- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cypress (CY) Adds Jeannine Sargent To Its Board Of Directors

Cypress Semiconductor Corp. (NASDAQ:CY) recently announced changes at the management level with the appointment of Jeannine Sargent to its board.

Sargent had earlier worked with Flex, where she led one of the most important and fast growing design-enabled businesses. She had also served as CEO at Oerlikon Solar, a thin-film silicon solar photovoltaic (PV) module manufacturer, and Voyan Technology, an embedded systems software provider to the communications and semiconductor industries.

Here at Cypress, she will be part of the company’s Compensation Committee besides holding other responsibilities.

Management believes that Sargent’s experience in varied fields and her leadership will be instrumental in the company’s long-term goal achievement.

Steve Albrecht, Cypress' chairman of the board, said, “She strengthens our team with the depth of her experience in growing innovative and profitable systems businesses at the forefront of emerging, high tech industries. I’m excited for her valuable contributions toward supporting the management team as they continue executing our strategy to become the leading embedded system solutions supplier in high-growth segments including Automotive, Industrial and applications across the IoT.”

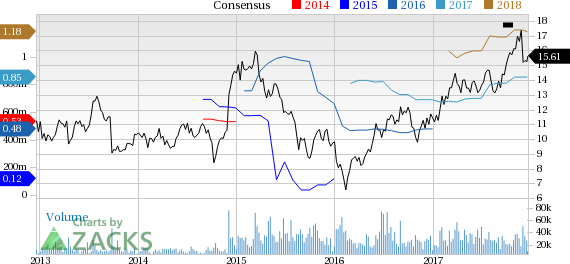

Notably, the company underperformed the industry it belongs to on a year-to-date basis. The company returned 37.6%, while the industry grew 43.6% over the same time frame.

Looking Ahead

Cypress is expected to report fourth-quarter 2017 results on Feb 1.

For the upcoming quarter, management expects revenues in the range of $575-$610 million, down 2%, reflecting weakness in the consumer segment. However, the company is expected to witness growth in PSoC, USB-C and memory. The Zacks Consensus Estimate is pegged at $593.7 million. Pro forma gross margin is expected in the range of roughly 43-44%.

On a GAAP basis, the bottom line is expected to be in the range of a loss of 1 cent to earnings of 3 cents per share. Pro forma earnings per share are expected in the range of 23 cents to 27 cents. The Zacks Consensus Estimate is pegged at 25 cents.

To Conclude

Cypress Semiconductor is currently benefiting from improvement in automotive, industrial PsoCs and USB-C solutions. Its USB-C product continues to witness rapid penetration. Driven by growth in these segments, the company has been performing well for quite some time now.

Also, the company’s increasing presence in the IoT market is giving a boost to the top line and profitability. The acquisition of Wireless Internet of Things (IoT) business has further strengthened the company’s leading position in the IoT market.Currently, its WICED platform is one of the largest IoT portfolios in the industry.

However, weak and uncertain macro environment remain concerns.

Stocks to Consider

Currently, Cypress carries a Zacks Rank #3 (Hold). A few better-ranked stocks in the broader technology sector are Groupon Inc. (NASDAQ:GRPN) , PetMed Express, Inc. (NASDAQ:PETS) and SMART Global Holdings, Inc. (NASDAQ:SGH) , each carrying a Zacks Rank #1 (Strong Buy). You can seethe complete list of today’s Zacks #1 Rank stocks here.

The long-term earnings per share growth rate for Groupon, PetMed Express and SMART Global is projected at 7%, 10% and 15%, respectively.

Zacks Editor-in-Chief Goes ""All In"" on This Stock

Full disclosure, Kevin Matras now has more of his own money in one particular stock than in any other. He believes in its short-term profit potential and also in its prospects to more than double by 2019. Today he reveals and explains his surprising move in a new Special Report.

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Groupon, Inc. (GRPN): Free Stock Analysis Report

Cypress Semiconductor Corporation (CY): Free Stock Analysis Report

SMART Global Holdings, Inc. (SGH): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

At the end of February, Lululemon (NASDAQ:LULU), DoorDash (NASDAQ:DASH), and Ulta Beauty (NASDAQ:ULTA) were among the Most Upgraded Stocks tracked by MarketBeat. Investors should...

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.