- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Deere (DE) Tops Q4 Earnings & Sales On Rising Farm Market

Deere & Company’s (NYSE:DE) fourth-quarter fiscal 2017 (ended Oct 29, 2017) earnings surged around 74% year over year to $1.57 per share. The bottom line also surpassed the Zacks Consensus Estimate of $1.46.

Net sales of equipment operations (which comprise Agriculture and Turf, Construction and Forestry) came in at $7.09 billion, rising 26% year over year. Revenues also surpassed the Zacks Consensus Estimate of $6.91 billion.

Price realization had an impact of 1% in the quarter with a favorable currency-translation effect of 2%. Region wise, equipment net sales increased 23% in the United States and Canada and 30% in the rest of the world. Total net sales (including financial services and others) were $8.02 billion, up 23% year over year.

Deere’s strong results were driven by improving markets for farm and construction equipment. Performance benefits from advanced products and flexible cost structure also drove growth.

Operational Update

Cost of sales in the quarter increased 23.8% year over year to $5.43 billion. Gross profit in the quarter came in at $1.67 billion, advancing 31.6% year over year. Selling, administrative and general expenses flared up 12.5% to $840.8 million. Operating profit significantly improved 59% year over year to $826.7 million.

Operating income from equipment operations surged 89% year over year to $669 million, owing to higher shipment volumes, favorable product mix and price realization, partially offset by elevated production costs, higher selling, administrative and general expenses.

Segment Performance

Agriculture & Turf segment’s sales increased 22% year over year to $5.44 billion, primarily owing to higher shipment volumes, the favorable effects of currency translation and price realization. Operating profit at the segment climbed 57% year over year to $584 million, driven by higher shipment volumes and a favorable sales mix, partially offset by escalated production costs and higher selling, administrative and general expenses.

Construction & Forestry sales increased 37% year over year to $1.66 billion, mainly as a result of higher shipment volumes, price realization and the favorable effects of currency translation. The segment reported operating profit of $85 million, as against an operating loss of $17 million in the prior-year quarter. The upswing was driven by shipment volumes and price realization.

Net revenues at Deere’s Financial Services division totaled $782 million in the reported quarter, up 6% year over year. The segment’s operating profit came in at $193 million, up 18% year over year. Net income at the segment was $127.8 million compared with $109.8 million recorded in the year-earlier quarter.

Fiscal 2017 Performance

Deere reported earnings per share of $6.68 in fiscal 2017, up 38.9% year over year and surpassing the Zacks Consensus Estimate of $6.51. Revenues improved 11% year over year to $25.9 billion and topped the Zacks Consensus Estimate of $25.7 billion. Worldwide net sales in fiscal 2017 were $29.7 billion compared with $26.6 billion in fiscal 2016.

Financial Update

Deere reported cash and cash equivalents of $9.33 billion at the end of fiscal 2017 compared with $4.34 billion at the end of the prior fiscal. The company reported cash from operations of $2.20 billion for fiscal 2017 compared with $3.77 billion in fiscal 2016. As of fiscal 2017-end, long-term borrowing totaled $25.9 billion, compared with $23.7 million in the prior-year fiscal end.

Wirtgen Acquisition

Deere expects the acquisition of the Wirtgen Group to close in December 2017. The buyout is expected to contribute about $3.1 billion in net sales in fiscal 2018. Wirtgen is expected to add about 12% to Deere's sales for the fiscal year and about 6% for the first quarter in comparison with 2017. After estimated expenses for purchase accounting and transaction costs, Wirtgen is expected to contribute about $75 million to operating profit and about $25 million to net income in fiscal 2018.

Looking Ahead

Deere projects total equipment sales to increase about 38% year over year in the first quarter of fiscal 2018 and 22% in fiscal 2018 compared with year-ago periods. The forecast includes a positive foreign-currency translation effect of about 3% in the first quarter and 2% for fiscal 2018. For fiscal 2018, Deere expects net sales to increase about 19% year over year and projects net income of about $2.6 billion.

Segment wise, Deere estimates Agriculture and Turf equipment sales to increase about 9% in fiscal 2018 including a positive currency-translation effect of about 2%. Industry sales for agricultural equipment in the United States and Canada are forecast to be up 5 to 10% for fiscal 2018, aided by higher demand for large equipment.

In the EU28 region, sales are projected to be up about 5% thanks to improving conditions in the dairy and livestock sectors. In South America, industry sales of tractors and combines are projected to be flat to up 5% as a result of continued positive conditions, particularly in Argentina. Sales in Asia are anticipated to be flat as strength in India will help counter weakness in China. Deere anticipates sales growth of turf and utility equipment in the United States and Canada to remain around flat for fiscal 2018.

The company foresees global sales for Construction & Forestry equipment to be up about 69% for fiscal 2018 including a positive currency-translation effect of about 1%. The Wirtgen acquisition is likely to add about 54% to the sales for the segment. The outlook is based on moderate global economic growth including higher housing starts in the United States and an improved oil and gas sector. In forestry, global industry sales are expected to be flat to up 5% on the back of improved lumber prices in North America.

The outlook for net income from Financial Services has been set at $515 million for fiscal 2018. The outlook reflects a higher average portfolio, partially offset by increased selling, administrative and general expenses.

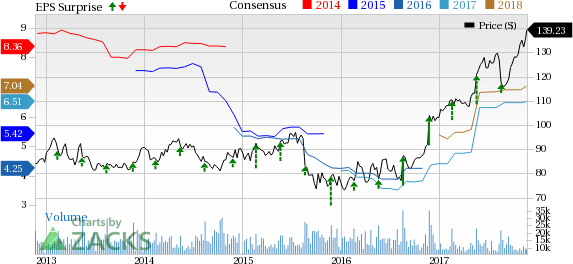

Share Price Performance

Deere has outperformed industry with respect to price performance in the last year. While the stock gained 36.3%, the industry recorded growth of 31% over the same time frame.

Zacks Rank and Key Picks

Currently, Deere carries a Zacks Rank #2 (Buy).

Other top-ranked stocks in the same space include Caterpillar Inc. (NYSE:CAT) , Kennametal Inc. (NYSE:KMT) and Parker-Hannifin Corporation (NYSE:PH) . All three stocks sport a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Caterpillar has a long-term earnings growth rate of 10.3%. Its shares have been up 48.4% year to date.

Kennametal has a long-term earnings growth rate of 43%. Year to date, its shares have surged 47.1%.

Parker-Hannifin has a long-term earnings growth rate of 11.6%. Its shares have rallied 31.7% year to date.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Kennametal Inc. (KMT): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Parker-Hannifin Corporation (PH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

When looking for dividend stocks, high dividend yields are one important factor to consider. Even if a company’s dividend yield isn’t nearing double-digit percentages, finding...

Whenever Wall Street authoritative figures, such as a large institution or individual investor, decide to shift a view on a specific stock or industry, retail traders can...

Monster Beverage (NASDAQ:MNST) faces headwinds that make it a potentially scary buy, including weakness in the alcohol segment. With the alcohol business contracting in Q4 2024,...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.