- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Despite Market Turmoil, Momentum Factor Still Dominates

The recent spike in stock market volatility has dented the momentum factor’s powerful bull run, but the strategy continues to reign supreme over its main competitors in the US equity factor space, based on a set of proxy ETFs.

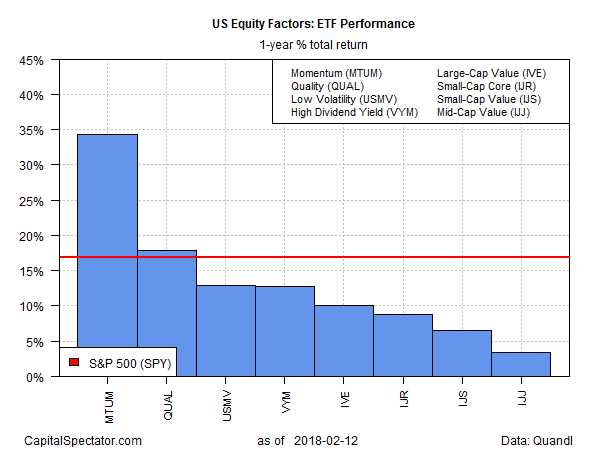

For the one-year trend, it’s still a one-factor race. The iShares Edge MSCI USA Momentum Factor (NYSE:MTUM) is up a strong 34.3% for the 12 months through yesterday’s close (Feb. 12) and there’s a wide moat that separates the ETF from the rest of the field. The second-best one-year performer (iShares Edge MSCI USA Quality Factor (NYSE:QUAL) is ahead by a distant 17.8%–an impressive return in its own right, but no match for MTUM’s one-year rise.

Note, too, that MTUM’s one-year change is also far ahead of the broad market’s gain. The SPDR S&P 500 (NYSE:SPY)) is up 16.8% over the past 12 months. That, too, is a solid run, but MTUM’s gain is roughly twice as high.

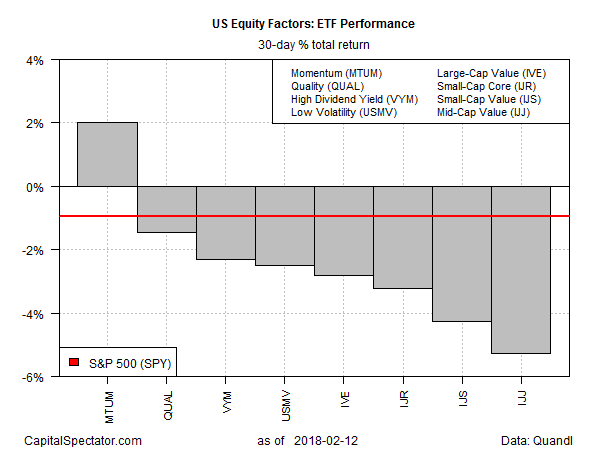

Does the profile for factor ETFs look different in recent history? Not according to a roundup of trailing 30-day returns. In fact, MTUM’s dominance looks even stronger for this time period. Indeed, momentum’s 2% gain over the last 30 days is conspicuous as the only positive return among the factor ETFs.

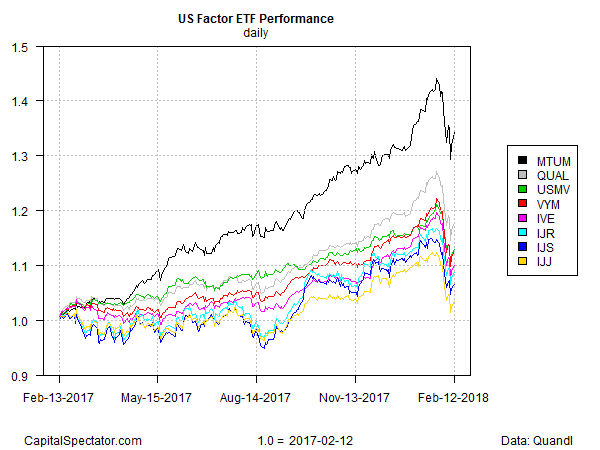

One reason that MTUM continues to exhibit unusually strong performance is its extraordinary run over the past year – a gift that keeps on giving in terms of relative performance. As the next chart reminds, the horse race of late has been remarkably kind to the momentum factor over the past year, an advantage that will probably endure in some degree for the near term.

The question is whether the jump in market volatility is an early sign that mark’s the beginning of the end for momentum’s reign? For the moment, there’s no sign that the king is about to be dethroned. But heightened market turbulence, if it continues, may take a toll.

Can a momentum strategy continue to dominate the factor landscape without the support of the consistent uptrend in the broad market that’s prevailed until recently? Perhaps not, although the answer will depend on how much damage, if any, is sustained in the competing factor strategies during a regime shift for market activity. Meantime, momentum’s edge still looks impressive.

Related Articles

The oldest ETF, the SPDR S&P 500 Trust, had the most inflows in February. The $14.6 billion in inflows allowed it to surpass the Vanguard S&P 500 ETF. Which ETFs saw the...

If the Vanguard S&P 500 Index ETF (VFV) doesn’t give you enough large-cap U.S. equity exposure as a Canadian investor, Invesco NASDAQ 100 Index ETF (QQC) is one of the most...

Leveraged exchange-traded funds (ETFs) substantially increase the potential reward of an investment by affording investors the chance to generate double or triple the returns of...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.