- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

CSX Corp: Weighing Efficiency Against Risks

In true monopoly board game fashion, CSX Corporation (CSX) - based in Jacksonville, FL – is one of the nation’s leading transportation suppliers. Operating about 21,000 railroad miles in 23 eastern states and Canada, CSX has access to over 70 ports along the Atlantic and Gulf Coasts. In turn, roughly two-thirds of the American population lives within CSX’s operating territory.

It should be relatively apparent that a railroad possesses significant barriers to entry – after all, you or I couldn’t just start a rail business overnight; even if we already owned strings of multi-state real estate. However, if a potential investment notion for CSX isn’t readily observable yet, perhaps the following example will hit you like a ton of bricks.

On CSX’s website you can find a “Carbon Calculator” which provides a comparison between CSX trains and the applicable alternatives. For instance, if you wanted to move 10,000 tons of bricks from Columbus, OH to Jacksonville, FL (a 904 mile trek) it would take 127 rail cars and release 216 tons of CO2 emissions to transport the shipment. Which, when taken out of context, seems like pretty large figures.

However, the calculator also compares these numbers to a comparable shipment using an alternative source. For instance, CSX indicates that this same shipment would have taken 714 trucks to complete, all-the-while emitting 939 tons of CO2 emissions; or approximately 723 more tons of CO2 emissions. Said differently, the emissions savings is the equivalent to the yearly electricity use of 80 homes, 140 acres of pine forests absorbing carbon or the gas emissions for 129 passenger vehicles for the year. Even if you’re not an environmentalist, it isn’t difficult to identify a substantial advantage.

Of course this environmental moat also carries over to the financial side of things as well. Railroads provide the lowest cost option amongst shipments without waterway connections, not to mention their considerable fuel-efficiency benefit over trucks. Further, the probability of increased competition is unlikely at best – replicating the current systems is near impossible.

Yet that’s not to say that CSX doesn’t come without risks. For one thing, railroads require huge yearly capital expenditures. It is true that they’re not ripping up the tracks every few years, but simply maintaining them is surely burdensome. Beyond that railroads are subject to the swings of the economy. For CSX this means concerns about coal demand and being able to adjust to an intermodal model. In addition to the basic throws of the business, railroads also face two somewhat unique obstacles: natural disasters and regulation. Taken collectively, CSX faces perhaps as many risks as opportunities. Yet given its quasi-monopolistic nature with few competitors and strong efficiency, this railroad might still provide an interesting investment thesis.

10 Years of Growth

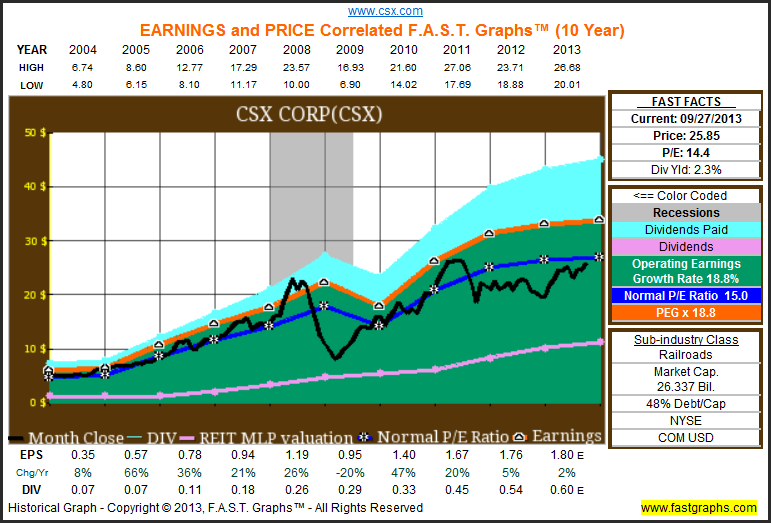

CSX has grown earnings (orange line) at a compound rate of 18.8% since 2004, resulting in a 26+ billion dollar market cap. In addition, CSX’s earnings have risen from $0.35 per share in 2004, to today’s forecasted earnings per share of approximately $1.80 for 2013. Further, CSX has been paying a steady dividend (pink line) and has been able to increase this payout for that last 9 years.

For a look at how the market has historically valued CSX, see the relationship between the price (black line) and earnings of the company as seen on the Earnings and Price Correlated F.A.S.T. Graph below.

Here we see that CSX’s market price previously began to deviate from its justified earnings growth; starting to become undervalued during the most recent recession and coming back to fair value a year or two later. Today, CSX appears undervalued in relation to both its historical earnings and relative valuation.

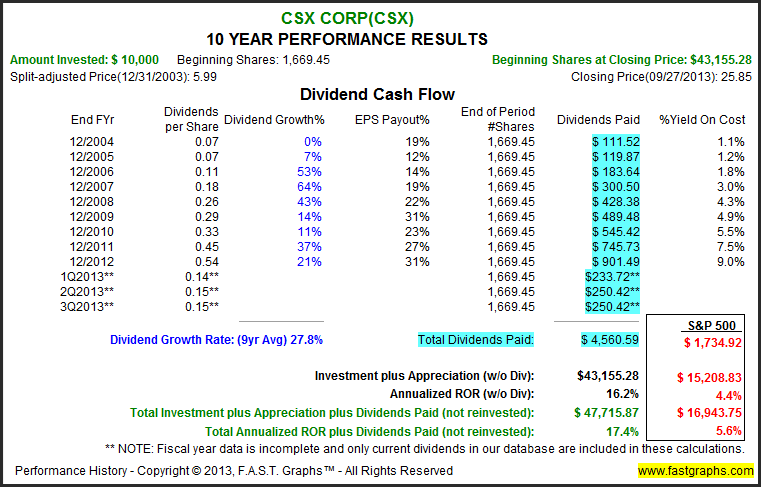

In tandem with the strong earnings growth, CSX shareholders have enjoyed a compound annual return of 17.4% which correlates closely with the 18.8% growth rate in earnings per share. A hypothetical $10,000 investment in CSX Corp on 12/31/2003 would have grown to a total value of $47,715.87, without reinvesting dividends. Said differently, CSX shareholders have enjoyed total returns that were roughly 3 times the value that would have been achieved by investing in the S&P 500 over the same time period. It’s also interesting to note that an investor would have received approximately 2.6 times the amount of dividend income as the index as well.

But of course – as the saying goes – past performance does not guarantee future results. Thus while a strong operating history provides a fundamental platform for evaluating a company, it does not by itself indicate a buy or sell decision. Instead an investor must have an understanding of the past while simultaneously thinking the investment through to its logical, if not understated, conclusion.

In the opening paragraphs a variety of opportunities and risks were described. It follows that the probabilities of these outcomes should be the guide for one’s investment focus. Yet it is still useful to determine whether or not your predictions seem reasonable.

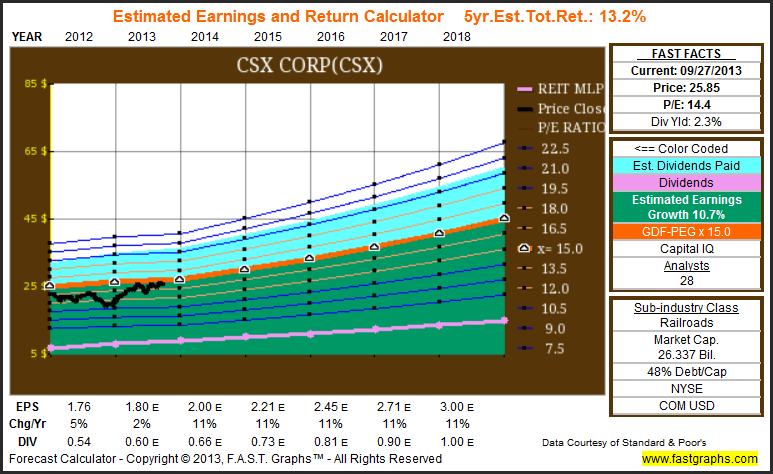

Twenty-eight leading analysts reporting to Standard & Poor’s Capital IQ come to a consensus 5-year annual estimated grow rate for CSX of 10.7%. In addition, CSX is currently trading at a P/E of 14.4, which is inside the “value corridor” (defined by the orange lines) of a maximum P/E of 18. If the earnings materialize as forecast, CSX’s valuation would be $44.97 at the end of 2018, which would be a 13.2% annualized rate of return including dividends. A graphical representation of this calculation can be seen in the Estimated Earnings and Return Calculator below.

Now it’s paramount to remember that this is simply a calculator. Specifically, the estimated total return is a default based on the consensus of the analysts following the stock. The consensus includes the long-term growth rate along with specific earnings estimates for the next two upcoming years. Further, the dividend payout ratio is presumed to stay the same and grow with earnings. Taken collectively, this graph provides a very strong baseline for how analysts are presently viewing this company. However, a F.A.S.T. Graphs subscriber is also able to change these estimates to fit their own thesis or scenario analysis.

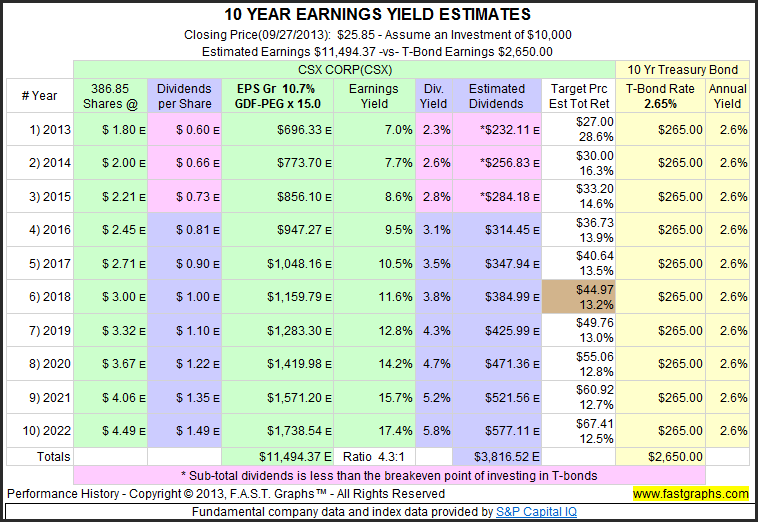

Since all investments potentially compete with all other investments, it is useful to compare investing in any prospective company to that of a comparable investment in low risk treasury bonds. Comparing an investment in CSX to an equal investment in a 10 year treasury bond, illustrates that CSX expected earnings would be 4.3 times that of the 10 Year T-Bond Interest. This comparison can be seen in the 10-year Earnings Yield Estimate table below.

Finally, it’s important to underscore the idea that all companies derive their underlying value from the cash flows (earnings) that they are capable of generating for their owners. Therefore, it should be the expectation of a prudent investor that – in the long-run – the likely future earnings of a company justify the price you pay. Fundamentally, this means appropriately addressing these two questions: “in what should I invest?” and “at what time?” In viewing the past history and future prospects of CSX we have learned that it appears to be a strong company with reasonable upcoming opportunities. However, as always, we recommend that the reader conduct his or her own thorough due diligence.

Disclosure: No position at the time of writing.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Related Articles

• Trump’s trade war, inflation data, and last batch of earnings will be in focus this week. • DoorDash’s imminent inclusion in the S&P 500 is likely to trigger a wave of...

The big US stocks dominating markets and investors’ portfolios just finished another earnings season. They reported spectacular collective results including record sales, profits,...

“Quality” stocks with strong fundamentals tend to be rewarding places to stash hard-earned money. Since 2009, investing in a basket of quality stocks over a standard index has...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.