- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

DineEquity (DIN) Q3 Earnings Beat, Revenues Lag, Stock Up

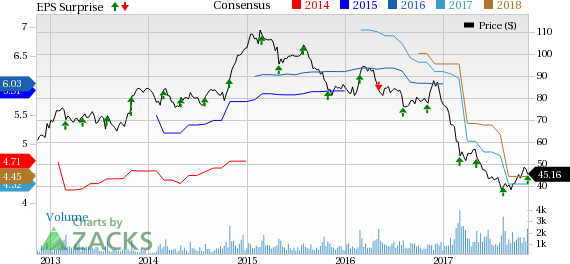

DineEquity, Inc. (NYSE:DIN) reported third-quarter fiscal 2017 earnings of 91 cents per share, which surpassed the Zacks Consensus Estimate of 88 cents by 3.4%. However, the figure declined 37.8% from the prior-year quarter earnings of $1.46 due to decrease in gross profits.

Total revenues of $144.7 million fell 7.3% year over year due to lower franchise and restaurant, rental as well as financing revenues. Also, the top line missed the Zacks Consensus Estimate of $146.5 million by over 1%.

DineEquity currently operates under the Applebee's Neighborhood Grill & Bar and International House of Pancakes (IHOP) brands. It is focused on developing a strong performance-based culture, driving sustainable positive sales at both brands thereby bringing its growth story back on track. In fact, the initial progress along with positive comps growth at both brands in October is heartening and management is optimistic on realizing the company's full potential.

Consequently, the company’s shares were up more than 5% in yesterday’s trading session, reflecting investors’ confidence regarding the initiatives undertaken to drive growth at both the brands.

Behind the Headline Numbers

IHOP's domestic system-wide comps declined 3.2%. This compares unfavorably with the fiscal second quarter’s comps decrease of 2.6% and the prior-year quarter’s comps decline of 0.1%. Despite witnessing soft sales in the last few quarters, the company believes that the IHOP brand remains on solid ground.

Moreover, initiatives to improve guest satisfaction via remodelling efforts, growing its off-premise business that include online ordering and delivery, and development of an IHOP mobile application are expected to create improved revenue channels.

Applebee's domestic system-wide comps were down 7.7% comparing unfavorably with the last quarter’s comps decline of 6.2% and the prior-year quarter’s fall of 5.2%. Notably, Applebee’s casual dining restaurants are facing stiff competition from fast-food and quick-service restaurants. Furthermore, consumers are favoring ordering in meals over going to brick-and-mortar retailers.

Nonetheless, DineEquity believes that fiscal 2017 will be a transitional year for Applebee's. In fact, the steps taken to revitalize the brand via increased focus on food and culinary innovation, marketing efforts, simplification of restaurant operations and elevating the guest experience are expected to drive comps over the long term with an improvement likely 2018 onwards.

Fiscal 2017 Outlook

For fiscal 2017, Applebee's domestic system-wide comps are now expected to decrease in the range of 5.5-6.5% (a decline of 6% to 8%, expected earlier).

IHOP's domestic system-wide comps are still expected to be down in the band of 1% to 3%.

Meanwhile, DineEquity continues to expect general and administrative expenses to range between $166 million and $172 million.

Applebee's franchisees are still anticipated to develop between 20 and 30 new restaurants globally, the majority of which are likely to be international openings. Additionally, its closures are projected to range between roughly 105 and 135 restaurants.

IHOP franchisees and its area licensee are estimated to develop between 80 and 95 restaurants globally, with the majority being domestic openings. IHOP closures are anticipated to range between 25 and 30 restaurants (earlier 20-25 restaurants).

The company also reiterated its expectations of capital expenditures of roughly $14 million in fiscal 2017.

DineEquity carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Peer Releases

McDonald's Corp. (NYSE:MCD) reported third-quarter adjusted earnings per share of $1.76, beating the Zacks Consensus Estimate of $1.75 by 0.6%. Earnings also increased 9% year over year, given stronger operating performance and G&A savings.

Darden Restaurants, Inc.’s (NYSE:DRI) first-quarter fiscal 2018 adjusted earnings of 99 cents per share outpaced the Zacks Consensus Estimate of 98 cents by over 1%. Further, the bottom line increased 12.5% year over year on the back of higher revenues.

Chipotle Mexican Grill, Inc.’s (NYSE:CMG) third-quarter 2017 adjusted earnings of $1.33 per share lagged the Zacks Consensus Estimate of $1.56 by 14.7%.

More Stock News: This Is Bigger than the iPhone!

It could become the mother of all technological revolutions. Apple (NASDAQ:AAPL) sold a mere 1 billion iPhones in 10 years but a new breakthrough is expected to generate more than 27 billion devices in just 3 years, creating a $1.7 trillion market.

Zacks has just released a Special Report that spotlights this fast-emerging phenomenon and 6 tickers for taking advantage of it. If you don't buy now, you may kick yourself in 2020.

Click here for the 6 trades >>

Chipotle Mexican Grill, Inc. (CMG): Free Stock Analysis Report

McDonald's Corporation (MCD): Free Stock Analysis Report

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

DineEquity, Inc (DIN): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.