- All Instrument Types

- Indices

- Equities

- ETFs

- Funds

- Commodities

- Currencies

- Crypto

- Bonds

- Certificates

Please try another search

Crown Holdings (CCK) Set To Buy Signode For $3.91 Billion

Consumer packaging company Crown Holdings, Inc. (NYSE:CCK) has agreed to acquire Signode Industrial Group Holdings (Bermuda) Ltd. — a unit of The Carlyle Group L.P. (NASDAQ:CG) — for $3.91 billion. This acquisition will strengthen Crown Holdings’ metal packaging business and significantly boost its free cash flow as well.

Why Signode?

Based in Glenview, IL, Signode operates in 40 countries with sales to customers in approximately 60 countries. This $2.4-billion company has 88 manufacturing facilities across six continents. Signode generated pro forma sales and adjusted EBITDA of $2.3 billion and $384 million, respectively, for the twelve-months ended Nov, 30.

The company boasts a diversified product offering offerings including strap, stretch and protective packaging consumables. Signode’s products secure and protect industrial and consumer goods during warehousing and shipment.

Benefits for Crown Holdings

The Signode acquisition will add a portfolio of premier transit and protective packaging franchises to Crown Holdings’ metal packaging business. Post buyout, Crown Holdings will be able to supply full solutions to meet customers' transit packaging needs utilizing Signode's products. In addition, Signode's geographic and product mix will provide Crown Holdings a solid platform for value-creating growth. Moreover, the buyout will broaden and diversify Crown Holdings’ customer base, facilitating growth in cash flow.

Other Details

The acquisition, which is subject to review by various competition authorities, is expected to close in the first quarter of 2018. Debt financing has been fully committed in support of the transaction.

Acquisitions Drive Crown Holdings’ Growth

The aforementioned acquisition is in sync with Crown Holdings’ strategy to evaluate select growth opportunities through capacity additions in its existing plants and new plants in existing markets. However, the Signode acquisition comes after nearly three years of the EMPAQUE buyout. The addition of EMPAQUE — a leading manufacturer for the beverage industry in Mexico — has significantly fortified Crown Holdings’ presence in the Mexican market, along with substantially boosting its strategic position in the beverage cans segment, both regionally and globally.

Thus, Crown Holdings is aimed at making potential acquisitions in geographic areas and product lines in which it already operates or that complement its existing businesses. Furthermore, acquisitions are anticipated to fuel the company’s growth.

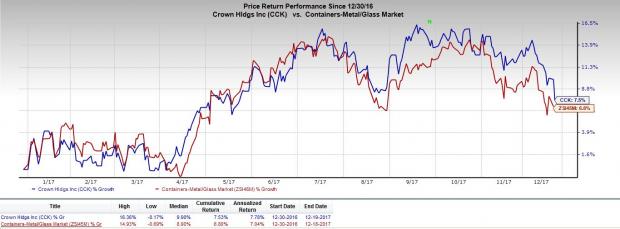

Share Price Performance

Year to date, Crown Holdings has outperformed the industry with respect to price performance. While the stock has rallied 7.5%, the industry has recorded growth of 6.8% during the same time frame.

Zacks Rank & Stocks to Consider

Currently, Crown Holdings carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the same industry are Caterpillar Inc. (NYSE:CAT) and Deere & Company (NYSE:DE) .

Caterpillar has a long-term expected earnings growth rate of 10.3%. Its shares have rallied 62.7% year to date. The company flaunts a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Deere, another Zacks Rank #1 stock, has a long-term expected earnings growth rate of 8.2%. The stock has appreciated 49.9% during the same time frame.

5 Medical Stocks to Buy Now

Zacks names 5 companies poised to ride a medical breakthrough that is targeting cures for leukemia, AIDS, muscular dystrophy, hemophilia, and other conditions.

New products in this field are already generating substantial revenue and even more wondrous treatments are in the pipeline. Early investors could realize exceptional profits.

Click here to see the 5 stocks >>

Crown Holdings, Inc. (CCK): Free Stock Analysis Report

The Carlyle Group L.P. (CG): Free Stock Analysis Report

Caterpillar, Inc. (CAT): Free Stock Analysis Report

Deere & Company (DE): Free Stock Analysis Report

Original post

Related Articles

The markets have been sluggish this week as investors hope for a jolt later in the week when AI juggernaut NVIDIA Corporation (NASDAQ:NVDA) reports fourth quarter and year-end...

On Friday, a wave of selling pressure swept across the US equity markets, leaving a trail of losses. The S&P 500 closed down 1.7%, the DOW slid 1.69%, and the NASDAQ tumbled a...

Palantir remains highly valued with a 460x P/E ratio and a 42.5x P/B ratio, far above its peers. The stock's beta of 2.81 signals high volatility, meaning sharp moves in both...

Are you sure you want to block %USER_NAME%?

By doing so, you and %USER_NAME% will not be able to see any of each other's Investing.com's posts.

%USER_NAME% was successfully added to your Block List

Since you’ve just unblocked this person, you must wait 48 hours before renewing the block.

I feel that this comment is:

Thank You!

Your report has been sent to our moderators for review

Add a Comment

We encourage you to use comments to engage with other users, share your perspective and ask questions of authors and each other. However, in order to maintain the high level of discourse we’ve all come to value and expect, please keep the following criteria in mind:

Enrich the conversation, don’t trash it.

Stay focused and on track. Only post material that’s relevant to the topic being discussed.

Be respectful. Even negative opinions can be framed positively and diplomatically. Avoid profanity, slander or personal attacks directed at an author or another user. Racism, sexism and other forms of discrimination will not be tolerated.

Perpetrators of spam or abuse will be deleted from the site and prohibited from future registration at Investing.com’s discretion.