

Discovery moved a step closer to buying fellow U.S. company — Scripps Networks Interactive, Inc. (NASDAQ:SNI) — following the receipt of antitrust clearance from the U.S. Department of Justice. In February, Discovery had received clearance on the issue from the European Commission.

Following the U.S and European approvals, Discovery anticipates the same from regulatory authorities in Ireland. The deal, subject to fulfilment of customary closing conditions, is expected to close by Mar 31, 2018.

The merged entity will cater to nearly 20% of the ad-supported pay-TV audiences in the United States. Upon completion, the acquisition is likely to substantially expand Discovery’s product portfolio and boost its earnings (adjusted) as well as free cash flow in the first year. Additionally, shareholders of Discovery and Scripps Network will own 80% and 20% of the combined entity, respectively.

Notably, both companies have struggled in recent years as more and more consumers are moving from cable subscriptions to online TV subscriptions. The rise of streaming platforms like Netflix (NASDAQ:NFLX) has not helped matters in this respect.

Zacks Rank & Key Pick

Discovery carries a Zacks Rank #3 (Hold). A better-ranked stock in the broader Consumer Discretionary space is Cinemark Holdings (NYSE:CNK) carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Shares of Cinemark have increased more than 30% in the past six months.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

Netflix, Inc. (NFLX): Free Stock Analysis Report

Scripps Networks Interactive, Inc (SNI): Free Stock Analysis Report

Cinemark Holdings Inc (CNK): Free Stock Analysis Report

Discovery Communications, Inc. (DISCA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.