- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Danaher To Soon Close BioPharma Buyout, Receives FTC Approval

Danaher Corporation (NYSE:DHR) is in the final stages of completing the acquisition of General Electric Company’s (NYSE:GE) BioPharma business. Yesterday, the conglomerate received a green signal from the U.S. Federal Trade Commission (“FTC”). With this, it completed all requirements for getting antitrust clearances for the buyout.

Notably, Danaher announced the buyout deal in February 2019.

The BioPharma business is part of General Electric’s GE Life Sciences business, which, in turn, is part of the Healthcare segment. The BioPharma business comprises single-use technologies, process chromatography hardware and related consumables, development instrumentation and related consumables, cell culture media and service.

Inside the Headlines

Danaher also noted that the buyout received clearances from the European Commission as well as antitrust authorities of Korea, Brazil, Russia, China, Israel and Japan.

The transaction is anticipated to close on Mar 31, after the fulfillment of conditions mentioned in the purchase agreement.

The buyout has been valued at $21.4 billion. Of the total amount, Danaher will pay roughly $21 billion through cash on hand, funds raised through debts and credit facilities, and proceeds from shares and preferred stock issuances. Also, it will assume certain pension liabilities of General Electric.

Post the completion of the buyout, Danaher will integrate the BioPharma business with its Life Sciences segment. The acquisition is anticipated to strengthen Danaher’s biologics workflow solutions. Earnings accretion of 60 cents per share is anticipated in 2020 (disclosed in January 2020) from the buyout. Previously, Danaher had expected 45-50 cents per share earnings accretion in the first year of the deal completion.

Danaher’s Acquisitions

We believe that the above-mentioned transaction is consistent with the company’s policy of acquiring businesses to gain access to new customers, regions and product lines. In 2019, it used $331.3 million for making acquisitions.

Danaher acquired Labcyte Corporation in January 2019. The buyout of Labcyte has been fortifying Danaher’s automation capabilities.

Zacks Rank, Price Performance and Estimate Trend

With a market capitalization of $89.2 billion, Danaher currently carries a Zacks Rank #3 (Hold). The company is poised to benefit from product innovation, Danaher Business System, shareholder-friendly policies and inorganic initiatives. However, forex woes, high costs and huge debts remain concerning.

The company’s share price has decreased 19% in the past three months compared with the 32.7% fall recorded by the industry.

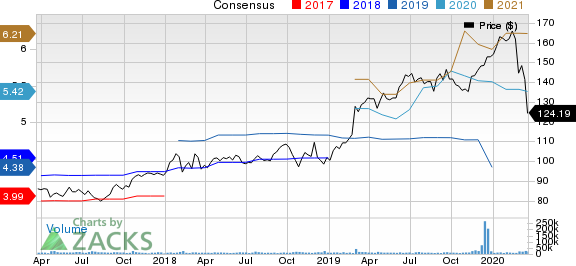

In the past 30 days, the Zacks Consensus Estimate for its earnings has been lowered by 2.2% to $5.42 for 2020 and 1.1% to $6.21 for 2021.

Danaher Corporation Price and Consensus

General Electric Company (GE): Free Stock Analysis Report

Danaher Corporation (DHR): Free Stock Analysis Report

Hitachi Ltd. (HTHIY): Free Stock Analysis Report

Griffon Corporation (GFF): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Regimes are changing in the market, and this could mean a few things, but today, it means that volatility is back. Whenever these shifts come, specifically to the S&P 500...

There are more than two reasons why NVIDIA’s (NASDAQ:NVDA) stock price can rally another 30% or more in 2025, but the two that underpin the others are data center and automotive...

Stocks fell sharply, with the S&P 500 leading the decline, finishing the day down almost 1.6% at 5,860. Meanwhile, the Nasdaq 100 dropped nearly 2.75%, closing at 20,550. This...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.