- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

DaVita (DVA) Q3 Earnings Miss & Revenues Beat, '17 View Dull

DaVita Inc. (NYSE:DVA) reported third-quarter 2017 adjusted operating earnings of 81 cents per share that missed the Zacks Consensus Estimate of 94 cents. Further, earnings declined from 14.7% on a year-over-year basis.

Total revenues increased 5.1% year over year to $3.92 billion and beat the Zacks Consensus Estimate of $3.89 billion. The year-over-year improvement was mainly attributable to a 3.8% rise in patient service revenues to $2.62 billion and 16.5% increase in capitated revenues to $1.02 billion from the year-ago quarter.

DaVita carries a Zacks Rank #4 (Sell).

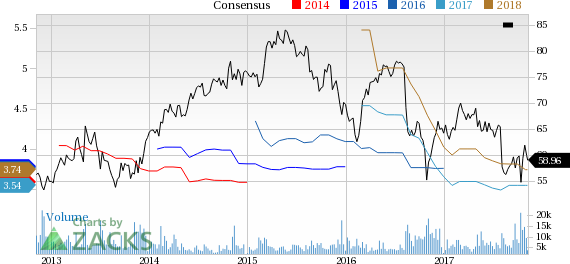

DaVita HealthCare Partners Inc. Price and Consensus

Segment Update

Davita Medical Group (“DMG”)

DMG, the nation's largest operator of medical groups and physician networks, provides integrated care management as an operating division of DaVita, focusing on delivering healthcare through a broad range of services.

For the third quarter of 2017, DMG incurred adjusted operating loss of $5 million, which excludes $601 million non-cash goodwill impairment and other adjusted items. In the third quarter, DaVita announced the restructuring of the DMG segment that eliminated 350 non-clinical positions. Thus, management at DaVita expects annualized savings of around $40 million per year starting 2018.

DaVita Kidney Care

As an operating division of DaVita, DaVita Kidney Care focuses on setting worldwide standards for clinical, social and operational practices in kidney care. DaVita saw solid results from the Kidney Care business.

Adjusted operating income in the third quarter at the segment was $404 million, up 1% year over year, primarily driven by an extra treatment day in the quarter. Notably, the company saw a negative financial impact of Hurricane Harvey and Irma, which is estimated to be approximately $7 million for higher costs and approximately $7 million of lost contribution from missed treatment and uncollected revenues owing to disruption of the company’s billing process during the natural disasters.

U.S.Dialysis and Related Lab Services

Revenue per treatment for U.S. dialysis and lab business was essentially flat with the last quarter. In fact, management at DaVita expects revenue per treatment to essentially remain flat in the fourth quarter as well. The company’s patient care costs were up approximately $1.76 per treatment compared with the last quarter.

Financial Update

For the twelve months ended Sep 30, 2017, DaVita had an operating cash flow of $2.08 billion and free cash flow of $1.49 billion. Operating cash flow was $553 million in the third quarter and $1.56 billion year to date.

Share Repurchase Update

DaVita bought back almost 2 million shares of the company’s common stock for approximately $117 million at an average price of $59.09 per share. In October, DaVita’s board of directors approved an additional share repurchase authorization worth approximately $1.253 billion.

As of Nov 7, 2017, DaVita repurchased a total of 11.4 million shares of the company’s common stock for a total of $702 million at an average price of $61.30 a share.

Guidance

DaVita expects adjusted consolidated operating income for 2017 in the range of $1.620 billion to $1.685 billion, lower than the previously issued range of $1.675 billion to $1.775 billion.

The company estimates adjusted operating income at the Kidney Care segment in the band of $1.570 billion to $1.600 billion. Notably, the previously issued range was $1.565 billion to $1.625 billion.

For the full year, DaVita expects adjusted consolidated operating income in the range of $50 million to $85 million, significantly lower than the previous guidance of $110 million to $150 million.

Our Take

DaVita ended third-quarter fiscal 2017 on a mixed note. Strong growth in patient services is likely to boost the company’s growth trajectory in the coming quarters. DaVita’s continuous improvement in Kidney care is commendable as well. The company’s efforts to control expenses hold promise. A compelling inorganic growth story supported by its strong financial position is another positive. However, DaVita is challenged by adverse effects of healthcare reforms, rise in Medicare costs, and an increase in Medicare Advantage (MA) beneficiaries. Also, MA rate cuts are likely to hurt the bottom line in the near future. Lackluster performance by the company’s DMG segment and a slashed guidance for the full year indicate looming concerns ahead for the stock. Sluggishness in the dialysis and lab businesses adds to our concerns.

Q3 Earnings of MedTech Majors at a Glance

The Q3 earnings season is drawing to a close, with most of the S&P members having reported their numbers. Medical, one of the broader sectors among the 16 Zacks sectors, is expected to put up an impressive show this quarter.

PetMed Express (NASDAQ:PETS) reported earnings per share of 43 cents in the second quarter of fiscal 2018, up 79.2% on a year-over-year basis. Also, gross margin expanded 548 bps year over year to 35.2% in the reported quarter. The stock sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Luminex (NASDAQ:LMNX) reported adjusted earnings per share of 19 cents in the third quarter of 2017, up 216.7% year over year. Revenues in the quarter increased almost 4.1% year over year to $74.1 million. The stock flaunts a Zacks Rank #1.

Intuitive Surgical (NASDAQ:ISRG) posted adjusted earnings of $2.77 per share in the third quarter of 2017, up 34.5% year over year. Revenues increased 18% year over year to $806.1 million. The stock carries a Zacks Rank 2 (Buy).

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Intuitive Surgical, Inc. (ISRG): Free Stock Analysis Report

Luminex Corporation (LMNX): Free Stock Analysis Report

DaVita HealthCare Partners Inc. (DVA): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.