- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Danaher Raises Q1 View On Solid Prospects For Life Sciences

Danaher Corporation (NYSE:DHR) recently raised its outlook for first-quarter fiscal 2018. Following the news, shares were up about 3.1% at one point in pre-market trading, reflecting investors’ bullish sentiments surrounding the latest guidance.

Danaher managed to impress investors in fiscal fourth-quarter 2017 as well, wherein its earnings surpassed the Zacks Consensus Estimate by 2.6%.

For first quarter fiscal 2018, the company anticipates its adjusted earnings per share to be higher than the range of 90-93 cents projected previously. The raised guidance was owing to better-than-anticipated performance in its Life Sciences and Diagnostics platforms, particularly at its acquired unit, Cepheid. Danaher has scheduled its first-quarter 2018 conference call on Apr 19, 2018.

Our Take

Danaher has had an impressive run over the past few quarters, consistently surpassing earnings in each of the trailing four quarters, with an average positive surprise of 2.8%. Also, Danaher has successfully repositioned itself as a healthcare company, gradually broadening its presence in the healthcare and dental markets. These markets are expected to benefit from rise in the aging population and increased spending on healthcare and fitness. Also, lucrative prospects in pharma and clinical end-markets bode well for the company.

Meanwhile, the company’s Life Sciences unit has successfully enhanced its growth trajectory with new product launches. Notably, it has introduced over 20 new products in the last three years. Overall, Danaher is witnessing compelling secular market drivers across each of its platforms and believes that rapid market traction of the newly launched products will supplement sales performance. Furthermore, the company remains optimistic about earnings growth owing to improving order trends and its operating culture — Danaher Business System (“DBS”).

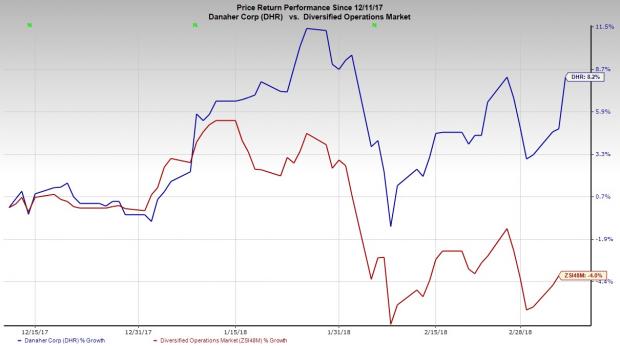

Additionally, Danaher’s recent acquisitions have helped it to enhance productivity and drive growth. Going ahead, these factors are expected to have a positive impact on the company’s results. Also, it anticipates core growth rate to accelerate on account of the improving order trends and acquisitions like Cepheid and Phenomenex. In the past three months, this Zacks Rank #3 (Hold) company has gained 8.2% against the industry’s loss of 4%.

Despite these positives, slowdown in the company’s academic business in Europe and stunted revenue growth in the Dental business remains concerns for the company. Moreover, softness in industrial markets in China, North America, Latin America and the Middle East has been severely impacting the company’s business. This apart, Danaher remains highly vulnerable to adverse foreign currency translations as a significant portion of its revenues is derived from regions outside the United States.

Key Picks

Some better-ranked stocks from the same space are Potlatch Corporation (NASDAQ:PCH) , Leucadia National Corporation (NYSE:LUK) and 3M Company (NYSE:MMM) . While Potlatch Corporation sports a Zacks Rank #1 (Strong Buy), Leucadia National and 3M Company carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Potlatch Corporation has surpassed estimates thrice in the trailing four quarters, with an average positive earnings surprise of 36.9%.

Leucadia National has outpaced estimates thrice in the preceding four quarters, with an average earnings surprise of 6.6%.

3M Company has surpassed estimates thrice in the last four quarters, with an average positive earnings surprise of 3.2%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Potlatch Corporation (PCH): Free Stock Analysis Report

3M Company (MMM): Free Stock Analysis Report

Danaher Corporation (DHR): Free Stock Analysis Report

Leucadia National Corporation (LUK): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.