- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Crown Holdings' Latest Kentucky Plant To Grow On Can Demand

Crown Holdings, Inc. (NYSE:CCK) will build a new beverage can manufacturing plant in Bowling Green, KY, to support the rising demand for beverage cans in North America. The facility is likely to commence operations in the second quarter of 2021 and create 126 job opportunities.

The state-of-the-art facility will supply beverage cans to the company’s customers, serving sparkling water, carbonated soft drinks, energy drinks, teas, hard seltzers, nutritional beverages, craft beers and cocktails.

With its many inherent benefits, including being infinitely recyclable, beverage cans continue being the preferred package for marketers and consumers globally. Moreover, the introduction of the facility backs Crown Holdings’ commitment to support its customers in meeting the growing demand for beverage can packaging.

Developing markets have witnessed higher growth rates owing to rising per capita income and the consequent increase in beverage consumption. While economies in Europe and North America are more mature, there are still bankable opportunities aided by beverages, such as energy drinks, teas, juices, sparkling water and craft beer.

Crown Holdings put up an impressive show in fourth-quarter 2019. Earnings and revenues both improved year over year and beat the Zacks Consensus Estimate.

Driven by the ongoing momentum in beverage can volume growth, Crown Holdings expects adjusted earnings per share to be $5.40-$5.60 for the current year. Beverage can volumes remain particularly strong in Brazil, Europe, Southeast Asia and the United States as consumers continue to prefer cans over other packaging. Notably, in 2019, the North American beverage can industry grew at its fastest pace in 25 years and beverage can volumes were up 3%. The company expects beverage can volumes to be up more than 5% in the current year.

To capitalize on beverage can demand, Crown Holdings intends to build new facilities and is poised to gain from the geographic expansion of beverage can lines. The company installed a new aluminum beverage can line at the Weston, Ontario plant, which began production in January. Crown Holdings is adding a third high-speed line at the Nichols, NY facility, which is expected to commence operations in the second quarter. Both facilities will be capable of producing multiple sizes. Moreover, the company has already commenced operations at a new facility in Rio Verde, Brazil.

It also begun construction of a beverage can plant in Nong Khae, Thailand, which will begin production during third-quarter 2020. Further, its multiyear project to convert beverage can capacity in Spain from steel to aluminum is nearing completion. Both lines in the Seville plant, which have multi-size capabilities, will be in commercial production by early second quarter.

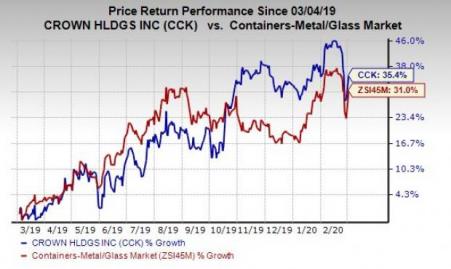

Share Price Performance

Over the past year, Crown Holdings’ shares have gained 35.4% outperforming the industry’s growth of 31%.

Zacks Rank and Stocks to Consider

Crown Holdings currently carries a Zacks Rank #3 (Hold).

A few better-ranked stocks in the Industrial Products sector include Northwest Pipe Company (NASDAQ:NWPX) , Graco Inc. (NYSE:GGG) and Sharps Compliance Corp (NASDAQ:SMED) . All stocks sport a Zacks Rank #1 (Strong Buy), at present. You can see the complete list of today's Zacks #1 Rank stocks here.

Northwest Pipe has an expected earnings growth rate of 19.5% for the current year. The stock has appreciated 34% over the past year.

Graco has a projected earnings growth rate of 4.3% for 2020. The company’s shares have rallied 19% over the past year.

Sharps Compliance has an estimated earnings growth rate of a whopping 767% for the ongoing year. In a year’s time, the company’s shares have gained 39%.

Breakout Biotech Stocks with Triple-Digit Profit Potential

The biotech sector is projected to surge beyond $775 billion by 2024 as scientists develop treatments for thousands of diseases. They’re also finding ways to edit the human genome to literally erase our vulnerability to these diseases.

Zacks has just released Century of Biology: 7 Biotech Stocks to Buy Right Now to help investors profit from 7 stocks poised for outperformance. Our recent biotech recommendations have produced gains of +50%, +83% and +164% in as little as 2 months. The stocks in this report could perform even better.

See these 7 breakthrough stocks now>>

Graco Inc. (GGG): Free Stock Analysis Report

Crown Holdings, Inc. (CCK): Free Stock Analysis Report

Sharps Compliance Corp (SMED): Free Stock Analysis Report

Northwest Pipe Company (NWPX): Free Stock Analysis Report

Original post

Related Articles

Through many years of frustration among gold bugs due to the failure of gold stock prices to leverage the gold prices in a positive way, there were very clear reasons for that...

I know there is the smell of fear in the air when I see my readership double as we reach a point where weekly chart factors come into play. Up until last week, markets have...

Professional traders get paid because of one skill and one skill only: the ability to foresee what the world (or the economy, at least) might look like in six to nine months....

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.