- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Daily Currency Outlook: EUR/CHF And USD/CAD : March 07,2018

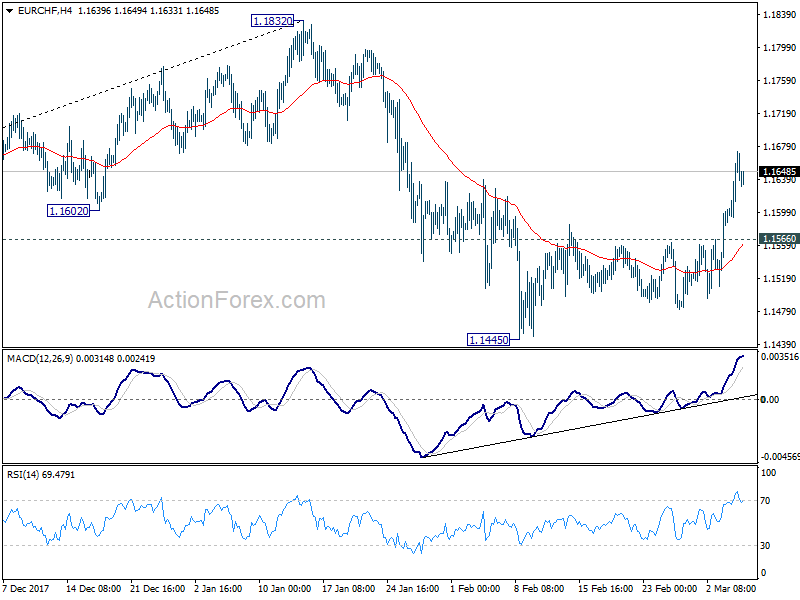

EUR/CHF Daily Outlook

Daily Pivots: (S1) 1.1611; (P) 1.1642; (R1) 1.1698;

EUR/CHF surges to as high as 1.1673. Break of 1.1639 minor resistance argues that pull back from 1.1832 has completed at 1.1445 already. Intraday bias is back on the upside for retesting 1.1832 high. At this point, we’d be cautious on strong resistance from there to bring another fall. Corrective pattern from 1.1832 might still have an attempt on 1.1355 cluster support (38.2% retracement of 1.0629 to 1.1832 at 1.1372) before completion. On the downside, below 1.1566 minor support will target 1.1455 low again.

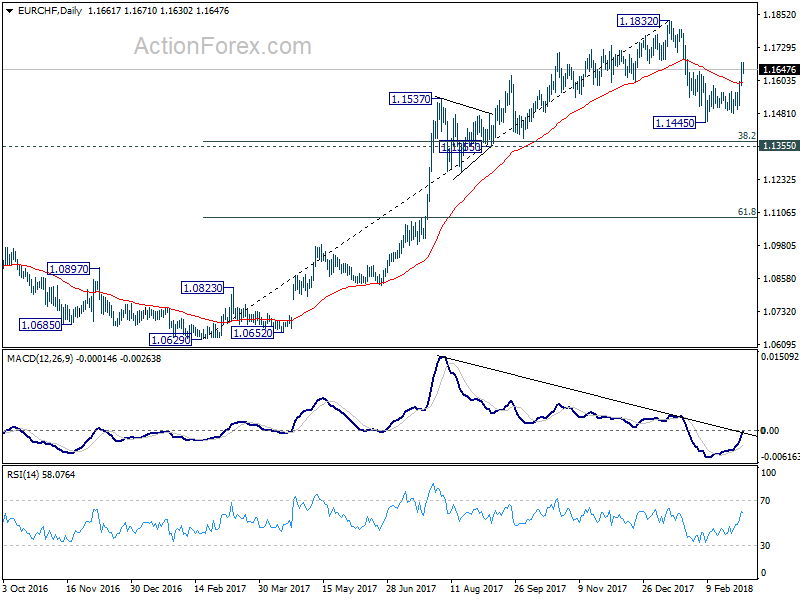

In the bigger picture, a medium term top should be in place at 1.1832 on bearish divergence condition in daily MACD. But there is no indication of long term reversal yet. As long as 1.1198 resistance turned support holds, we’d still expect another rise through prior SNB imposed floor at 1.2000.

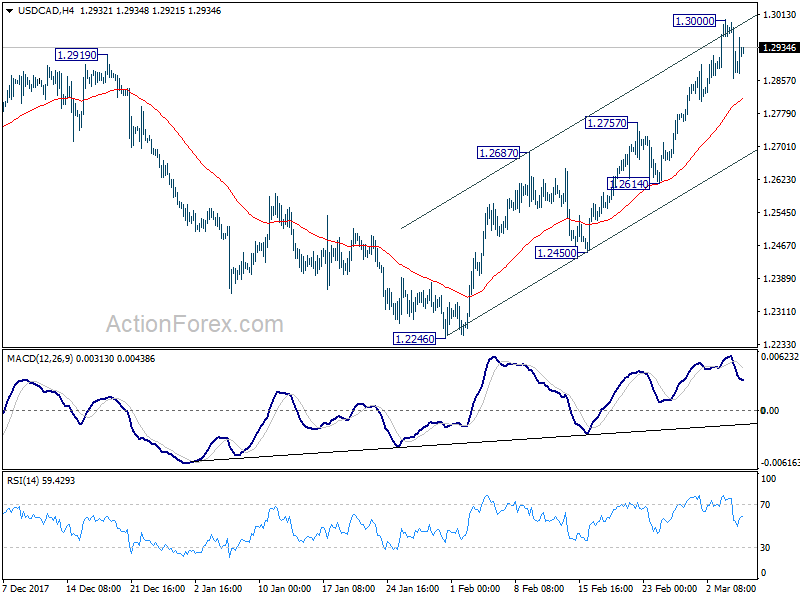

USD/CAD Daily Outlook

Daily Pivots: (S1) 1.2826; (P) 1.2910; (R1) 1.2959;

A temporary top is in place at 1.3000 in USD/CAD and intraday bias is turned neutral first. Nonetheless, outlook stays mildly bullish as long as 1.2757 resistance turned support holds. Another rise is still in favor. Above 1.3000 will extend the rise from 1.2246 to t 1.3065 fibonacci level next. However, firm break of 1.2757 will indicate reversal and turn outlook bearish for 1.2450 support.

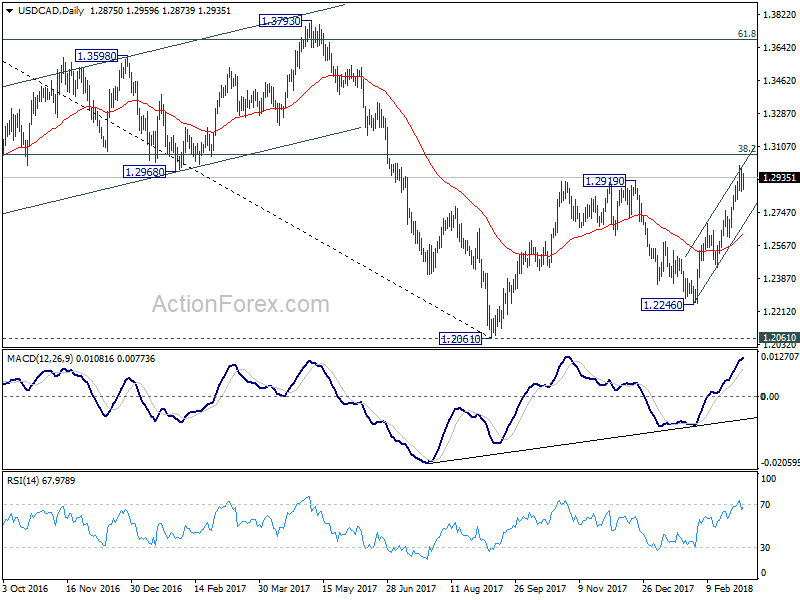

In the bigger picture, strong break of 1.2919 resistance adds much credence to the bullish case. That is larger down trend from 1.4589 has completed at 1.2061, drawing support from 50% retracement of 0.9406 (2011 low) to 1.4689 (2015 high) at 1.2048. Further rally should be seen back to 38.2% retracement of 1.4689 to 1.2061 at 1.3065 first. Break will target 61.8% retracement at 1.3685. This will be the preferred case now as long as 1.2687 support holds.

Related Articles

An aggressive fiscal spending proposal by Germany has attracted bullish animal spirits into EUR/USD. A significant rally in the longer-end German Bund yields is likely to alter...

USD/JPY trades heavy despite widening yield differentials Non-farm payrolls loom large as traders focus on the unemployment rate. Mixed signals in data could see choppy trade,...

US Dollar Key Points Traders are starting to price in the potential for outright contraction in the US economy. Meanwhile, Germany’s announcement of a €500B infrastructure and...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.