- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Packaging Corp (PKG) Rides On E-commerce Boom Amid Cost Woes

On Jul 15, we issued an updated research report on Packaging Corporation of America (NYSE:PKG) . The company is poised to gain from solid demand for both of its segments and the e-commerce boom which will spur demand for boxes. However, the company’s results will be affected by annual maintenance outages.

Higher Maintenance Outage & Lower Prices to Impact Q2 Earnings

The company expects second-quarter 2019 earnings of around $2.05 per share, reflecting year-over-year decline of 1%. While seasonally higher containerboard and corrugated products shipments, reduced energy costs, recycled fiber prices and lower effective tax rate will bolster earnings, softer prices will affect results. Further, in the Paper segment, scheduled outage costs will be higher due to annual shutdown at the International Falls mill. Nonetheless, the company anticipates higher freight, repairs, and certain fixed costs as well as higher share-based compensation costs across its segments owing to the accounting treatment of restricted stock.

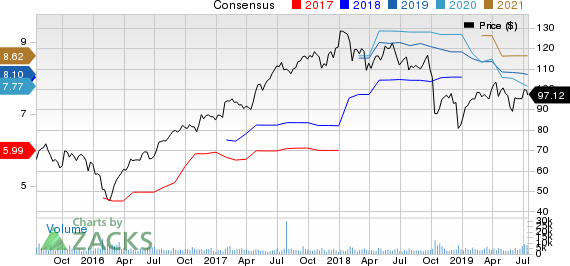

The Zacks Consensus Estimate for current-year earnings is pinned at $8.10, reflecting 0.87% year-over-year growth. The Zacks Consensus Estimate for revenues is currently pegged at $1.80 billion, calling for 1.56% year-over-year growth.

E-commerce Boom to Aid Performance

Packaging Corporation is projected to benefit from the e-commerce boom, which will spur demand in boxes. These days, customers find a lot of different channels to sell through, including e-commerce. The company has a wide base of consumers and anticipates its business to grow in the near term.

Investment for Future Growth

The company maintains a balanced approach toward capital allocation to profitably grow the company, as well as maximize returns for its shareholders. It ended first-quarter 2019 with $442 million of cash. Packaging Corporation anticipates capital spending for the ongoing year to be $390-$410 million, with roughly 35-40% earmarked for strategic capital projects, including organic growth, cost reduction, and efficiency projects. Further, share repurchases will bolster earnings.

Packaging Corporation of America Price and Consensus

Packaging Corporation of America (PKG): Free Stock Analysis Report

Roper Technologies, Inc. (ROP): Free Stock Analysis Report

John Bean Technologies Corporation (JBT): Free Stock Analysis Report

CECO Environmental Corp. (CECE): Free Stock Analysis Report

Original post

Related Articles

Home improvement retailers Lowe’s (NYSE:LOW) and Home Depot (NYSE:HD) turned a corner, and their Q4 2024 earnings reports confirmed it. The corner is a return to comparable store...

One of our old flames, a former Contrarian Income Portfolio holding, has pulled back sharply in recent weeks. Time to buy the dip in this 4.3% dividend? Let’s discuss. Kinder...

Emini S&P March collapsed on Thursday from strong resistance at 6010/6015The low and high for the last session were 5873 - 6014.(To compare the spread to the contract you...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.