- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Declining Comps Likely To Hurt Fred's (FRED) In Q3 Earnings

Fred’s Inc (NASDAQ:FRED) is slated to report third-quarter fiscal 2017 results on Dec 6, before the opening bell.

We note that Fred’s delivered losses in the past five quarters. Further, the company has been struggling with murky comparable-store sales (comps).

While the company has a mixed record of bottom-line surprises in the trailing four quarters, let’s look into how things are shaping up for the upcoming announcement.

What to Expect?

The Zacks Consensus Estimate for the third quarter of fiscal 2017 is pegged at a loss of 15 cents, which has widened by a penny over the past 30 days. However, estimated loss for the quarter under review is lower than the prior year adjusted loss of 27 cents.

Also, analysts polled by Zacks expect revenues of $500.5 million, down 3.1% from the year-ago period.

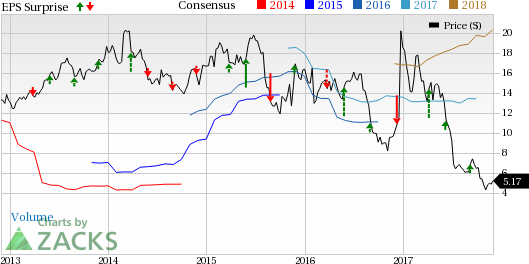

Fred's, Inc. Price, Consensus and EPS Surprise

Factors Impacting the Quarter

Fred’s has been delivering dismal comps since past many quarters, owing to declining traffic trends, sale of low productive discontinued inventory and rise in generic dispensing rate. Additionally, the company’s store expansion plans were gravely impacted by the cancelled Walgreens Boots Alliance (NASDAQ:WBA) and Rite Aid Corporation (NYSE:RAD) merger in June 2017. Had the deal materialized, Fred’s would have emerged as the third-largest drugstore chain in the nation after Walgreens and CVS Health Corporation (NYSE:CVS) .

We note that comparable store sales dipped 1.2% and 0.3% during the first and second quarters of fiscal 2017. The company’s weak comps trend is likely to continue in the third quarter as well.

Nevertheless, Fred’s has been advancing with initiatives to reduce selling, general and administrative expenses and boost free cash flow. Further, the company has been trying to organize pharmacy business to drive scripts into the stores and improve service to its patients. Although such efforts seem promising, they are yet to bear significant impacts upon the company’s performance.

What Does the Zacks Model Unveil?

Our proven model does not conclusively show that Fred’s is likely to beat earnings estimates this quarter. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) for this to happen. You may uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Although Fred’s carries a Zacks Rank #3, its Earnings ESP of 0.00% makes surprise prediction difficult. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce ""the world's first trillionaires,"" but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Fred's, Inc. (FRED): Free Stock Analysis Report

Rite Aid Corporation (RAD): Free Stock Analysis Report

CVS Health Corporation (CVS): Free Stock Analysis Report

Walgreens Boots Alliance, Inc. (WBA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

With 2 full months of the year completed, the S&P 500 (SPY) is up +1.38% while the Barclay’s Aggregate is +2.76% YTD, leaving a 60% / 40% balanced portfolio up +1.93% YTD as...

• Trump’s trade war, U.S. jobs report, and last batch of Q4 earnings will be in focus this week. • Costco's earnings report is seen as a potential catalyst for growth, making it a...

The market has taken a turn this past month, with volatility picking up and key technical indicators signaling caution. The S&P 500, which had been trading within a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.