- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Dean Foods (DF) Q3 Earnings In Line, Stock Down On View Cut

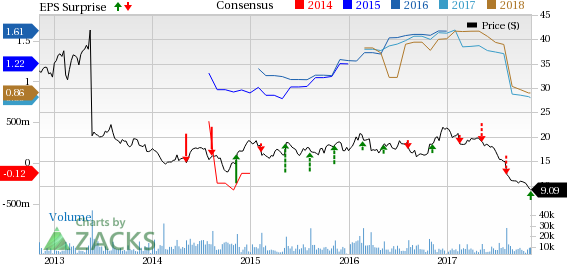

Shares of Dean Foods Company (NYSE:DF) declined 1.1% on Nov 7 as the company slashed its adjusted earnings view for 2017 after reporting in-line third-quarter 2017 earnings. This marked an improvement from the company’s negative earnings surprises delivered in the preceding three quarters. However, the company’s sales lagged estimates.

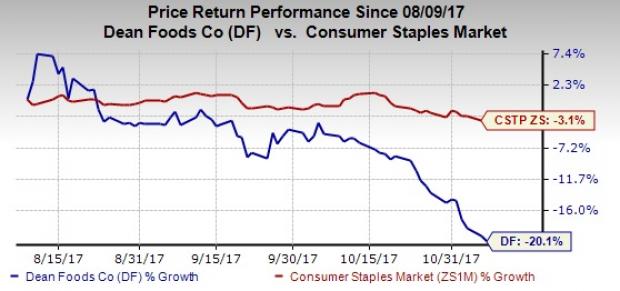

Further, this Dallas-based food and beverage company’s shares have plunged 20.1% in three months, wider than the Consumer Staples sector’s downside of 3.1%.

Despite a tough retail backdrop, the company’s results gained from overall solid sales execution, which helped in wining some new business for 2018. Though the company displayed stringent focus on cost productivity and commercial initiatives, results were hurt by lost sales volumes and incremental costs related to the recent hurricanes in both Texas and Florida. The company estimates that the hurricanes impacted business in the third quarter by nearly $6 million or 4 cents of earnings per share. The impacts primarily related to revenue lost, soft resin supplies and increased freight.

Further, soft volumes, higher raw milk costs, and loss of share in U.S. fluid milk volumes were hindrances.

Q3 in Detail

Plagued by lower volumes and increased raw milk expenses, the company’s quarterly adjusted earnings of 20 cents per share came in line with Zacks Consensus Estimate while it plunged 45.9% year over year.

On GAAP basis, the company posted loss per share of 11 cents, against earnings of 16 cents reported in the year-ago quarter.

Net sales declined 1.4% year over year to $1,937.6 million, and lagged the Zacks Consensus Estimate of $1,973 million. Total volumes of 608 million gallons dropped 6.6% from 651 million gallons in the prior-year quarter. The lag was mainly due to volume and private label mix challenges that continued in the quarter.

Raw milk costs escalated about 10% year over year and nearly 7% on a sequential basis, which also impacted top line.

Further, the milk category remained soft as the USDA data through August 2017 revealed that fluid milk volumes dipped 2.2% year over year, on a quarter-to-date basis. Additionally, Dean Foods' share of U.S. fluid milk volumes contracted 50 basis points.

Adjusted gross profit declined 9.1% to $448 million, while the adjusted operating income collapsed by 34.8% to $45 million in the third quarter.

Financial Position

Dean Foods ended the quarter with cash and cash equivalents of $24.3 million, long-term debt including current maturities of about $946.5 million, and shareholders’ equity of $604.4 million. Total debt outstanding, excluding cash on hand, was nearly $928 million as of Sep 30, 2017.

In the first three quarters of 2017, the company generated nearly $67 million of net cash from operating activities and $5 million of free cash flow.

The company deployed roughly $61 million as capital expenditure in the nine months of 2017. As of the end of the third quarter, Dean Foods’ all cash netted leverage (net debt to bank EBITDA total leverage ratio) came in at 2.56 times, reflecting slight increase from second-quarter 2017.

In the fourth-quarter, the company expects free cash flow to benefit from sequential rise in operating results, partly offset by seasonal ice cream build and higher capital expenditures. Further, management significantly lowered its free cash flow guidance for 2017 to $10-$20 million, from the prior forecast of $60-$75 million. Additionally, the company trimmed its capital expenditure forecast for the year to $105-$115 million.

The Road Ahead

While the third-quarter performance remained soft, the company expects to gain from its smart volume initiative through the rest of 2017, aimed at improving top line, building margins and creating operating efficiencies. This initiative relates to managing private label products, while also analyzing new volume opportunities and evaluating existing volume profitability. This means ensuring that volumes are produced and sold at appropriate margins.

Additionally, the company’s initiatives to strengthen brands and diversify portfolio will enable it to build brand equity on DairyPure by launching innovative products and improving marketing. Further, the company remains on track with its comprehensive productivity program, including OpEx 2020, and company-wide initiatives to drive efficiencies. Evidently, the Zacks Rank #4 (Sell) company is progressing well on its OpEx 2020 cost productivity plan, which is aimed at generating annual savings in a range of $80-$100 million.

Following the third-quarter results, the company slashed adjusted earnings guidance for 2017. The company now envisions adjusted earnings per share in the range of 80-90 cents, compared with the previous forecast of 80-95 cents.

Still Interested in Consumer Staples Space? Check these 3 Hot Picks

Better-ranked stocks in the consumer staples sector include MGP Ingredients, Inc. (NASDAQ:MGPI) , Snyder's-Lance, Inc. (NASDAQ:LNCE) and McCormick & Company, Incorporated (NYSE:MKC) , all carrying a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

MGP Ingredients, with long-term EPS growth rate of 15%, has increased 27.2% in the last three months.

Snyder's-Lance has a Growth Score of B. Moreover, the company has to its credit a spectacular earnings history as it delivered an average positive earnings surprise of 2.1% in the trailing four quarters.

McCormick & Company, with long-term EPS growth rate of 9.4%, has grown 1.9% year to date.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Dean Foods Company (DF): Free Stock Analysis Report

McCormick & Company, Incorporated (MKC): Free Stock Analysis Report

Snyder's-Lance, Inc. (LNCE): Free Stock Analysis Report

MGP Ingredients, Inc. (MGPI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.