- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Darden (DRI) Posts Solid Q2 Earnings, Lifts 2018 Guidance

Darden Restaurants, Inc. (NYSE:DRI) reported better-than-expected results in second-quarter fiscal 2018 results.

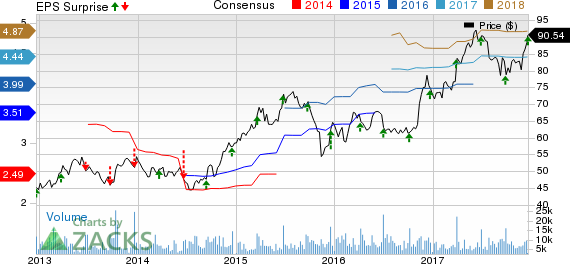

Adjusted earnings of 73 cents per share beat the Zacks Consensus Estimate of 70 cents by 4.3%. Earnings increased 14.1% year over year on the back of higher revenues. Notably, the quarter marked the 13th consecutive earnings beat for the company. Darden’s impressive earnings also resulted from the company’s relentless efforts in improving the basic operating factors of the business — food, service and atmosphere.

Total revenues of $1.88 billion surpassed the Zacks Consensus Estimate of $1.85 billion and increased 14.6% year over year. The upside was driven by the addition of 153 Cheddar's Scratch Kitchen and 28 other new restaurants. The reported quarter witnessed strong comps growth as well These factors helped the company gain market share.

Darden Restaurants, Inc. Price, Consensus and EPS Surprise

Moreover, Darden’s shares have rallied 24.5% so far this year, outperforming the industry’s gain of 14.8%.

Revenues by Segments

Darden reports its business under four segments: Olive Garden, LongHorn Steakhouse, Fine Dining, which includes The Capital Grille and Eddie V's, and Other Business.

In the reported quarter, the company’s legacy brands posted blended comps growth of 3.1%. In the previous quarter, comps had increased 1.7%. Meanwhile, the company witnessed increased sales across all segments in the fiscal second quarter.

Sales at Olive Garden were up 4% year over year to $951.6 million. Comps grew 3% at the segment, much higher than prior-quarter comps growth of 1.9%. Traffic rose 1.1% along with a 1.7% improvement in pricing and 0.2% growth in menu mix.

Sales at Fine Dining increased 9.3% to $140.6 million. Comps at The Capital Grille rose 3.8%, higher than the prior-quarter comps growth of 2%. Eddie V's also posted comps growth of 6.8%, significantly higher than the 2.5% improvement recorded in the preceding quarter.

Revenues from Other Business jumped 75.5% year over year to $401.6 million. However, comps at Seasons 52 fell 0.5% in the quarter, compared with the prior-quarter comps decline of 2.2%. Comps at Yard House inched up 2% in the quarter against a 0.4% decline in the last quarter. Meanwhile, comps grew 2.5% at Bahama Breeze, higher than the comps growth of 1.2% in the preceding quarter.

At LongHorn Steakhouse, sales rose 6.2% to $387.7 million. Comps at LongHorn Steakhouse increased 3.8%, higher than the prior-quarter comps growth of 2.6%. Traffic increased 0.9%, while pricing and menu mix grew 0.8% and 2.1%, respectively.

In the quarter under review, comps at Cheddar's declined 2%, comparing unfavorably with the prior-quarter decline of 1.4%.

Operating Highlights & Net Income

Total operating cost and expenses increased 14.8% year over year in the second quarter to nearly $1.8 billion. This was led by an overall increase in food and beverage costs, restaurant labor and restaurant expenses, marketing expenses and general and administrative expenses. As a result, operating margin in the quarter contracted 20 basis points (bps) on a year-over-year basis.

Net earnings in the second quarter was $84.7 million, recording 6.5% growth from the year-ago level.

Balance Sheet

Cash and cash equivalents at the end of the second quarter was $114.7 million, down from $146.8 million in the previous quarter.

Inventories totaled $199.1 million at the end of the reported quarter. Goodwill, as a percentage of total assets, was 22.1% in the quarter.

Long-term debt was $1.4 billion, up from $936.6 million in the previous quarter.

In the quarter under review, the company generated cash flow of $134.7 million from operating activities. It spent about $77.9 million on dividends in the quarter.

During the second quarter, the company repurchased approximately 1.1 million shares of its common stock for a total cost of approximately $89 million. As of the end of the quarter, Darden had approximately $281 million remaining under the current $500-million repurchase authorization.

Fiscal 2018 Outlook Raised

The company raised its fiscal 2018 adjusted EPS guidance to the range of $4.45 to $4.53, up from the previously guided range of $4.38 to $4.50. The Zacks Consensus Estimate for fiscal 2018 earnings is pegged at $4.44.

Moreover, the company lifted its guidance for total sales growth to roughly 13% (earlier growth projected at 11.5% to 13%) on expectations of 40 new restaurant openings. Meanwhile, comps are anticipated to grow roughly 2%, at the high end of the previously guided range of 1% to 2%.

Zacks Rank & Stocks to Consider

Darden carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the same space are Famous Dave's of America, Inc. (NASDAQ:DAVE) , Arcos Dorados Holdings Inc. (NYSE:ARCO) and Good Times Restaurants, Inc. (NASDAQ:GTIM) .

Dave's of America sports a Zacks Rank #1 (Strong Buy). The company’s long-term earnings growth rate is projected at 20%. You can see the complete list of today’s Zacks #1 Rank stocks here.

Arcos Dorados and Good Times carry a Zacks Rank #2 (Buy). Long-term earnings growth rate for Arcos Dorados and Good Times are projected at a respective 11.9% and 25%, respectively.

Zacks Editor-in-Chief Goes "All In" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

Darden Restaurants, Inc. (DRI): Free Stock Analysis Report

Famous Dave's of America, Inc. (DAVE): Free Stock Analysis Report

Arcos Dorados Holdings Inc. (ARCO): Free Stock Analysis Report

Good Times Restaurants Inc. (GTIM): Free Stock Analysis Report

Original post

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.