- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Cummins (CMI) Down 7.8% Since Earnings Report: Can It Rebound?

A month has gone by since the last earnings report for Cummins Inc. (NYSE:CMI) . Shares have lost about 7.8% in that time frame.

Will the recent negative trend continue leading up to its next earnings release, or is CMI due for a breakout? Before we dive into how investors and analysts have reacted as of late, let's take a quick look at the most recent earnings report in order to get a better handle on the important catalysts.

Cummins Q4 Earnings Top Estimates, Guidance Revised

Cummins reported adjusted earnings of $3.03 per share in fourth-quarter 2017, surpassing the Zacks Consensus Estimate of $2.65. The company’s bottom line was $2.25 in the year-ago quarter. Excluding the tax reform impact, net income was $503 million in fourth-quarter 2017.

Revenues improved 22% year over year to $5.48 billion in the reported quarter. The top line also outpaced the Zacks Consensus Estimate of $5.2 billion. The year-over-year rise was owing to increased demand for trucks, construction and mining equipment.

Operating income increased to $595 million from $507 million a year ago. Earnings before interest and taxes (EBIT) were $620 million (11.3% of sales) compared with $526 million (11.7% of sales) a year ago.

Fiscal 2017 Results

Cummins reported adjusted earnings of $5.97 per share in fiscal 2017, down from $8.23 earned in fiscal 2016. Also, earnings missed the Zacks Consensus Estimate of $10.22.

Net income fell to $999 million from $1.4 billion recorded a year ago. Consolidated revenues rose to $20.43 billion, up from $17.5 billion in the prior fiscal. Moreover, the figure beat the Zacks Consensus Estimate of $20.15 billion.

Segmental Performance

Sales at the Engine segment grew 16% to $2.3 billion on the back of a 14% increase in on-highway revenues and 27% in off-highway revenues, resulting from growing demand in global truck and construction market. The segment’s EBIT increased to $224 million (9.8% of sales) from $194 million (9.9% of sales) a year ago.

Sales at the Components segment surged 32% to $1.6 billion owing to revenue growth of 35% in North America in addition to international sales increase of 30% on the back of higher commercial truck manufacturing in North America and China. The segment’s EBIT was $168 million (10.8% of sales) compared with the year-ago tally of $140 million (11.9% of sales).

Sales at the Power Generation segment augmented 18% to $1.1 billion, banking on increased demand in mining, oil and gas and power generation markets. The segment’s EBIT rose to $95 million (8.6% of sales) in fourth-quarter 2017 from $68 million (7.3% of sales) in fourth-quarter 2016.

Sales at the Distribution segment shot up 16% to $1.9 billion. Revenues benefited from a 21% rise in the North American segment and a 7% ascent in the international markets. The segment’s EBIT plunged to $97 million (5% of sales) from $122 million (7.3% of sales) a year ago.

Financial Position

Cummins’ cash and cash equivalents increased to $1.37 billion as of Dec 31, 2017 from $1.12 billion as of Dec 31, 2016. Long-term debt totaled $1.59 billion as of Dec 31, 2017, a slight increase from $1.57 billion recorded on Dec 31, 2016.

At the fiscal 2017-end, Cummins’ net operating cash inflow increased to $2.3 billion from $1.9 billion in the same period last year. Capital expenditures declined to $506 million from $531 million within the same time frame.

Capital Deployment

In 2017, Cummins returned $1.2 billion to shareholders in the form of dividends and share buybacks. The company achieved its plan to return 50% of operating cash inflow in the year.

2018 Guidance

For 2018, Cummins anticipates revenues to grow 4-8% compared with the prior outlook of 14-15% rise in revenues. EBIT is expected in the range of 15.8-16.2%, an increase from the previous projection of 11.8-12.2%.

How Have Estimates Been Moving Since Then?

In the past month, investors have witnessed an upward trend in fresh estimates. There have been eight revisions higher for the current quarter In the past month, the consensus estimate has shifted by 6.6% due to these changes

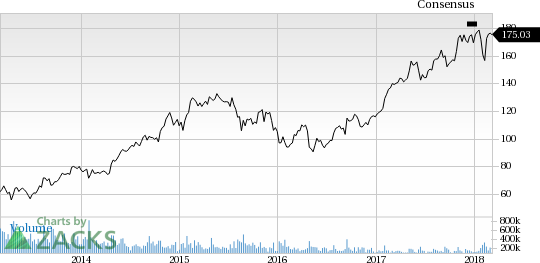

Cummins Inc. Price and Consensus

VGM Scores

At this time, CMI has a great Growth Score of A, a grade with the same score on the momentum front. Charting a somewhat similar path, the stock was allocated a grade of B on the value side, putting it in the second quintile for this investment strategy.

Overall, the stock has an aggregate VGM Score of A. If you aren't focused on one strategy, this score is the one you should be interested in.

Based on our scores, the stock is equally suitable for growth and momentum investors while value investors may want to look elsewhere.

Outlook

Estimates have been trending upward for the stock and the magnitude of these revisions looks promising. Notably, CMI has a Zacks Rank #3 (Hold). We expect an in-line return from the stock in the next few months.

Cummins Inc. (CMI): Free Stock Analysis Report

Original post

Zacks Investment Research

Related Articles

Since the Robotaxi event on October 11th, Tesla (NASDAQ:TSLA) stock is up 38%, currently priced at $291.60 per share This is a return to the early November 2024 price level. But...

The Q4 2024 earnings season tapers off from here, with S&P 500® EPS growth surpassing 17%, the highest in 3 years Large cap outlier earnings dates this week include:...

Shares of Alibaba (NYSE:BABA) are on a tear to start off 2025. The consumer discretionary and tech stock is up by 52% this year as of the Feb. 25 close. The company’s cloud...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.