- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Daily Currency Outlook: EUR/AUD And EUR/GBP : July 12,2018

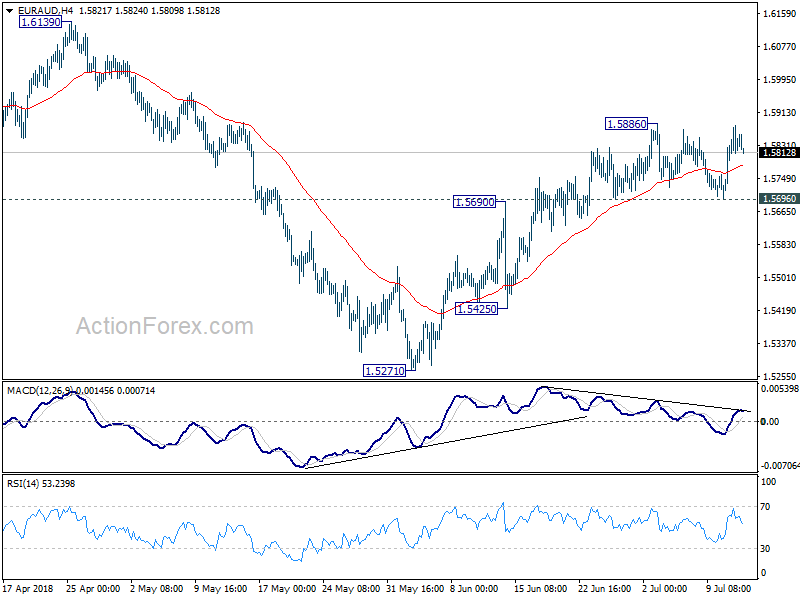

EUR/AUD Daily Outlook

Daily Pivots: (S1) 1.5762; (P) 1.5823; (R1) 1.5908;

EUR/AUD rebounds ahead of 1.5969 support but it’s staying below 1.5886 resistance. Intraday bias remains neutral for the moment. Further rise is is expected with 1.5696 minor support intact. On the upside, break of 1.5886 will resume the rebound from 1.5271 and target 1.6189 high. However, as the rebound from 1.5271 is not clearly impulsive yet and momentum isn’t too convincing. Break of 1.5695 minor support could be an early sign of near term topping. In such case, bias will be turned back to the downside for 1.5425 support.

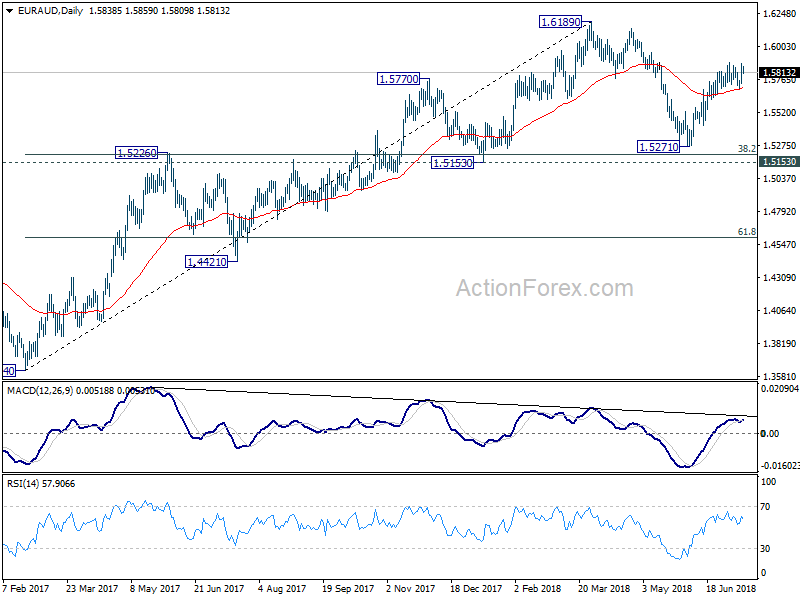

In the bigger picture, current development suggests that fall from 1.6189 is a corrective move and has completed at 1.5217 already. Key support levels of 1.5153 and 38.2% retracement of 1.3624 to 1.6189 at 1.5209 were defended. And medium term rise from 1.3624 (2017 low) is still in progress. Break of 1.6189 will target 1.6587 key resistance (2015 high).

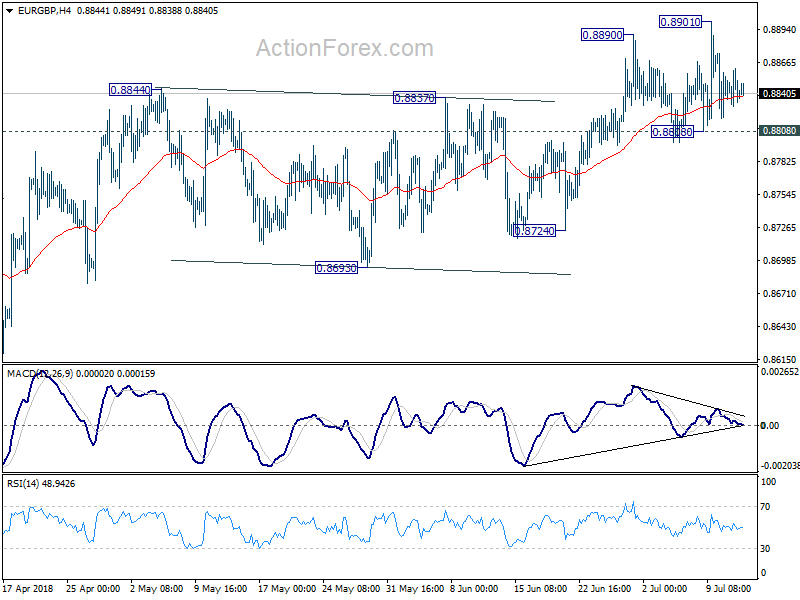

EUR/GBP Daily Outlook

Daily Pivots: (S1) 0.8826; (P) 0.8845; (R1) 0.8860;

Intraday bias in EUR/GBP remains neutral for consolidation below 0.8901 temporary top. Further rally is expected with 0.8808 minor support intact. On the upside, break of 0.8901 will resume the whole rise from 0.8620 and target 0.8967 cluster resistance (50% retracement of 0.9305 to 0.8620 at 0.8963). However, break of 0.8808 support will be the first sign that whole rebound from 0.8620 is completed. Deeper fall would then be seen to 0.8724 support for confirmation.

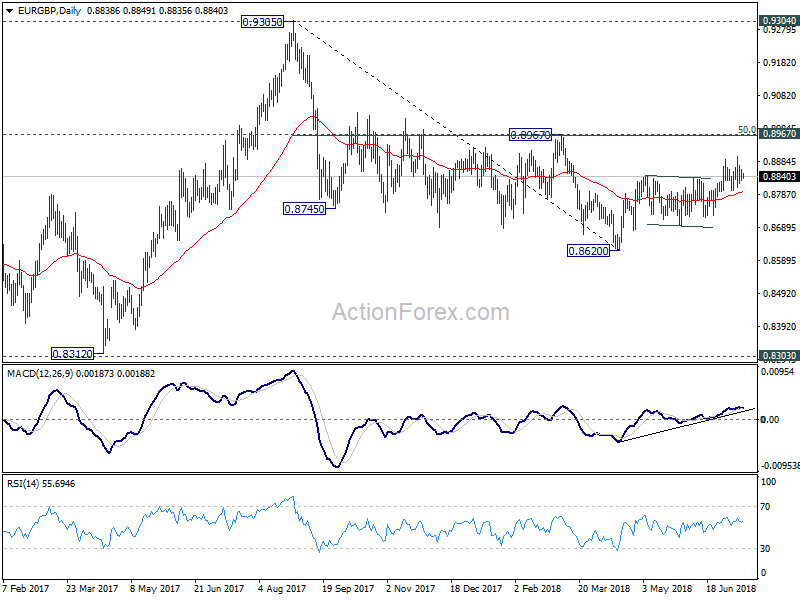

In the bigger picture, EUR/GBP is staying in long term consolidation pattern from 0.9304 (2016 high). Such consolidation pattern could extend further. Hence, in case of strong rally, we’d be cautious on strong resistance by 0.9304/5 to limit upside. Meanwhile, in another decline attempt, we’d expect strong support from 0.8116 cluster support (50% retracement of 0.6935 to 0.9304 at 0.8120) to contain downside.

Related Articles

Trump confirms 25% tariffs on Mexico, Canada, and a fresh 10% on China GBP/USD struggles as risk-off flows boost the U.S. dollar Core PCE inflation data in focus amid U.S. growth...

The Japanese yen has extended its losses on Friday. In the European session, USD/JPY is trading at 150.39, up 0.40% on the day. Tokyo Core CPI Edges Lower to 2.2% After a string...

USD/CAD recoups drop below EMAs as March tariffs become reality Technical indicators suggest quick rebound is fragile; focus on 1.4470 USD/CAD made a strong comeback just when...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.